UK overall media inflation is expected to increase to 2.2% in 2024, from 0.9% last year, according to a new report.

ECI Media Management’s latest quarterly study paints “an equally mixed picture for advertisers the world over” as a result of continuing uncertainty, geopolitical tensions and the global economy oscillating between recovery and recession, alongside national elections and global sporting events.

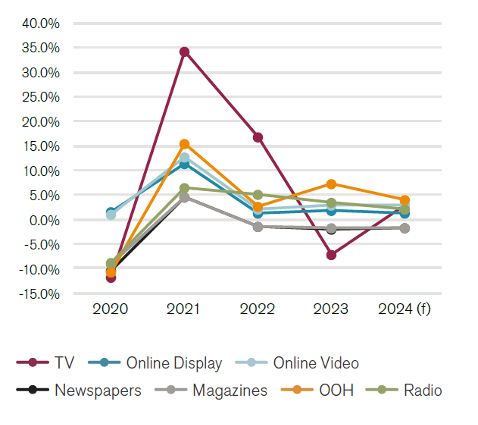

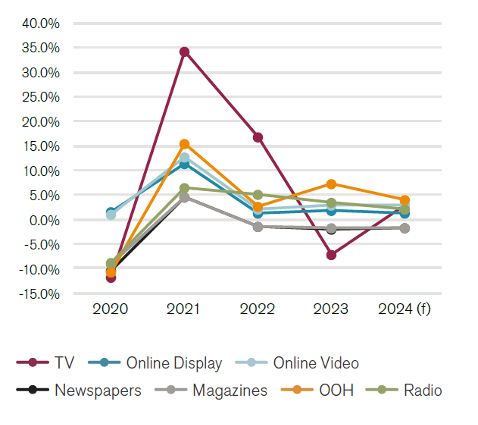

The Media Inflation Report forecasts media inflation for seven key channels in Q1: TV, online display, online video, newspapers, magazines, OOH and radio. Research covers both a global and regional level across 48 countries.

In the UK, TV is set to “rebound significantly” from “a depressed year in 2023”, with media inflation predicted to rise to 3.0% in 2024, compared with -7.1% in 2023.

There were high levels of inflation in 2021 and 2022 following the pandemic.

ECI global CEO Fredrik Kinge attributed this to many advertisers “sitting tight last year” and postponing campaigns and investments until 2024. He added that since the UK TV market is “so reactive”, it is “now witnessing a significant rebound in TV advertising spend, driving up prices”.

There is “increasing confidence” that 2024 will be “a big year” in terms of sporting events such as the Olympic and Paralympic Games in Paris and the Uefa men’s Euros in Germany — all of which hold “a huge appeal for advertisers”, Kinge added.

UK media inflation by channel

Source: ECI

Meanwhile, ECI anticipated OOH media inflation in the UK to reach 4.0% in 2024, followed by online video with 2.8%, radio with 2.2% and online display with 1.4%. Newspapers and magazines will deflate by 1.8% and 1.7% respectively this year.

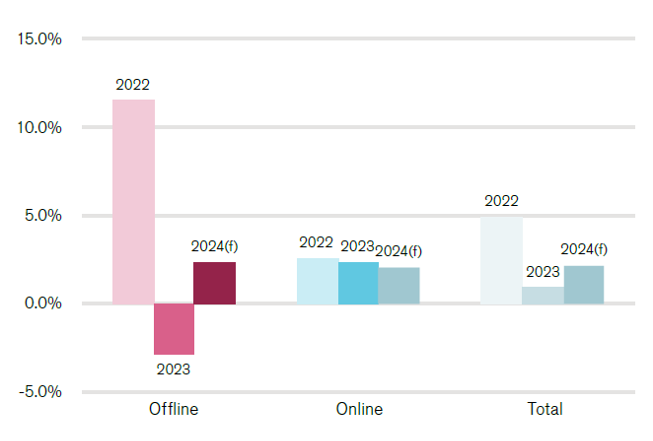

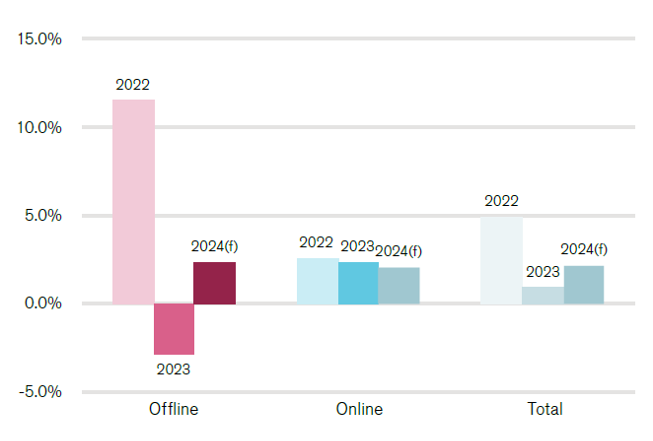

UK media inflation by online and offline

Source: ECI

Global outlook

ECI forecasts global media inflation at 3.1%, down slightly on 2023 and 2022.

All seven media channels are forecast to see inflation.

OOH and online video are expected to have the highest inflation, of 4.2% each, and overtake TV, which had the highest forecast (which was later downgraded) last year.

On a regional level, EMEA has the second-highest level of inflation with 3.8%, after Latin America with 11.4%. Asia-Pacific is expected to grow 3.6% and North America by 1.4%.

Kinge said “the overarching theme” for 2024 is “relatively steady inflation at a global level”, but with “significant exceptions including continued deflation for TV in the US”.

He added: “In the UK, TV pricing has recovered after spending 2023 in deflationary territory. It joins the cluster of other media types seeing single-digit inflation, with the exception of print, which is deflationary, contributing to an overall impression of pricing stability in the UK.

“With such uncertainty in countries across the world at the moment, both politically and because of all the changes we are seeing in the media industry, it’s critical that media investments are focused, precise and transparent, so that brands can be sure that every ad dollar drives higher media value.”

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.