WPP Media forecasts 8.8% global ad revenue growth in 2025 but warns of ‘K-shaped economy’ risk

Global ad revenue is forecast to grow 8.8% year on year to $1.14tn in 2025 despite persistent macroeconomic headwinds, WPP Media’s This Year Next Year report has predicted.

The growth prediction is an upgrade from the summer, when WPP Media downgraded its 2025 forecast over “disruptions to global trade and continued deglobalisation pressures weighing on ad investment”, referring to the Trump administration’s tariff policy as a potential economic drag.

While growth is still expected to slow to 7.1% in 2026, WPP Media is now forecasting the global ad market will reach $1.55tn by 2030.

The UK’s ad market is expected to slightly trail global growth this year (+8.0% to $58.4bn) and next (+7.0%), but will remain the biggest market in Europe, representing a quarter (24.2%) of all European ad spend.

Kate Scott-Dawkins, WPP Media’s global president of business intelligence and author of the This Year Next Year report, explained that the sunnier outlook was driven by two key developments. One a better-than-expected response to tariffs. And two AI driving both business efficiency and creating new companies that are beginning to spend heavily on advertising (and digital advertising in particular).

“Tariffs have not had the impact this year that we expected,” Scott-Dawkins admitted. Instead, retailers broadly pulled inventory forward to smooth the transition to higher prices, and consumer spending has remained “resilient”.

But Scott-Dawkins warned there exists substantial downside risk related to the health of the global economy. While consumer spending has been maintained despite price inflation and signs of a contracting job market, the growth of buy-now-pay-later schemes may be helping to artificially prop up short-term spending habits, she suggested.

Meanwhile there is evidence the post-pandemic economic recovery is “K-shaped“, with upper classes in many advanced markets responsible for larger proportions of discretionary spending while middle and lower classes get squeezed.

Nevertheless, adspend growth is continuing to outstrip GDP growth, implying a greater willingness among businesses to maintain or grow marketing budgets even through macroeconomic uncertainty.

‘Astounding’ Big Tech growth leads to consolidation elsewhere

Scott-Dawkins called the “sustained 20+% growth” at companies like Meta, Amazon and Alphabet this year “astounding”, noting that the “tenor” of the wider media industry is that of “structural decline” of linear and traditional media channels in favour of their digital counterparts.

WPP Media found that a concentrated group of the top 25 media sellers now accounts for over 70% of total industry revenue. This is likely to be exacerbated as advertisers funnel money to media owners that can afford to invest significantly in AI products.

“The growth of large platforms and the addition of AI engines are pushing consolidation of other players,” Scott-Dawkins said.

Case in point, Netflix on Friday agreed to acquire Warner Bros for $82.7bn, and in the UK Sky is in “preliminary discussions” to purchase ITV’s Media & Entertainment business. There has also been mass consolidation among media buying agencies, including through the consolidation of WPP’s own GroupM (now WPP Media) earlier this year, as well as this month’s merger between Omnicom and Interpublic Group.

The report estimated that 84% of all advertising is now via digital channels, inclusive of “traditional” media’s digital counterparts, like connected TV (CTV) and digital OOH (DOOH). OOH is predicted to have had a strong 2025 (+6.3% to $54.6bn), driven by growth in investment at travel sites.

Meanwhile, the global linear TV market will be surpassed this year by commerce media for the first time, WPP Media predicted.

Commerce-driven ad revenue (inclusive of retail media, travel services media and financial services media) will account for 15.6% of total ad revenue in 2025 ($178.2bn), though WPP Media forecasts the segment will decelerate to high-single-digit growth by 2030.

While TV has demonstrated “remarkable stability in absolute terms” (the channel grew +0.6% year on year in 2025 to reach $167.4bn globally), the resilience is “surface-level” due to the shift in TV’s global market position.

