Steady dating vs Tinder, Netflix and a one-off headline

Dominic Mills is wholly unsurprised to see that Asda is once again reviewing its creative account. Plus: Netflix subverts the norms while MullenLowe races ahead

News that Asda is reviewing its creative account out of AMV is probably the least surprising of the year so far. It has all the feel of a supermarket that doesn’t quite know what’s going on – not surprising, given recent events.

To recap: first, Asda tried and then failed to merge with Sainsbury’s. Second, US parent Walmart put it on the block again in February, where it remained for several months until, third, it was bought in October by the unlikely combination of a pair of garage forecourt entrepreneurs and private equity.

One suspects that much of this uncertainty permeated through to its marketing team, and hence to its agencies — culminating in some dire Christmas advertising starring (and I use the word loosely) Asda super fan Sunny and his family (who even knew there was such a thing as an Asda super fan?).

You’ve got to feel a bit sorry for AMV, which has only had the business for two years and surely deserves a longer chance. Instead, that opportunity may transfer to the winner of this shoot-out.

I say that because, if you look at the history of supermarket-agency relationships they are remarkable, and I think unparalleled in any other sector, for their longevity. Roughly speaking, it is a rare relationship — bar the occasional blip — that does not last at least five years, and one reason is that the complexity of the business means it can take the agency some time to properly get its feet under the table.

Take Tesco. It has been with BBH six years. Before that, other than two years with Wieden and Kennedy — a one-night stand in this world — it had been with Lowe and then The Red Brick Road (essentially the same agency team since TRBR was Lowe in exile) since the late 80s.

Sainsbury’s too. Before it appointed Wieden and Kennedy in 2016, whose pitch was no doubt helped by its Tesco experience, it had been with AMV for 35 years, the relationship surviving the odd repitch and multiple changes of personnel on both sides.

And look at the German twins, whose growth has been remarkable. Lidl, with Karmarama since December 2018, had spent the previous six years — during which time it doubled its market share, cannily stewarded by a couple of Lowe Tesco veterans — with TBWA.

Aldi, for its part, has been with McCann Manchester since 2005, including a repitch in 2016.

[advert position=”left”]

If these retailers are steady daters, tending towards the serially monogamous, Asda relatively speaking is a Tinder fan jumping from one agency to another. Before AMV in 2018 it dallied briefly with Saatchi and Saatchi (two years), VCCP (two years), Saatchi and Saatchi again (four years), Fallon (two years) — all after coming out of a 20-year relationship with Publicis.

And broadly, by the way, media agency relationship longevity tracks those of the creatives.

Asda’s market share, in case you’re interested, is currently just above 14%, down just over 1 percentage point from its appointment of AMV in 2018 and pretty much the same as it was 20 years ago.

Now, looking at Sainsbury’s long-term failure to materially challenge Tesco’s lead, you could argue that longevity isn’t always all it’s cracked up to be. But you could also argue the opposite looking at Asda: given its Walmart parentage of 25+ years you might have expected it to do better over the longer term.

One contact of mine, with experience on three supermarkets (including Tesco and Sainsbury’s), has an interesting perspective. While agencies have to combine the longer-term brand building — like selling BMWs, they say — they are also focused on the screamingly urgent short-term. How short-term? As short term, sometimes, as analysing the previous day’s sales figures at 7am, explaining why they might be 0.075% down on the same day the previous year — and figuring out what to do about it.

Paradoxically in successful relationships, it may be, my contact suggests, that it is the intensity of the short-termism that brings the two together into the longer-term.

“The clients get hooked on the agency in the way they’re hooked on the till receipts”, they say, drawing an analogy between the dealer and the junkie.

Netflix ad: back to the future

In the week in which a Netflix sub at £168pa overtook the BBC licence fee — and there’s a huge debate to be had about value here — I’m going to highlight instead the streaming giant’s unusual approach to film marketing.

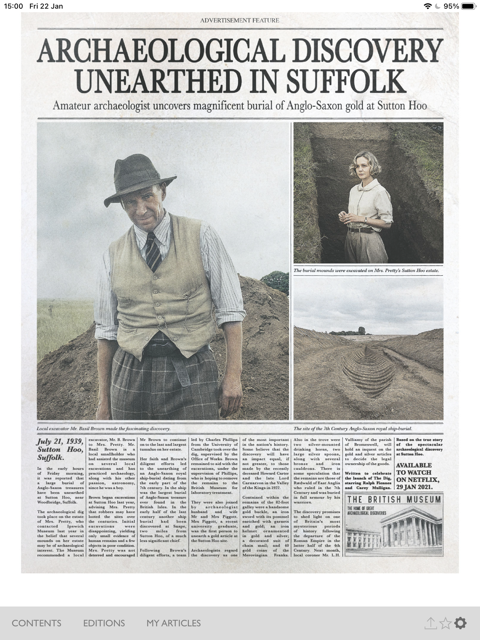

This full-page, faux-vintage, spoof-style news story caught my eye.

It’s certainly advertorial, and marked as such. The washed-out pictures add to the sense of authenticity as does the somewhat understated headline — that was the way 80 years ago.

But how back-to-the-future is this? A streaming giant using a long-copy, print-based ad to promote a film that won’t even be released in something that is as old-fashioned as a cinema.

I loved it, but I suspect I’m in a minority. And that’s because it’s bloody hard work finding out what’s really going on. You have to zip to the end of the copy to see that it’s promoting The Dig, a film about the Sutton Hoo treasure trove find (which probably only means something to fans of archaeology), stars Ralph Fiennes and Carey Mulligan and is released this Friday.

Still, I’m all in favour of people prepared to mess with and subvert the norms. But I wonder how the stars Fiennes and Mulligan felt about having their names appear in mere 10pt type?

An unrepeatable headline

In a previous life I used to have a bit of fun by asking top agency people what trade press headline they would most and least like to see about themselves or their agency. But the excessive hubris they showed meant I got bored with the idea.

Still, none ever had the chutzpah to suggest a headline as crystal-clear as the one I saw in Campaign last week. “MullenLowe miles ahead in creative new-business rankings”, said the top-level, before the sub-level explained that its net gain was two and a half times more than its nearest competitor.

It’s the ‘miles ahead’ I love. Headline writers are normally required to rein in any tendencies to hyperbole, but on this occasion the author was bang on: with a £151m increase, that is by far and away the biggest winning margin I’ve ever seen. And compare that with the media agency table, topped by PHD with a ‘mere’ £51m gain and a lead of £10m.

MullenLowe’s performance is down of course to its triumph picking up the government’s Covid and Brexit transition work, although no-one at the time anticipated just how large those would turn out to be, particularly the former.

It goes without saying that this performance is due to a unique set of circumstances and likely unrepeatable. And if it isn’t, then God help us.