Dentsu report heralds 'third massive wave' despite adspend downgrade

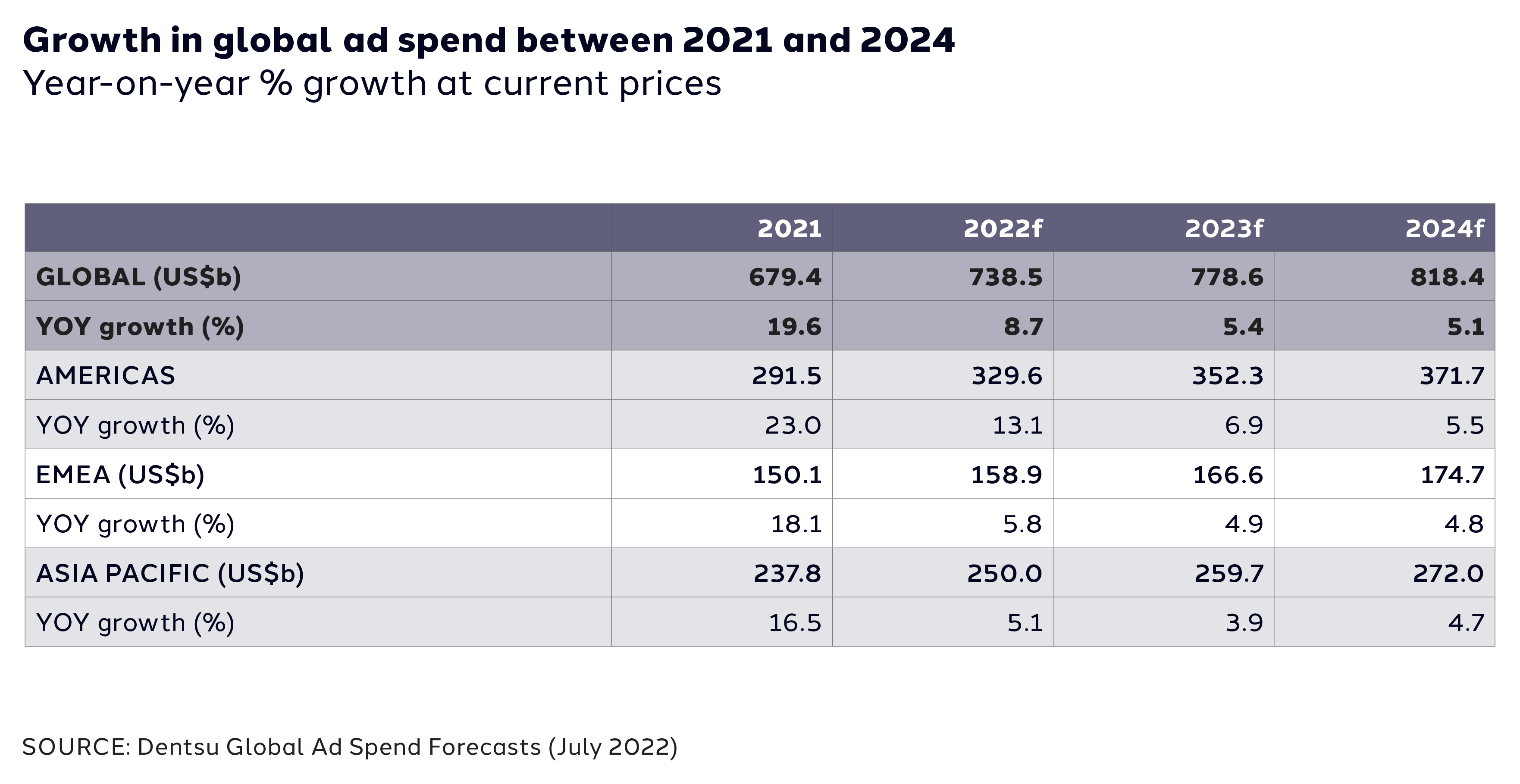

Dentsu has projected global adspend to grow at 8.7% to $738.5bn in 2022, in a downgrade from the Japanese-owned advertising company’s previous forecast.

