5 global streamer pivots taking TV back to the future

For the first time in a decade, global streamers — covering major subscription VODs (SVODs) and studio direct-to-consumer (D2C) services — have stopped inventing business and content distribution models. Instead, they are drawing on approaches that proved successful before they disrupted the TV universe.

As independent analyst Ben Keen noted recently, they are drawing on refreshed versions of business models that worked in the past.

Keen has outlined five pivots designed to move major streaming services towards profitability. As he made clear, streamers like Netflix have been happy to re-code their DNA where necessary, citing the many instances when Netflix slapped down the idea of introducing advertising.

“If you look now, 55% of new Netflix sign-ups choose the ad tier in the markets where it is available and the company has reached 70m ad tier users,” Keen noted.

He also pointed to the 157m global ad tier subscribers at Disney, spanning Disney+, Hulu and ESPN+, and referenced the way Amazon Prime Video turned its ad tier into the default option.

The move to ad tiers and live sport

So pivot one in the pursuit of global streamer profitability is the move from subscription-only and ad-free streaming to hybrid models that include advertising support.

The economics of the TV industry had always relied historically on advertising as one of the major revenue streams to pay for premium content.

Pivot two, as outlined by Keen, is the move into live programming and especially live sport.

Using Netflix as an example again, he pointed to how it started creating global “events” like a celebrity golf tournament (The Netflix Cup) and celebrity tennis matches (The Netflix Slam, featuring Rafael Nadal vs Carlos Alcarez).

“This strategy continued last year with the famous [Jake] Paul vs [Mike] Tyson boxing match, which attracted a staggering 180m viewers,” Keen explained. Netflix also has a $5bn, 10-year deal for WWE Raw and a three-year partnership to show two NFL games on Christmas Day, as well as the exclusive US rights to the Fifa Women’s World Cup in 2027 and 2031.

“Apple are using the same playbook, with a $2.5bn billion, 10-year deal for Major League Soccer with global exclusivity,” Keen continued. “Other streamers have taken a market-by-market approach to build up their rights, but they are all interested in live sport because it is the single biggest driver of subscriber sign-ups.”

He pointed to Q4 2024 figures from Digital i showing that 11% of Netflix subscribers watched the Paul v Tyson fight and another 7% watched NFL games on Christmas Day. “It works,” Keen said of sports content as a way to drive engagement. “There was a massive bump in Netflix sign-ups for the Paul-Tyson fight and another sign-up peak around the NFL Christmas games.

“You can retain these new subscribers too. Churn after the Paul-Tyson fight was bigger than the Netflix average, but the figure was still better than the industry benchmark.”

Once again, sports as a driver for success is not new. “Rupert Murdoch invented this model,” Keen noted, referring to how the pay-TV pioneer staggered the UK industry in 1992 when Sky took the exclusive rights to the newly formed Premier League.

Return of the bundle

Pivot three is also inspired by historically successful pay-TV business models, namely bundling.

“TV aggregation really began with the pay-TV guys curating content through a single user interface and that was tightly aligned to the core pay-TV strategy of bundling channels together,” Keen said.

“I would argue that forcing consumers to take some channels they didn’t want was part of the reason cord-cutting began, creating the conditions for the OTT explosion.”

The proliferation of streamers has now created a new fragmentation challenge, while pay-TV operators are leaning in to super-aggregation.

“But these legacy guys have stiff competition from multiple gatekeepers, like virtual pay-TV providers and device OS companies,” Keen continued. “The streaming apps themselves are choosing to return to the bundle, like the fascinating combination of Disney and Warner Bros Discovery, with its price discount.”

Keen said the studio D2C and SVODs involved in bundling (whether streamer-organised or pay-TV-organised) now accept this model because it is proven to drive new subscriptions and help retain customers.

Rise of licensing

Pivot four once again welcomes back a business model that was previously standard practice: selling content to third parties (which then distribute them via their free or subscription TV channels or streaming services).

“What we saw was an expensive shift by studios to put all their content rights into their own walled garden [streaming service] and not sell to others,” Keen explained.

Disney was the first major studio to sell films to Netflix before it decided three years ago that it was fuelling a rival and should retain content for its own service (Disney+). Many studios came to the same conclusion, leading to less licensing.

But they are now relaxing their attitude. As Keen noted: “The big studios are increasingly selling the second-window rights to others — and increasingly to rival streamers.”

