The time for media agencies to adopt a new mindset is now

To mark the 30th anniversary of Manning Gottlieb Media, Nick Manning looks back on how the agency model was created and what needs to change today

The media agency formerly known as Manning Gottlieb Media officially opened for business thirty years ago this month and continues to go from strength to strength, including being voted Global Media Agency of the Year as recently as June.

However, this is no time for celebration, especially as our old agency is neck-deep in helping the UK Government communicate its way through the nexus of Covid-19 and Brexit, with media plans that no doubt change by the hour. Maybe honours or medals will be granted for courage under fire, and they will have been hard-earned.

At their best, media agencies are vital business partners to advertisers, helping them navigate through today’s complex media maze. In the thirty years since 1990, the Media Agency sector moved from being a cottage industry to a massive machine processing billions of dollars, with spectacular growth fuelled by industry consolidation and the emergence of new media platforms.

However, the media agency business model is coming under severe pressure as the traditional paid-for media model is eroded by new and lower cost ways to build businesses and brands. The Covid-19 crisis adds another layer of difficulty as traditional media budgets, hitherto the source of so much earned and unearned revenue, are pulled.

Fast forward to today. As Warren Buffett famously said “When the tide goes out you find out who has been swimming naked” and Coronavirus has exposed the fault-lines behind the business models that have been so lucrative for the intermediaries in the media eco-system, including the ‘media trading benefits’ that are often larger than client fees.

The golden days of growth from volume-led buying in mass media are coming to an end and while the media agency groups have prospered royally from digital channels, group buying clout matters less in biddable media and the agencies have strong competition, not least from the platforms themselves and specialist players.

With the decline of volume as a key discriminator in the market, and a primary source of profit, the traditional media agency business model will need to be reinvented.

Some lessons from the past can maybe help provide a perspective as to how that can and should happen.

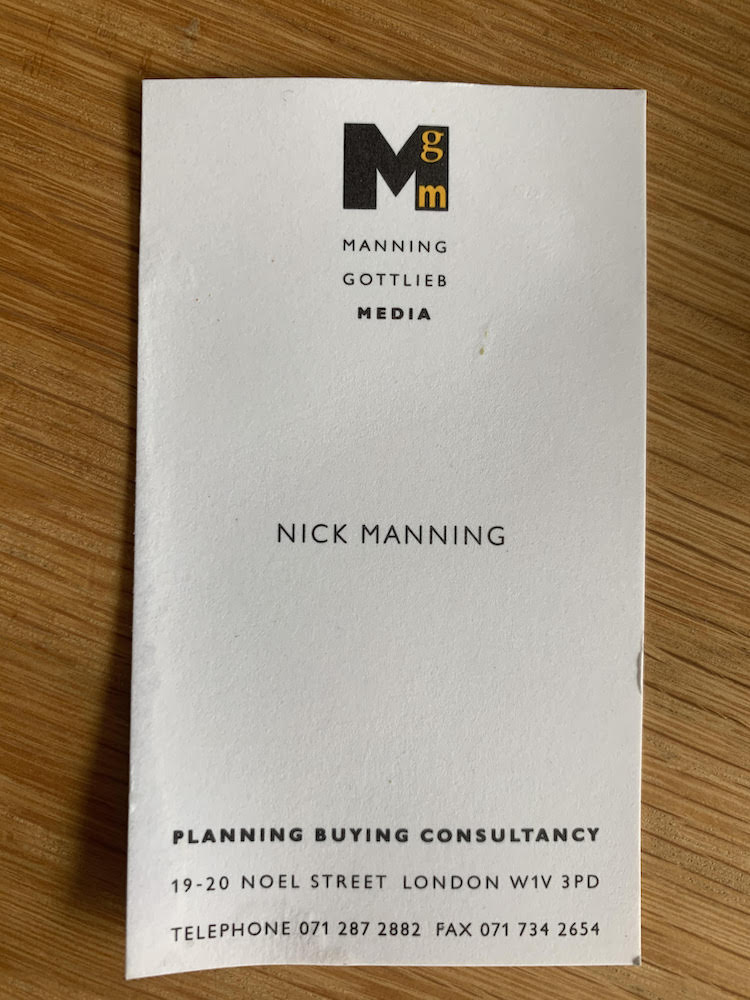

Manning Gottlieb Media launched into the teeth of a recession just at the time when the unbundled media agencies were getting into their stride. Zenith led the way, followed by MindShare in 1997. The media buying market was going down a volume-led route as rapid consolidation took place within the agency and media-owner sectors.

