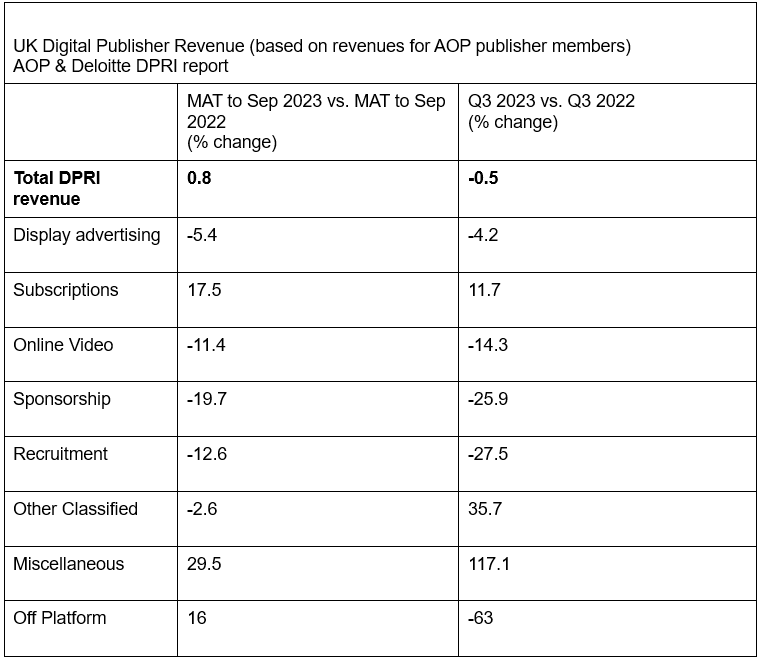

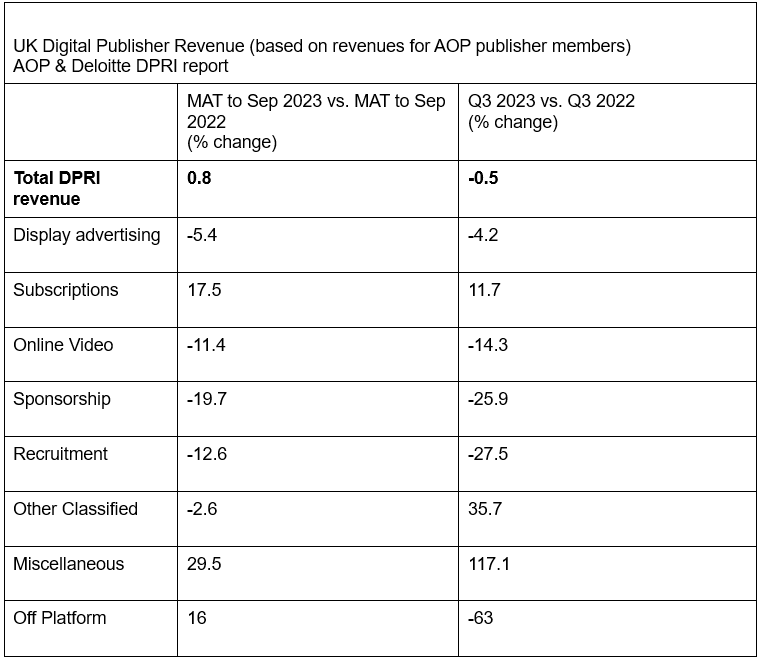

Digital publisher revenues in the last quarter grew by 0.3%, an indication of “wider contraction” in adspend, with drops in display (-4.2%), video (-14.3%) and sponsorships (-25.9%).

However, these were offset by consistent growth in subscription revenues (11.7%) which have been “performing well” for more than a year, according to the latest Digital Publishers’ Revenue Index (DPRI) from the Association of Online Publishers (AOP) and Deloitte.

The DPRI found that found digital audio revenues, described as a “relatively minor revenue stream”, hit £3m in Q3 2023, a fourfold growth fourfold (500%).

‘Green shoots of growth’

Richard Reeves, managing director at the AOP, commented: “Subscription revenues now account for almost a third of total publisher revenues, and by current trends, it could hit this milestone within a couple of quarters.

“Decoupling revenues from the ups and downs of advertising spend can provide a greater degree of financial security, though this cannot be a solution for all properties.”

Total digital revenues were slightly down from Q3 2022 to Q3 2023 at £153m (-0.5%).

Andy Cowen, lead partner for telecommunications, media and entertainment at Deloitte, called this “green shoots of growth” within “a more subdued quarter for digital publishers”.

He added: “This is a sign of ongoing diversification of revenue across the publishing industry and demonstrates consumer appetite for content across various platforms.”

Multi-platform revenues grew 10.5% year-on-year for the quarter, while platform-specific revenues like mobile and desktop decreased by 30% and 16.7% respectively.

New products and services ‘a priority’

The “miscellaneous” category, including data monetisation, more than doubled between Q3 2022 and Q3 2023 to £8.9m.

All of those surveyed said new products and services were a future business priority for the next 12 months, increased cashflow by three-quarters of respondents, non-advertising revenue by two-thirds, cost reductions by half, and acquisitions by one-third.

Advertising revenue growth was the only one to diminish compared to Q2 2023 to Q3 2023 from 75% to 50%.

The AOP and Deloitte surveyed 13 UK digital publishers; nine B2C and four B2B, for this quarterly report.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.