WPP Media launches framework for evaluating AI advertising capabilities

WPP Media has designed and released a framework for how its business intelligence arm will evaluate AI-driven “advertising intelligence” tools and platforms.

The framework examines and weights “the capabilities necessary to own the future of ‘search’ and intelligence.”

Categories scrutinised include data assets, AI/technical capability, distribution, transaction/commerce capability, and content/media.

“We believe the future of advertising will increasingly involve not just human consumers making purchase decisions, but AI agents and bots acting on behalf of users to research, compare and transact,” the report’s author, WPP Media’s global head of business intelligence Kate Scott-Dawkins, wrote. “Understanding which platforms are positioned to facilitate those interactions matters profoundly for brands, agencies and media sellers planning multi-year strategies.”

In its present state, the framework is designed to evaluate platforms that enable “personalised, data-driven advertising intelligence”. However, Scott-Dawkins said such a design “should not suggest we undervalue advertising thought of as mass media”, including sponsorships, OOH, experiential marketing, TV, or other “brand-building creative work”.

She added that priming and brand preferences “will be equally — if not more — important within an AI-enabled advertising future,” in which brand salience is a core factor in how AI agents make product recommendations to consumers.

WPP Media will release quarterly updates to its analysis within this framework, taking into account the current state of AI development when theorising about strengths and opportunities in the market over the next five years.

Who are the current ‘intelligence’ leaders?

Breaking the framework down by category, WPP Media identified several current leaders in advertising intelligence, most of which are tech giants that already account for over 70% of global advertising revenue.