However, we zigged while others zagged, with a manifesto at launch showing how we would approach media, based on how people’s behaviour was changing:

“Given an ever-increasing choice, tomorrow’s media-literate generation will develop a butterfly mentality in their media use”.

Even in those pre-internet days we saw that media proliferation was leading to self-editing (ie personal media menus), less time spent with any one medium and ‘more cynicism’, presaging the public’s loss of trust in advertising. We recognised that attention was key to advertising success and our use of media needed to deliver stand-out for our clients.

Our proposition was based on the truth about the way people’s media habits were changing, and not on the prevailing internal industry trends. We asked:

“How is the media buying community responding to this change? By moving away from selectivity and light-footedness and towards volume-based, cost-oriented dealing with those media who are increasingly unable to deliver those elusive target consumers. The result is that more and more money chases smaller, less attractive audiences causing costs to rise and a loss of advertising effectiveness.

As volume-based dealing grows, as buying clubs form, as broking looms, the real needs of advertisers and the business interests of the buyers grow further apart.”

Remember, this was 1990 and long before digital media administered a dose of steroids to the trend towards media fragmentation, rebates and arbitrage.

So, what was our solution? A primitive PowerPoint deck from the time describes how we worked:

- Rooting media thinking in the client need

- Being consumer-centric (using Account Planning techniques as well as media research)

- Working hand-in-glove with creative partners

- Being innovative to achieve cut-through

- Marrying innovation with the best available media pricing

This was counter-cyclical at the time. Our business was based on ideas; not just creative uses of media but buying media in different ways to make the creative work harder. We had challenger brand clients such as Nike, Virgin Atlantic and PlayStation, who especially valued our approach.

We were successful because our ideas made advertising distinctive, visible and effective. We made money when our clients did and we won new business because we were client-led, inventive and good value. We invested in talent as we grew and hired people who shared our view of what good media looked like.

Our partnerships with creative agencies and media-owners were precious to us, and we cared about effectiveness and quality.

This approach is more valid than ever now.

For 30 years, our industry (with some notable exceptions such as PHD and some recent market entrants) went down the volume route. And vast amounts of money were made for shareholders as the media buying behemoths emerged and went global. The focus shifted from strategy to execution and the media trading benefits funded the holding company structures that are proving intractable today.

During the Gold Rush, prospectors would move around to find new seams, and that’s been the case too for media. The rebate-led market began with Outdoor, spread to Print, moved onto TV and Radio and achieved its peak in Online Display, and especially programmatic.

The consolidation of agency power, the explosion of digital and the growth of ad tech produced a myriad of trading opportunities to improve margins to stratospheric levels, but without a corresponding client benefit.

For many years, volume was the only game in town and the media agency networks subsidised the holding companies’ profits and less profitable ventures in other parts of the forest. There was little left for investments in front-line staff or systems, innovation and diversification.

The unquestionable dedication of talented media people in some media agencies has been diluted by the profit needs of the holding companies, with media planning integrity sometimes compromised by volume- and rebate-led media trading practices.

When the 2016 ANA investigation exposed the truth of the market, trust between clients and agencies dipped sharply, as did rebates. It got harder to make the extra margin, placing pressure on ‘real’ money at a time when the clients were also driving a harder bargain.

Media agencies found themselves caught between the escalating demands of their clients and their own holding companies, with fewer short-cuts to profit.

The big media buying groups have invested excessive and sometimes insane resources into chasing the same large global clients down an increasingly narrow rabbit hole, leaving them inward-looking, vulnerable to hawkish procurement practices and unable to chase uncontested market opportunities.

This focus also missed out on the emerging stratum of clients who were building their brands through internet-based channels and social commerce, such as The Hut in the UK, worth $6.3 billion today without the need to invest heavily in infrastructure or conventional marketing. The marketing cost of entry for brands has never been lower.

