‘We are in a crisis’: Advertising: Who Cares? suggests media business models must change

Who cares about improving the advertising industry?

If the attendance of Thursday’s second annual ‘Advertising: Who Cares’ event in Leicester Square’s Vue cinema is anything to go by, at least 200 senior industry leaders from the UK, Europe and North America, spanning agencies, brands and media owners.

The day-long conference, led by industry veterans Brian Jacobs and Nick Manning, sought not only to characterise the “crisis” the advertising industry has fallen into as it faces a decline in effectiveness and budgets, but also to provide solutions for how the industry can and should move forward.

“Advertising has lost its swagger,” Manning declared in his opening remarks. He pointed out that five companies — Meta, Amazon, Alphabet, Alibaba and ByteDance — now account for half of all ad revenue, including 70% of incremental revenue.

This “consolidation of power”, he argued, has led to worsening results for advertisers, who too often conduct automated media buys through their platforms without sufficient examination of the effectiveness of such efforts.

Defining a pre-AI “doom loop” of ad bombardment online, leading to low attention, which in turn leads to ineffectiveness, and ultimately to even more “force-feeding” of ads to consumers to meet KPIs, he noted that these issues are likely to worsen as the open web becomes overloaded with AI-generated content.

More importantly, Manning noted, Big Tech’s ad businesses are built on one-to-one relationships with users, offering supposedly targeted and “personalised” ad experiences that, he argued, are rife with fraud and aren’t especially effective in the long term compared to larger-scale brand-building efforts.

“Advertisers are fishing with a rod, not a net,” he explained.

The concerns raised are familiar to readers of Manning’s column for The Media Leader, but his warning of the mass waste created by the ad industry was no less substantive. Later in the conference, the7stars’ owner Jenny Biggam off-handedly acknowledged that the global ad fraud industry is now larger than even the global heroin industry.

“Advertisers have to regain control, with the help of their agencies,” Manning concluded.

Rebuilding business models

How do we regain control? It comes down to ‘righting the ship’ in nine key areas, according to Manning: readjusting business models, adapting to new technology, improving media trading and measurement, strengthening talent and industry relationships, and refocusing on the importance of creativity and comms planning.

In other words, adapting nearly everything the industry currently does to better suit the moment.

For agencies, as Caroline Johnson, co-founder of The Business Model Company, explained, that could mean changing the entirety of their business model.

Since agencies typically have service-based business models, Johnson argued that there is often “significant misalignment and tension” between self-interested profit-seeking and what is in the best interest of the client. Agency businesses, she suggested, perform best financially when they allow opaque operations, but clients typically desire the opposite.

This was exemplified in a later discussion with Biggam and Neil Harrison, the head of media at Standard Life, on the subject of principal media. The practice, wherein an agency buys and resells ad inventory to clients at a markup, with undisclosed margin, “leads to a conflict of interest”, the pair agreed. As Harrison explained, if the agency stands to benefit from putting certain ad inventory on a plan, that compromises the integrity of the plan.

Presenting research on the subject conducted by Isba’s Media Leaders group, Biggam noted that of 30 brand marketers surveyed, just one indicated they believe principal media does not compromise an agency’s ability to provide neutral media planning recommendations, and just two indicated they felt “positive” about the practice of principal media. This compared to 15 that were neutral and 12 that were negative.

According to Johnson, agencies must redesign their business models to move “from self-interest to best-interest” and “from service to value” by becoming more client-centric. This includes moving away from time-based billing amid an era of “less is more” as clients demand greater efficiency through AI-led products.

Instead, agencies should offer outcomes-based billing, moving “from ‘we will do’ to ‘you will have'” as a model for business.

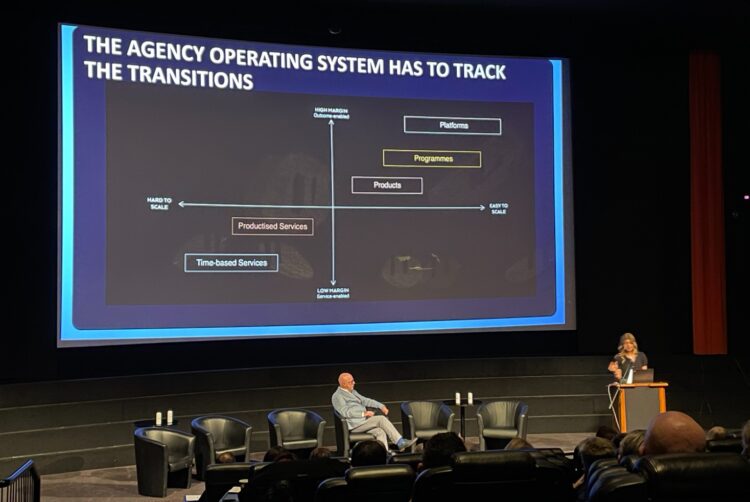

This requires a “neighbourhood shift”. Currently, agencies could be generally described as low-margin, hard-to-scale enterprises with productised, time-based services, Johnson explained. Tech platforms, on the other hand, are high-margin and easy to scale.

Holding groups are broadly investing substantially in AI tools aimed at improving efficiency and working with clients more akin to how platforms conduct business. However, Johnson warned such investments are being “dragged back” by outdated service-based business models.

Equally, creative agencies “are on their knees”, holding back the much more profitable media businesses at large holding groups. Johnson suggested that creative needs to be “decoupled from creative services” and moved more upstream to improve value.

For Manning, these recommendations are “necessary, but not sufficient” conditions to improve the media ecosystem. Likening it to “getting the soil right”, further changes to how media effectiveness is measured and communicated to clients, among other factors, are also needed.