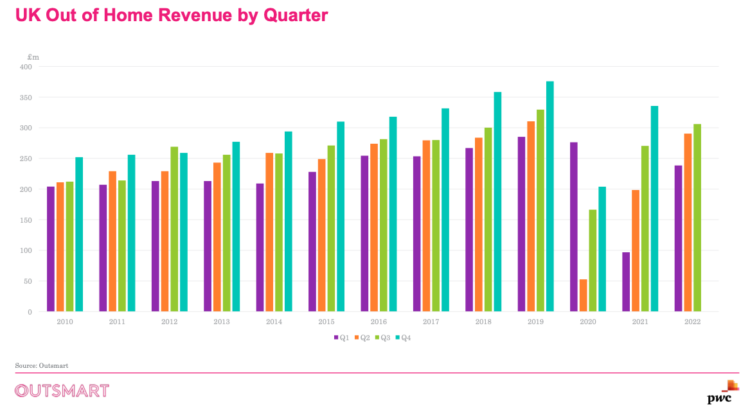

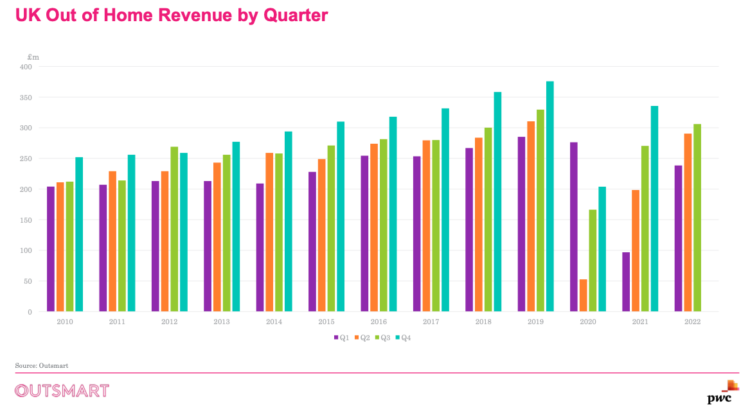

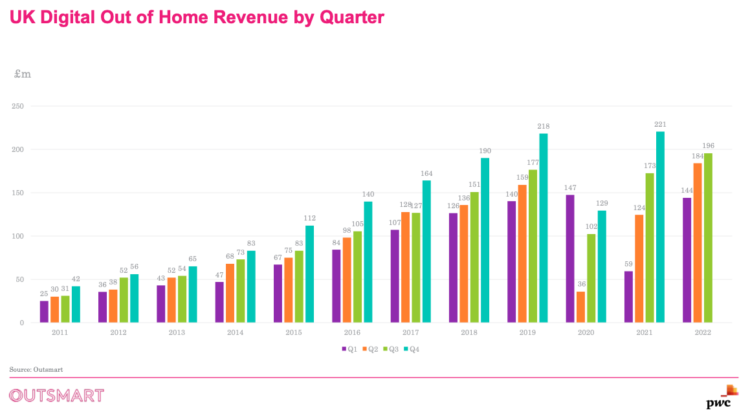

Out-of-home (OOH) advertising revenue for the third quarter of 2022 grew 13% year on year to £306m.

It’s the biggest third-quarter for the UK outdoor sector since 2019, before the Covid-19 pandemic wrecked advertiser demand due to lockdowns in 2020 and 2021.