Dentsu’s January forecast was 9.1% growth. The downgrade is in-line with similar updated projections previously released this Summer from GroupM, Zenith, and Mediabrands, which have projected 8.4%, 8%, and 9% adspend growth, respectively.

Read: How we should treat GroupM, IPG, and Zenith adspend forecasts

Dentsu also notes that a “third massive wave” in digital marketing (after search and social) is coming in the form of retail media, which it projected to grow 27.1% in the US alone this year. The soaring demand has caused the significant inflation in the space, according to earlier reports.

Led by Amazon, Criteo, Deliveroo, Marriott, Shopify, Salesforce, and others, brands are increasingly leveraging first-party consumer data available in retail media to more effectively reach consumers.

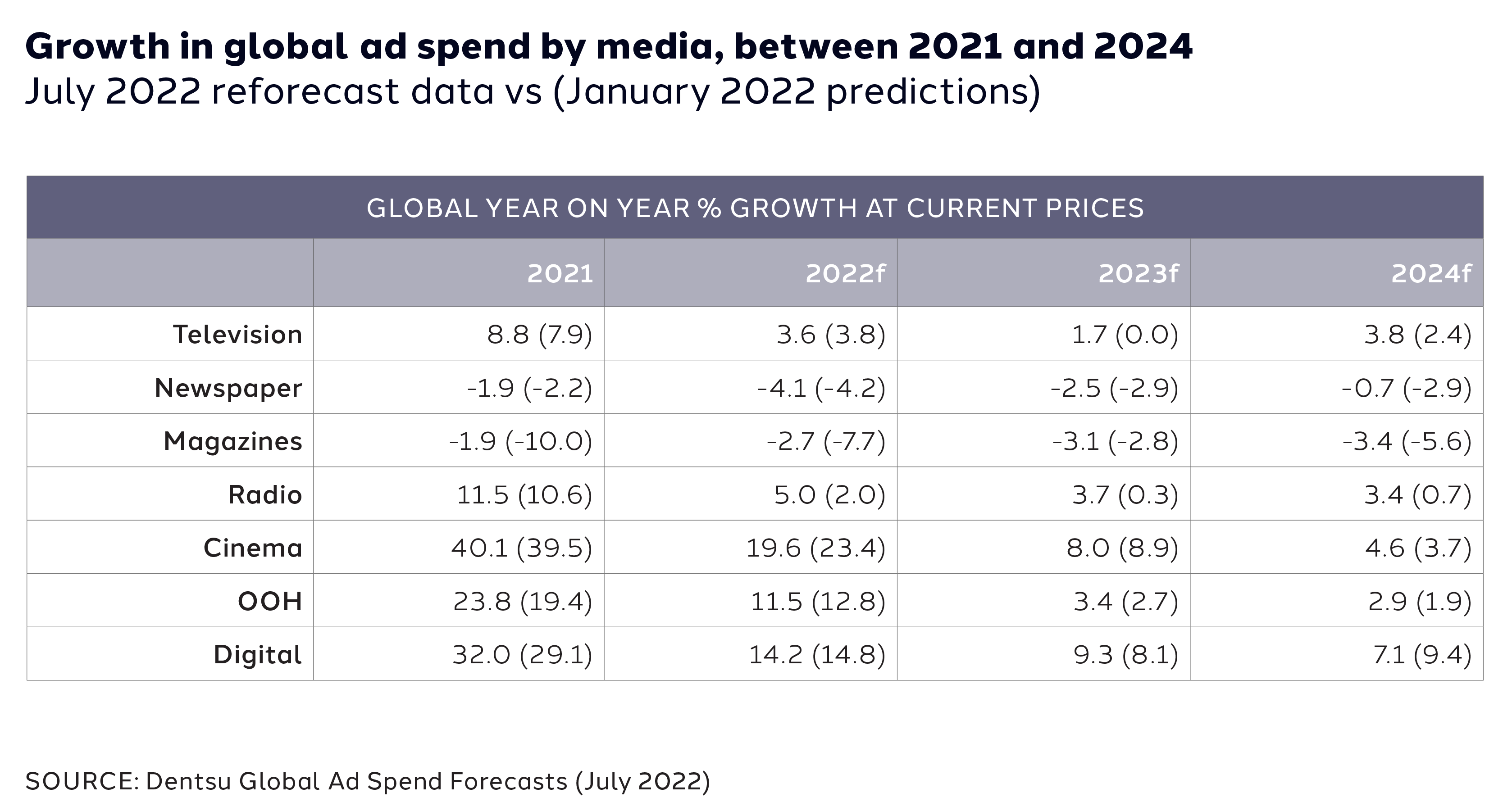

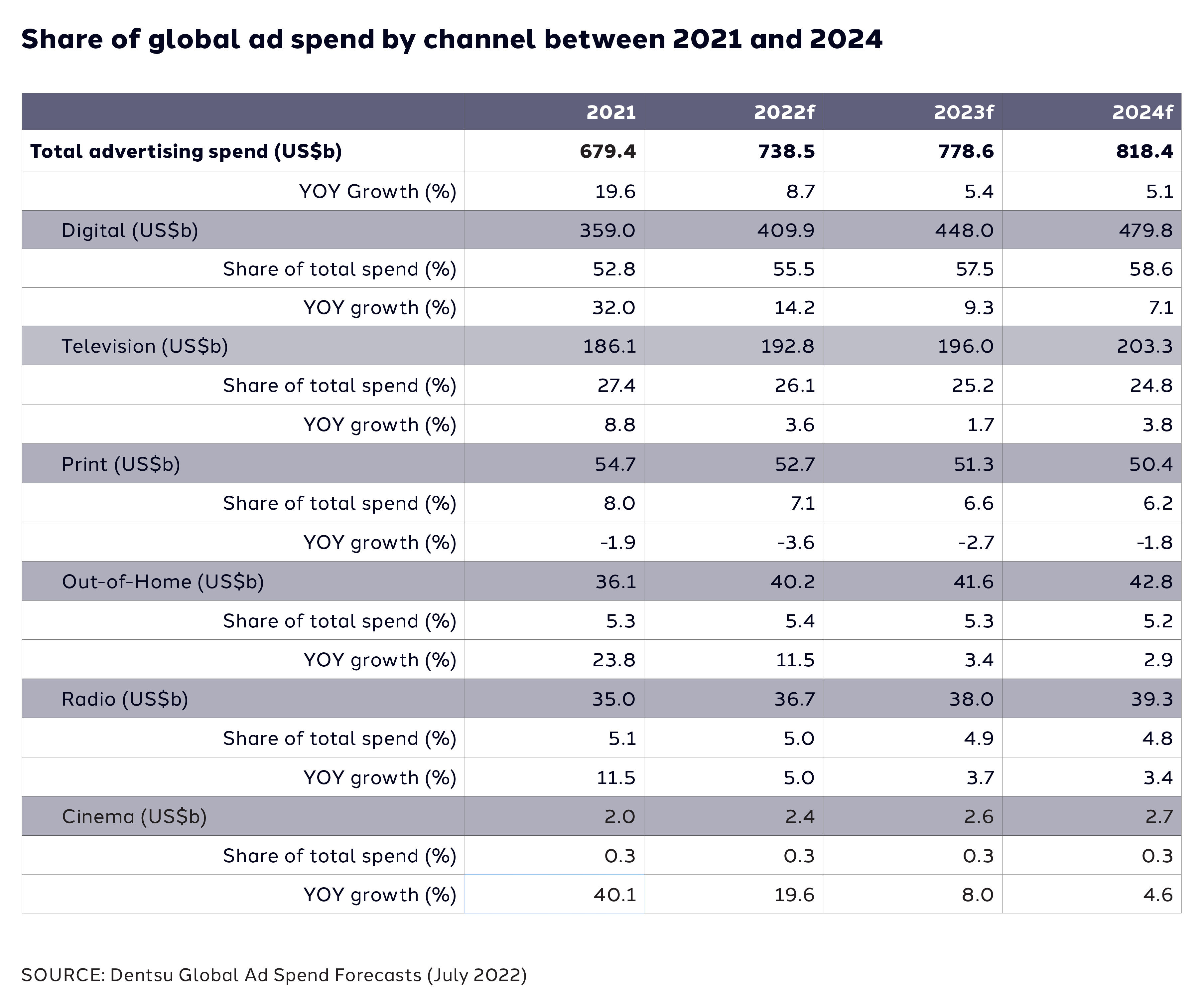