An industry that has become hooked on volume rather than value is confronted by the end of the volume-led era. The seams are all mined out, Fool’s Gold is being bought at an unimagined scale, ad effectiveness has declined and the public is often over-loaded with irrelevant and unwanted ‘noise’.

The biggest area of failure is in programmatic, where the intermediaries (including ad tech and media agencies) have too often extracted massive margins without delivering effective advertising, with the various intermediaries taking an unsustainable and unwarranted 50% of the client’s media budgets in fees, mark-ups and rebates.

Yes, some independent media agencies have been able to exploit this shortcoming at a national level, providing the client-centricity and flexibility that has declined in the bigger agencies, but their market-share and geographic reach remain modest.

True innovation has also been stifled within the holding companies by the ‘swim lanes’ needed to prevent turf warfare.

The failure to adopt the right technology to both improve brand communications and internal workflows has left agencies with legacy systems that hold them back and allow new tech-savvy competitors to steal in and encourage client in-housing.

Facebook, Google and Ad Tech offered easy ways to advertise for all advertisers and siphoned off talent with better career prospects and higher salaries.

As ‘faster, better, cheaper’ became the client mantra, the media agency networks found it hard to react and with a cost-base of offices and well-remunerated staff that made profit harder to achieve. There is little scalability in the traditional media agency model. Big is no longer beautiful in an ‘agile’ world and sclerotic legacy systems can act as barriers to progress.

Search, Social and Programmatic opened up massive opportunities for paid and organic brand communications but the media agency networks were slow to embrace them, seeing them as a margin opportunity and primarily for paid- for use.

Specialist agencies in these niche disciplines were able to bloom by being more capable than the generalist media agencies, and have since been acquired for significant multiples by new players, not the holding companies-arguably a missed opportunity.

Media agencies were unable to invest in proprietary technology, falling back instead on white-labelling to give the appearance of innovation.

Perhaps ironically, the explosion in media choice and consequent atomisation of audiences makes the media agency’s task more important, not less, so this should be a Golden Era for them, but the pursuit of profit by any available means has prevented the holding companies’ agencies from innovating and diversifying as much as is needed.

The fundamentals of what clients and brands need are the same today as they were in 1990 and have always ever been.

They need powerful communications ideas supported by compelling content delivered to the most relevant audiences at scale, and the means of delivering these needs exist as never before and at a fraction of the cost.

The solution must lie in the truth about people’s use of media in the internet age, not internal industry trends.

The convergence of content and channel, powered by Social, has provided untold opportunities for both paid and organic exploitation at scale.

The media world is being shaped by Apple, Google, Facebook, Amazon, Snapchat and now Tik Tok; this world will be powered by 5G, Social Commerce and Augmented Reality, with content and its distribution increasingly viral and organic.

To evolve successfully, today’s media agencies will need to provide powerful ideas, tailor-made integrated content and distribution solutions and the ability to provide scale and speed.

The concept of media specialisation in isolation is itself in question, and even the expression ‘media agency’ will come to look anachronistic.

They will need to provide relevant services for the newer breed of client, especially the disruptor brands, and rely less on the ‘pass the parcel’ of big media pitches and the zero-sum game of providing more for less.

They will no longer be able to rely on media trading benefits as volume becomes less of a bargaining chip in negotiations and first-party data becomes the most important currency in media distribution. The demise of third-party data from cookies will challenge the existing trading practices that have been so profitable.

Revenue will need to be earned, and margins will contract as the volume-led market declines.

There are some early signs of change. Last week saw IPG announce a new venture to address this gap, and similar embryonic entities exist patchily in other groups, but it will take a significant reallocation of costs to achieve this goal, and that means using technology to slim down traditional structures to invest in new ventures.

A new mindset and bold measures will be needed to catch up with a consumer media world that has moved on.

With the right approach to innovation and diversification, tomorrow’s media agencies can rediscover their true value to advertisers; the best time to do this was yesterday, and the second best time is now. It will take pioneering leadership, investment and a lot of courage to make it happen.

As a co-founder of one of the most successful media agencies, I truly hope to see this happen. It’s not too late.