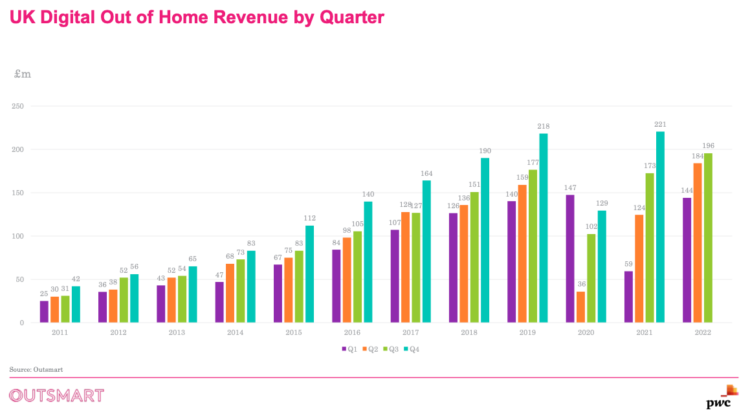

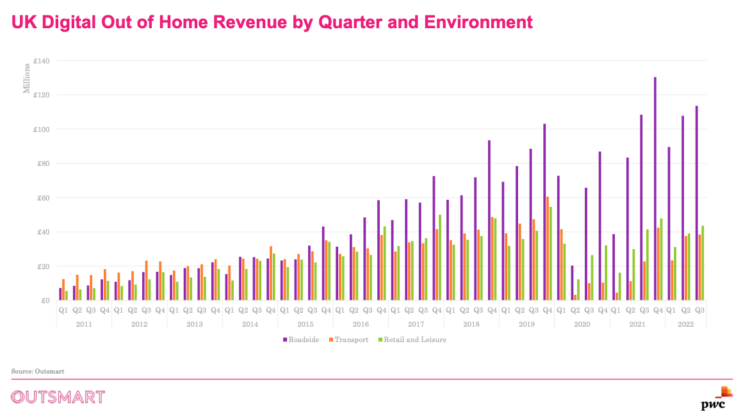

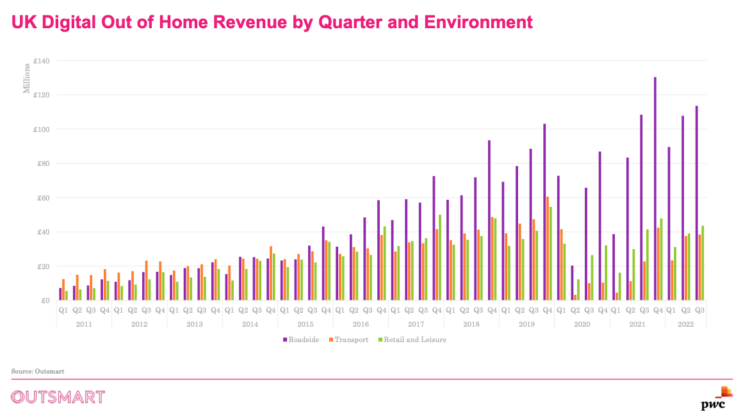

The 13% growth was evenly driven by digital (up 13% to £196m), and “classic OOH” (up 13% to £110m), data from the sector’s marketing body Outsmart revealed today. Digital now makes up almost two-thirds (64%) of all UK outdoor ad revenue, compared to 53% in 2019.

Comparable growth in OOH ad revenue occurred in the US in Q3 (+11%).

Surge in digital revenues ‘not a blip’

Dallas Wiles, co-CEO of JCDecaux UK, told The Media Leader the latest figures underline why it believes 2023 will be “the year of the public screen”, as the company described in its upfronts this year.

“This year we have seen the continued rise in programmatic OOH, with powerful opportunities for clients to maintain their brand and drive sales using the new digitised capabilities of the medium,” Wiles said. “We know that 83% of people visit a top 60 city every month and with OOH investment in digital screens in major cities, the public screen is able to drive real value for our advertising partners across the UK.”

Phil Hall, Ocean Outdoor’s joint MD in the UK, said the industry growth figures are expected to continue throughout 2023, despite ongoing cost-of-living crisis and a lengthy recession.

Hall said: “This will be driven largely by digital spend — the surge in digital revenues post-pandemic was not a blip and is here to stay.”

Last week IAB Tech Lab, the global digital advertising technical standard-setting body, published a set of resources to support standardised Real Time Bidding in digital OOH. This would, Outsmart, said, allow DOOH to be “properly described and traded” alongside more established digital media channels of online display, mobile, audio and connected TV.

Richard Bon, Clear Channel’s UK MD and European commercial lead, said the sector’s growth next year will be driven by the medium’s capability to offer “cost-effective, real-world reach, in an entirely brand-safe and environmentally accountable context.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.