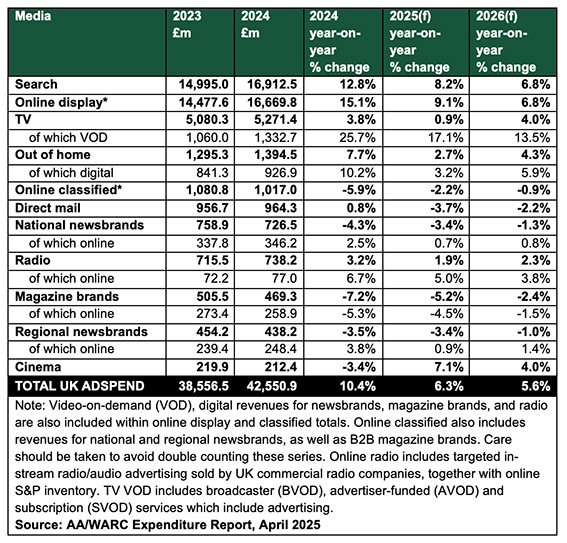

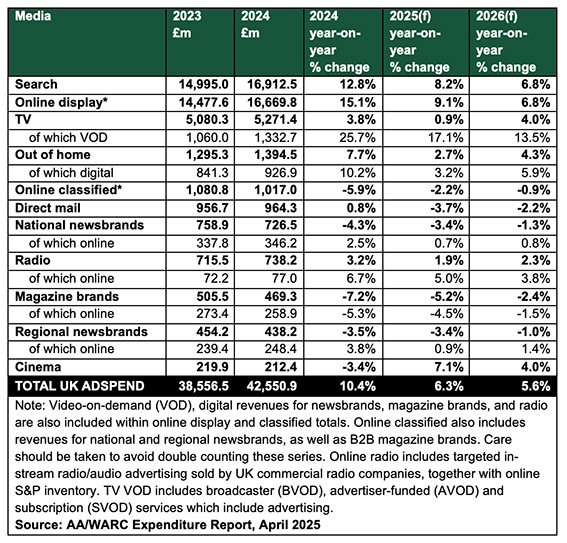

UK adspend rose 10.4% to reach £42.6bn last year, according to the latest quarterly Expenditure Report from the Advertising Association and Warc.

Once inflation has been taken into account, growth was estimated at 7.6% — considerably higher than the wider UK economy, which grew 1.1% in 2024.

“It’s important to remember once again that advertising supports competition and promotes innovation, and helps to create jobs across the UK, so a healthy advertising sector is integral to a healthy economy,” commented AA CEO Stephen Woodford.

TV adspend was up by 3.8% last year to £5.3bn.

Within the VOD sub-segment of TV, growth was estimated at a much higher 25.7%. Importantly, this sub-segment has been redefined in the report to now also include subscription VOD (such as Disney+, Netflix and Amazon Prime Video), advertising-supported VOD and free ad-supported TV, alongside broadcaster VOD.

Lindsey Clay, CEO of TV trade body Thinkbox, commented that TV’s growth is reflective of the channel’s “expansion” and “proof of TV’s effectiveness”.

Online display was an outperformer in terms of growth, with adspend rising by 15.1% to £16.7bn. Social media accounted for 53% of this. Retail media was also included in online display and increased by 22.7% in 2024.

IAB UK’s latest Digital Adspend Study, also out this week, pointed to strong growth in video display within the wider display category.

Adspend in search, the biggest category, rose 12.8% to £16.9bn in 2024. In fact, the category accounted for £2 of every £5 of adspend in the UK last year, said the AA and Warc.

Notably, online formats more generally were responsible for £4 in every £5 of spend on advertising in 2024.

Elsewhere, OOH, radio and direct mail all saw increases in 2024, at 7.7%, 3.2% and 0.8% respectively.

Meanwhile, in a continuing trend, declines in 2024 came from magazine brands, online classifieds, national news brands, regional news brands and cinema.

Video display outpaces digital ad market growth

Christmas bonanza

The Expenditure Report also revealed that, during the important Christmas season in Q4, adspend rose 9.1% compared with Q4 2023.

Channels that showed the strongest growth were search (12.5%), online display (15.4%), VOD (23.2%) and cinema (24.2%).

Cinema, in particular, benefited from a strong film slate during this period, including Wicked and Paddington in Peru, said the AA and Warc.

Figures from Comscore showed that cinema box office in the UK and Ireland grew 21% in December alone.

Wicked and Moana 2 help 2024 box office surpass £1bn for second straight year

Looking ahead

In 2025, the AA and Warc expect adspend growth to slow slightly to 6.3%, hitting £45.2bn. This is a 0.6 percentage point downward revision from January.

While search (+8.2%) and online display (+9.1%) will continue to see increases, growth is anticipated to be slower than the double-digit rises seen in previous years.

Meanwhile, cinema (+7.1%), OOH (+2.7%), radio (+1.9%) and TV (+0.9%) are all expected to experience growth this year.

The AA and Warc cited “a possible destabilising effect from the US trade tariffs on the wider global economy and a tougher economic backdrop” for the downward revision.

UK adspend is forecast to rise by 5.6% in 2026 to £47.8bn. By that point, search and online display are expected to account for 80% of the market, according to the report.

Notably, with 2026 being a football Men’s World Cup year, TV is anticipated to reach £5.5bn, with VOD responsible for almost a third (32%) of this.

Digital channels drive growth as UK adspend rises 9.7% in Q3

James McDonald, director of data, intelligence and forecasting at Warc, highlighted that confidence in the UK ad market remains “fragile” as a result of economic stagnation, business taxes introduced in the autumn budget and the US trade tariffs.

He warned: “The temptation to cut ad budgets in such a climate will be elevated.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.