UK advertising exports rebound to reach £15bn

The UK exported £15bn in advertising and market research services in 2021 — a 33% year-on-year increase.

The latest Office for National Statistics (ONS) data shows a significant rebound from the plateaued export value seen during the pandemic. It is the highest figure reported since Credos, the advertising industry’s think tank, began tracking the industry’s export figures in 2018.

The growth brings export value back in line with the industry’s pre-Covid trajectory and places the UK second only to the US for advertising and marketing services exports worldwide.

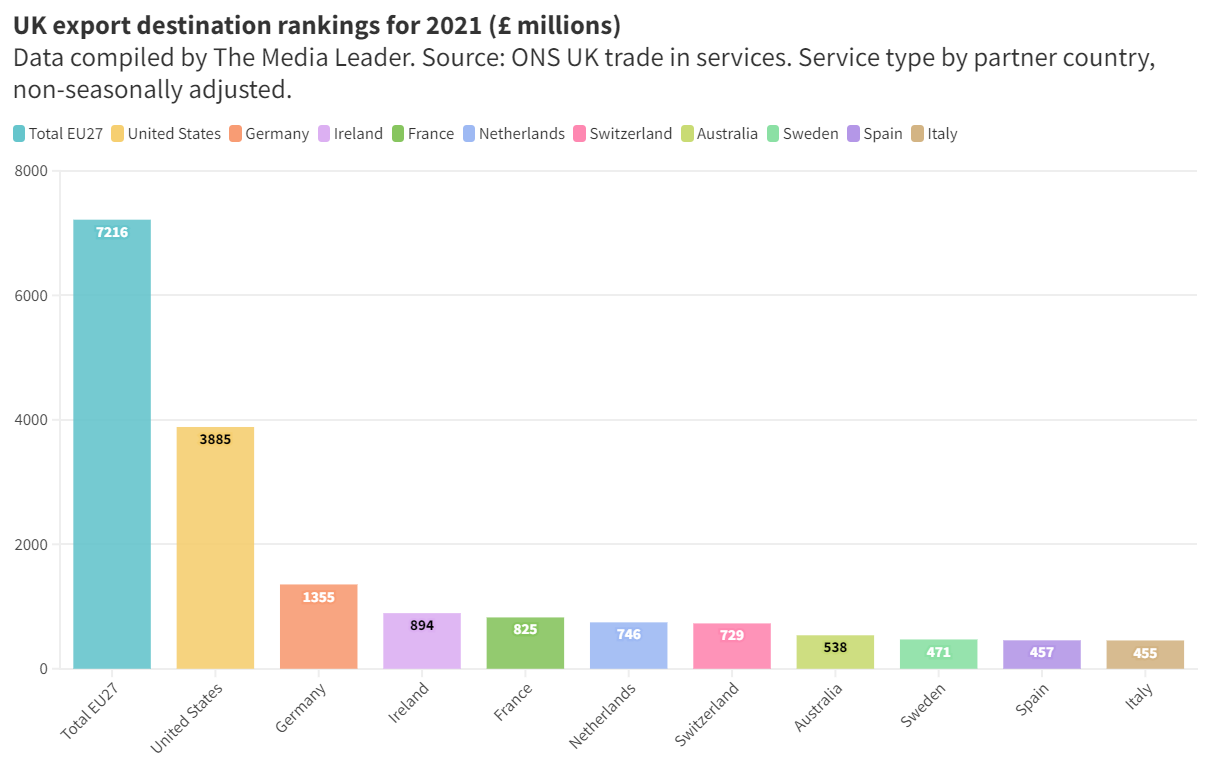

While most exports went to EU member nations (£7.2bn), the top individual recipient remains the US with £3.9bn, a value that has more than tripled since 2020. This is followed by Germany (£1.36bn) and Ireland (£894m).

Since Credos’ first report tracking export figures from 2017, exports to the EU have more than doubled (+125%) from £3.2bn, a stark increase that has occurred despite the UK’s decision to leave the union.

The figures drew praise from Secretary of State for the Department of Business and Trade Kemi Badenoch. “The advertising industry is one of the UK’s strongest exports and these record figures provide a great boost as we aim to sell £1tn of goods and services a year to the world by the end of the decade,” she said. “I look forward to working closely with the industry to help businesses expand into new markets and help drive further economic growth in the years ahead.”

The UK’s total ad market is expected to grow to £36.1bn in 2023, according to the latest estimates from AA/WARC.

The UK also sharply increased its imports of advertising and marketing research services in 2021. Valued at just under £12bn in imports, it marks a 70% rise from 2020’s figure of £7bn. The UK therefore retained an overall trade surplus of £3bn in 2021.

Last month, in one of the largest trade deals since the country left the European Union, the Government announced the UK was set to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a trade bloc consisting of 11 countries spanning the Indo-Pacific with a combined GDP of £11tn. The UK Advertising Exports Group (UKAEG) says it is eager to seize this potential for growth and expansion as it makes its plans for the years ahead.

However, Credos’ analysis of export data showed significant headwinds for the global advertising industry. Inflation is taking a “more noticeable effect” as the cost-of-living crisis continues. The difference in export value vs real terms in 2021 is approximately 12%, compared to 2016.

“It is terrific to see such strong growth figures from the UK’s world-leading advertising and marketing services, showing the innovative way our industry has responded to the challenges posed by the pandemic,” said Stephen Woodford, CEO of industry trade body the Advertising Association. “We prepare now to support the next decade of UK advertising growth, through our productive partnership between the industry, through the UK Advertising Exports Group, and the Department for Business and Trade.

“As the UK Government sets out its ambitions to become a science and technological superpower, we should not forget the UK is already a creative superpower and our recent success at SXSW demonstrates how our industry can continue to play a key part in UK export growth.”

The UKAEG, in partnership with the Department for Business and Trade, recently completed its “biggest trade mission to date” at SXSW in Austin, Texas. UK House attracted over 10,000 delegates at the conference.

The trade mission was backed with the launch of a new “GREAT” campaign, targeted at North America, to help promote the UK as the global hub of advertising and innovation.

To better understand the UK’s further prospects for export growth, the UKAEG and Credos have commissioned a new research project with Enders Analysis. The report will be launched in November as part of International Trade Week with Department for Business and Trade (DBT).