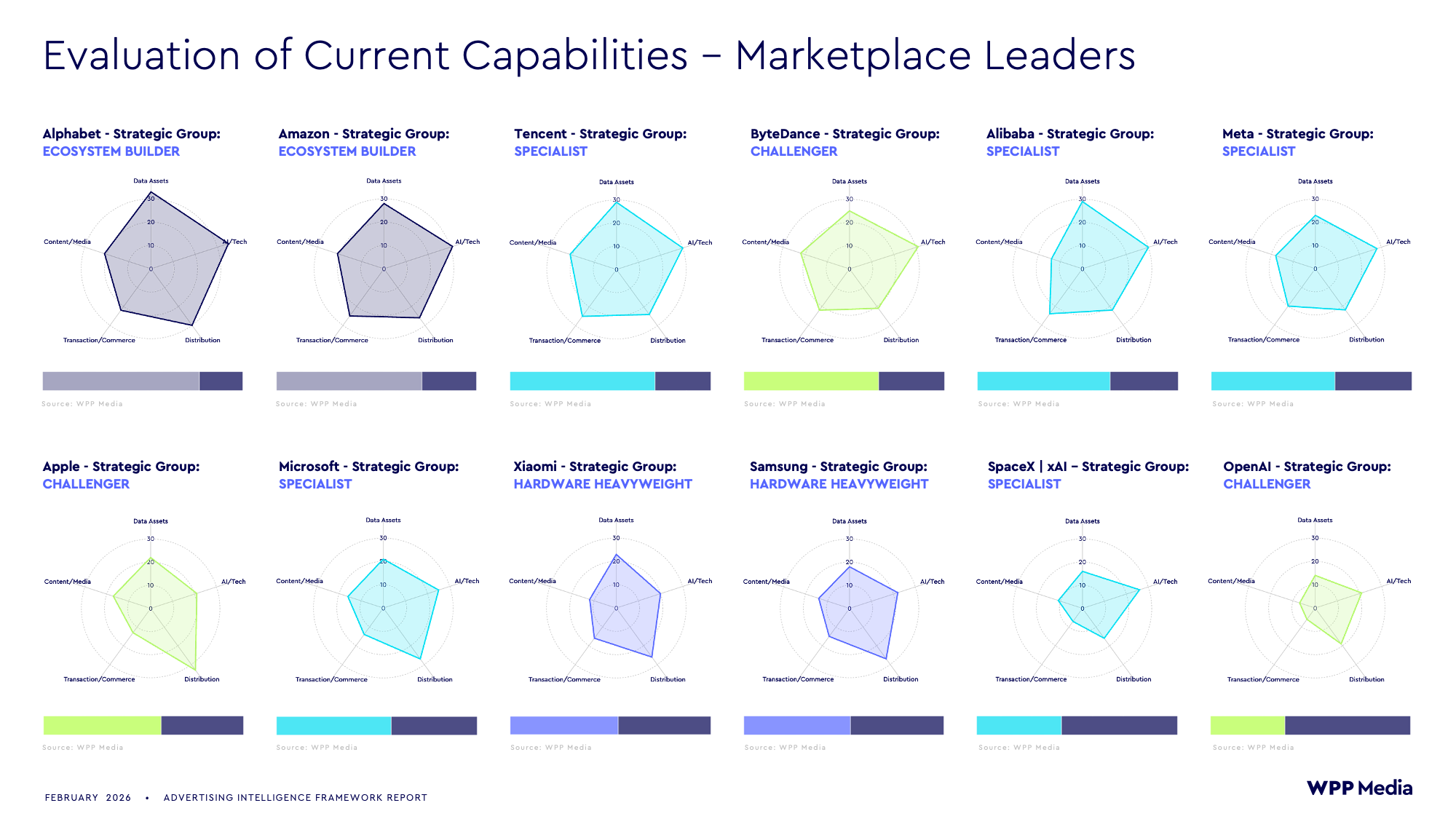

Its analysis grouped leaders into four groups: Ecosystem Builders (Alphabet and Amazon), Specialists (Alibaba, Meta, Microsoft, Tencent, and xAI), Challengers (Apple, ByteDance, and OpenAI), and Hardware Heavyweights (Samsung and Xiaomi).

Those businesses were more or less robustly rated by category:

Data Assets

WPP Media defines data assets as the volume, quality, and variety of proprietary data that companies possess, whether about users, businesses, the physical world, or other individuals.

Alphabet was singled out as the one “real-world leader” in the category, as most of its peers, including Meta, ByteDance, Tencent and Amazon, lacking “defensible physical-world index at scale”.

The framework recommends that advertisers “favour partners with persistent multi-modal signals and verified identity” and insists on clean-room access. Lower-funnel efforts, WPP Media suggests, should prioritise platforms with “transaction visibility”; upper-funnel efforts should seek to combine platform data with behavioural data and “shoppable pilots”.

AI/Tech

This category evaluates AI model development, infrastructure capability and the quality of algorithms powering personalised and “proactive” intelligence.

Current leaders in model development include Alphabet (Gemini 3), OpenAI (ChatGPT and Sora), Meta (Llama) and xAI (Grok).

Infrastructure giants include Amazon, Alphabet, Microsoft and, to a lesser extent, Apple via its private, device-side compute infrastructure.

The best recommendation algorithms are dominated by similar companies: Alphabet, ByteDance and Meta. Amazon, likewise, is singled out by WPP Media for personalised product recommendations.

For advertisers, WPP Media warns that brands “depending on single-platform black boxes”, including many of the companies listed above, “face concentration risk as regulatory pressure mounts”. It recommends that advertisers instead build multi-platform measurement capabilities, demand transparency into AI systems, and judge partners on real-world performance rather than model benchmarks by demanding transparency and evidence of performance.

Distribution

The distribution category measures how companies reach users and provide access to intelligence services.

A small set of current leaders in this category has global scale, according to WPP Media. They include: Google, Apple and Meta, with Apple the only one of the three with a presence in the lucrative Chinese market.

Scott-Dawkins notes that many advertisers see these partners as “ubiquitous and a priority for broad reach across demographics, geographies and contexts”, with additional platforms used to target specific cohorts.

Transaction/Commerce

Transaction capability is defined as the extent to which companies can monetise AI tools and features, whether through commerce or advertising.

At the moment, “excelling at both commerce infrastructure and advertising systems simultaneously is exceptionally rare”, according to Scott-Dawkins.

Just four firms currently do this well: Amazon and Alibaba, which began as e-commerce platforms before adding advertising capabilities, and Alphabet and Meta, which began as advertising platforms before developing e-commerce capabilities.

Importantly, Scott-Dawkins notes there are likely “inherent tensions” between marketplaces that are “merchant-friendly” in their operations and those that employ an “advertiser-serving monetisation infrastructure”.

Content/Media

Entertainment creates advertising opportunities. For the purposes of its framework, WPP Media examines content based on that which “enables high-impact ad inventory, commerce integration and ecosystem lock-in” as opposed to “quality for its own sake”.

On that basis, Scott-Dawkins notes that YouTube retains strong engagement but lacks “ad innovation, content exclusivity and seamless commerce”.

TikTok, on the other hand, has significant scale and algorithmic recommendations but does not necessarily have a moat, as content creation is commonly shared across competitor short-form video platforms. Amazon, meanwhile, “leads in content-commerce integration”, but is reliant on the Prime bundle and lacks “IP depth”.

“Look for companies building next-gen solutions enabling shopping conversions within content,” Scott-Dawkins advises. “Low churn environments provide opportunities for repeated messaging to audiences and brand priming.”