Digital is driving much of the growth forecast in Dentsu’s latest report, with a 14.2% anticipated increase in spending this year, giving it a 55.5% share of global total spend. Growth is particularly driven by increases in video (+23.4%), paid social (+21.9%), search (+12.9%), and programmatic (+19.9%).

Cinema (+19.6%) and out-of-home (+11.5%) are both still anticipated to receive double-digit growth this year as pandemic restrictions are no longer in effect.

On the other hand, magazines and newspapers are expected to still see declines of 2.7% and 4.1%, respectively.

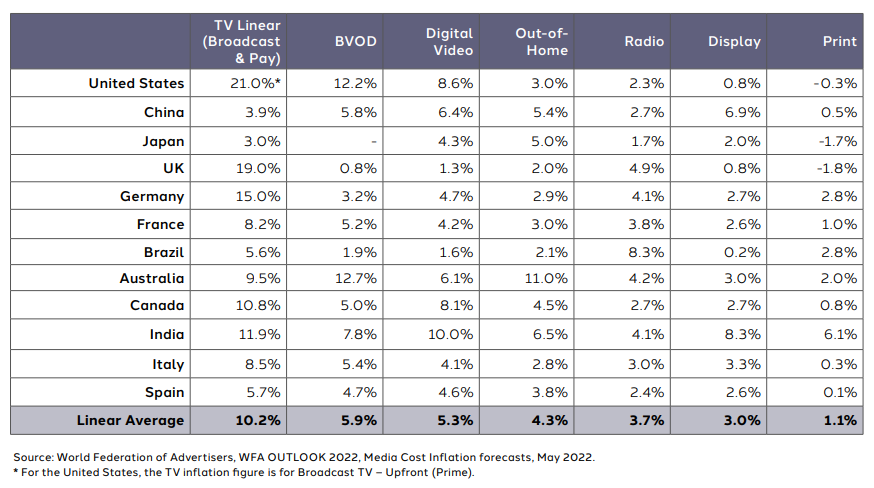

Meanwhile, inflation for linear TV (broadcast and pay TV) is anticipated to increase 10.2% globally, led by the US (21% inflation) and UK (19% inflation). Broadcaster video-on-demand (BVOD) and digital video inflation is also high in the US at 12.2% and 8.6%, respectively.

Dentsu attributes high inflation numbers to increased demand for media inventory, as brands are eager to capture consumer demand in a post-Covid lockdown world, alongside decreased supply of ad space, particularly in TV, due to the rising popularity of advertising-free platforms.

New TV ad supply is expected soon, with streaming services like Netflix and Disney+ opening up ad tiers later this year. However, ad inventories are not expected to be as robust as on broadcast, with Disney+’s ad tier being limited to just four minutes per hour.

The US ad market is expected to grow 12.8% to reach $292.2bn, driven by increased demand for digital (which accounts for 52.7% of adspend in the US) and out-of-home, which is forecast to grow 36.4% in the US as the market recovers from lockdowns.

The UK is expected to grow 6.8% to reach $43.2bn, a 1.4% increase over Dentsu’s January prediction driven by exceeded expectations in digital and total TV.

The fastest-growing ad market worldwide, however, is India, with 16% forecasted growth to reach $11.1bn.