UK households with SVOD services drop as inflation hits

The number of UK households subscribing to at least one video-streaming service appears to have fallen this quarter as the rising cost of living squeezes disposable incomes.

Kantar’s latest Entertainment on Demand study showed UK households were starting to prioritise saving money over entertainment as cancelling subscription video on-demand (SVOD) services increased quarter-on-quarter and year-on-year.

The number of UK households that have at least one paid subscription fell by 215,000 quarter-on-quarter to 16.9 million households or 58% of households.

Kantar also found 1.51 million SVOD services were cancelled by households this quarter compared to 1.04 million in Q4 2021 and 1.20 million in Q1 2021.

More than half a million of these cancellations were put down to “money saving”.

Nearly four in 10 (38%) of households are planning to cancel an SVOD service mainly down to “wanting to save money” this quarter, compared to 29% in the preceding three months.

Streaming service penetration amongst GenZ households fell for the first time from a peak of 75.8% in Q4 2021 to 74.6% in Q1 2022.

For the three months up to March 2022, only 3% of households in Great Britain signed up to a new video-streaming subscription, compared to 4.2% in Q1 2021.

Churn rates for streaming platforms increased across the board as inflation hit 7% this month, however, Netflix and Amazon were seen as more of a “hygiene” subscription, the last to go when households were budgeting for rising costs.

Disney+, NOW, Discovery+ and Britbox saw significant churn rates this quarter compared to the last. Disney+ for example tripled its quarterly churn to 12% this quarter.

Kantar’s research found UK homes that subscribe to streaming services now subscribe to an average of 2.4 services.

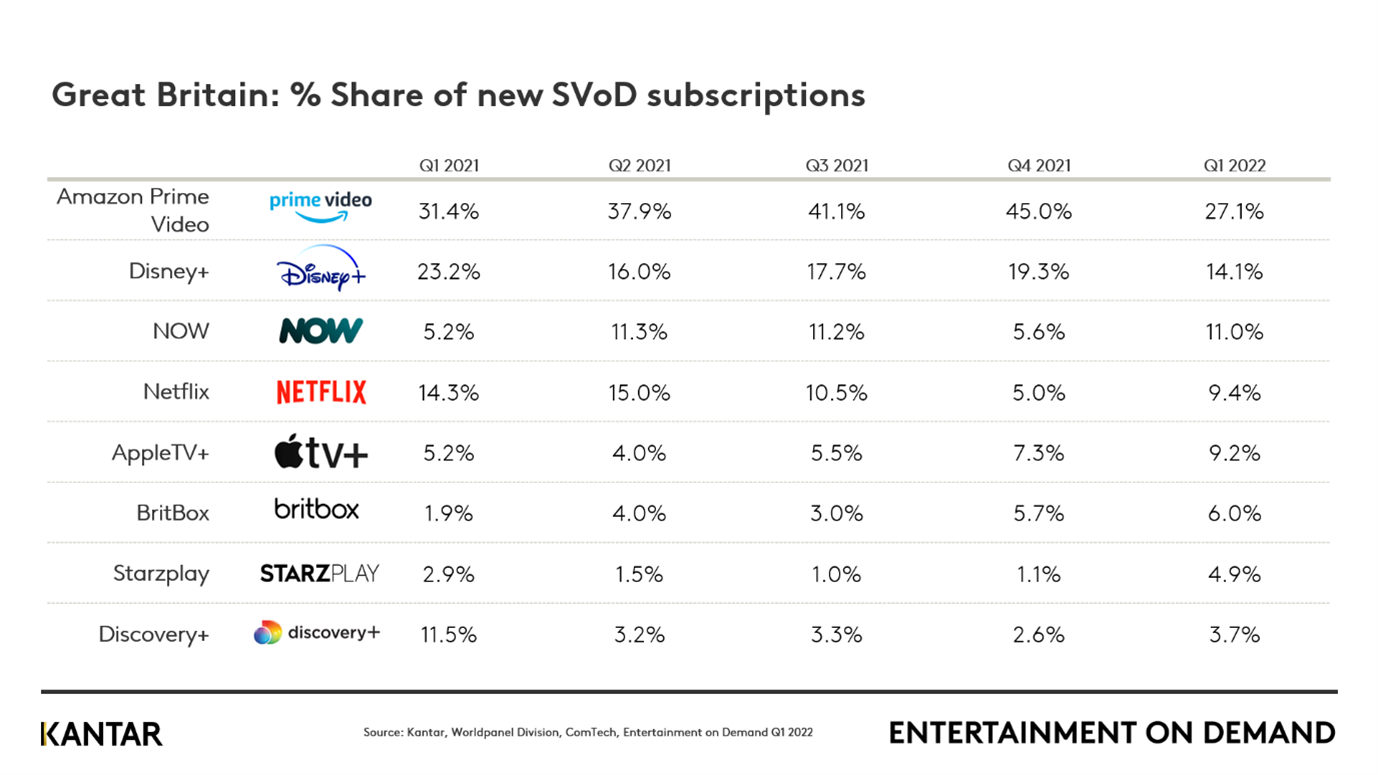

In the last 12 months the number of consumers stating they signed up to a service to watch a specific show or film has risen from 30% to 36%, and Amazon Prime Video came out top for new subscribers in the UK (see chart, above).

Additionally, the study found Netflix subscribers’ attitudes to advertising were “softening” with 44% now saying they “don’t mind” seeing ads on streaming services if it makes them cheaper, up from 38% at the same time last year.

This comes as Netflix CFO Spencer Neumann said in March “it’s not like we have religion against advertising”.

Dominic Sunnebo, global insight director, Kantar, Worldpanel Division, said: “With many streaming services having witnessed significant revenue growth during the height of Covid, this moment will be sobering. The evidence from these findings suggests that British households are now proactively looking for ways to save, and the SVoD market is already seeing the effects of this.

He added: “As a result, it’s now more critical than ever that SVoD providers demonstrate to consumers how their services are indispensable in the home in what has become a heavily competitive market. New marketing and content acquisition strategies will likely need to be deployed to support this and avoid further churn.”

“Content accolades offer huge value to SVoD services, demonstrating that their original production investments and creative capabilities can outshine Hollywood. While Netflix has won numerous awards for its films, Apple made it first to the Oscars, which could drive further growth for Apple TV+ as consumers take out a subscription to find out what made CODA so impressive,” he continued.

Amazon Prime’s Reacher (pictured, main image) was the most enjoyed show in Q1 2022 among UK audiences, with Netflix’s Ozark and Inventing Anna coming in second and third.