Keen pointed to 3Vision data showing how Disney kept nearly all of its own US-scripted series content during both the first and second windows during 2021/22 and 2022/23, but in 2023/24 notably increased second-window sales to third parties.

This data showed that Paramount kept three-quarters of its scripted series content for Paramount streaming during 2022/23 and 2023/24, but ramped up sales to third parties in the second window the following year.

Popular with viewers

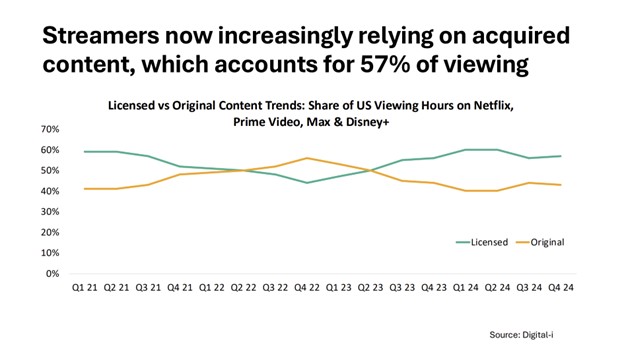

Licensed content is very popular on streaming services and Keen pointed to Digital i data showing that 57% of US viewing hours across Netflix, Prime Video, Max and Disney+ in Q4 2024 came from licensed content.

Between Q2 2022 and Q2 2023, original content accounted for more viewing on these services than licensed content. Before Q2 2022, it was licensed content that delivered the most viewing hours (with the chart going back as far as Q1 2021).

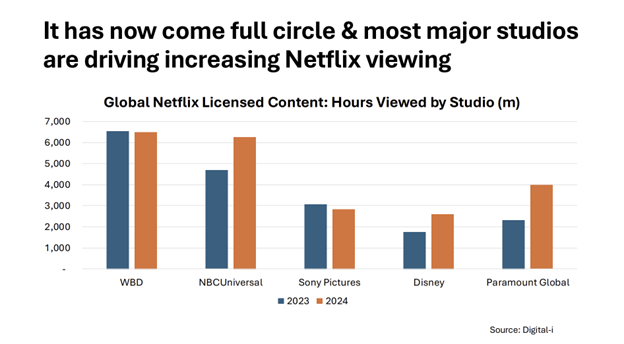

Digital i figures showed that, in 2024, Warner Bros Discovery content accounted for well over 6bn hours of Netflix viewing globally, with NBCUniversal content also above the 6bn hours mark.

Paramount content gained approximate 4bn global viewing hours on Netflix that year, with Sony Pictures content close to 3bn hours and Disney content close to 2.5bn hours.

Consumers clearly enjoy the availability of licensed content on major streaming services, so this return to the past could also be viewed as a return to giving consumers more of what they want.

Keen highlighted the power of Netflix to boost consumption of older shows from broadcasters. Drawing on Digital i/Barb data, he noted that BBC drama Killing Eve achieved threefold the viewing time on Netflix that it did on BBC iPlayer. There was a similar pattern for ITV shows Victoria, Benidorm and Unforgotten on Netflix versus ITVX.

“This is what I call the Netflix accelerator effect,” Keen said, adding that the more relaxed licensing at global studios is helping to drive more viewing on Netflix.

Global rights shift

Keen has also identified what could become a fifth pivot and another significant shift away from the revolutionary models employed by global streamers and back to the way business used to be conducted.

“The streamer model of global rights buyouts may be starting to change,” he suggested.

“Netflix set the model for global streaming in 2016 with their global rights deals and that rapidly became the dominant streamer model. But more flexible models are starting to emerge.”

At Netflix, Keen pointed to the deal for the independently financed Penelope series, in which Netflix took the US rights and Fremantle held the distribution rights for the rest of the world. “Amazon has taken only the UK/Ireland rights to the three-party thriller Fear, with Banijay selling to the rest of the world,” he added.

Keen highlighted Ampere Analysis data to demonstrate the growing number of shows being greenlit at Amazon and Disney where the streamers have not demanded global rights. At both companies, this has approximately doubled since 2020 (to over 120 shows at Amazon and over 80 at Disney).

Performance deals could also make a return in the streaming space, according to Keen, such as a pay-per-stream model when bidding for new shows.

Keen presented his presentation of four pivots at Connected TV World Summit in March and revealed his fifth pivot to The Media Leader afterwards. He emphasised that, in his view, pivots are not a sign of weakness but a sign of strength at companies that are flexing their business models.