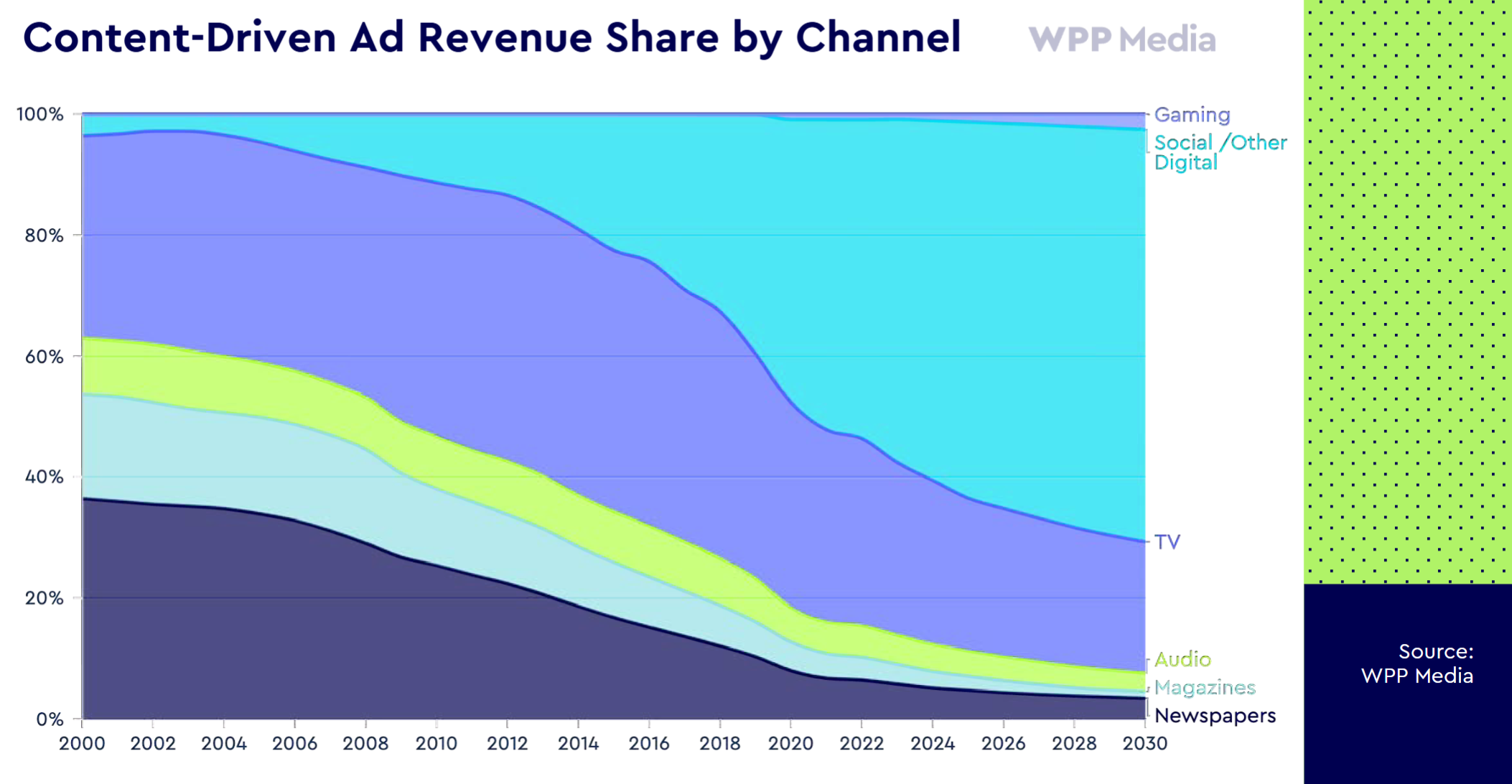

TV, along with audio and publishing, has practically been pushed out by the primary growth engine for “content-driven advertising”, social and digital platforms (+12.8% year on year to $413bn in 2025).

WPP defines “content-driven advertising” as inclusive of TV, audio, newspapers, magazines, social and gaming. The largest of any segment it measures, these channels are expected to account for 58% of total ad revenue in 2025.

Social and digital platforms alone are expected to account for 36.1% of total global adspend in 2025, with this rising to 36.4% in 2026.

Gaming, meanwhile, is predicted to be the fastest-growing content advertising channel (+29.5% year on year to 8.5bn in 2025), though it remains just a fraction (0.7%) of total ad revenue.

Big Tech’s growth is likely to be further buoyed by young AI-driven businesses turning to the likes of Meta and Google search for their marketing strategies, Scott-Dawkins added.

That said, there do exist downside risks for the platforms. WPP Media is predicting ad growth for the channel to decelerate next year, in part due to age bans. Australia’s ban on social media for under-16s is set to come into effect later this week.