Subdued tech spend continues to weigh on holding groups

All five major holding companies have reported their earnings for Q4 and fiscal year 2023, with all projecting modest single-digit growth for 2024.

Publicis Groupe, which had the best 2023 among the big five, expects organic growth in 2024 to land at 4-5%.

Omnicom forecasts organic growth of between 3.5% and 5%. This is followed by Interpublic, which anticipates organic net revenue growth of 1-2%, then Dentsu, which is projecting 1% organic growth.

WPP, which released its full results on Thursday, expects 0-1% like-for-like revenue less pass-through costs growth in 2024.

These forecasts suggest the holding groups are broadly expecting a similar performance this year compared with 2023, with the exception of Dentsu, which is projecting a return to growth after a relatively poorer performance in 2023.

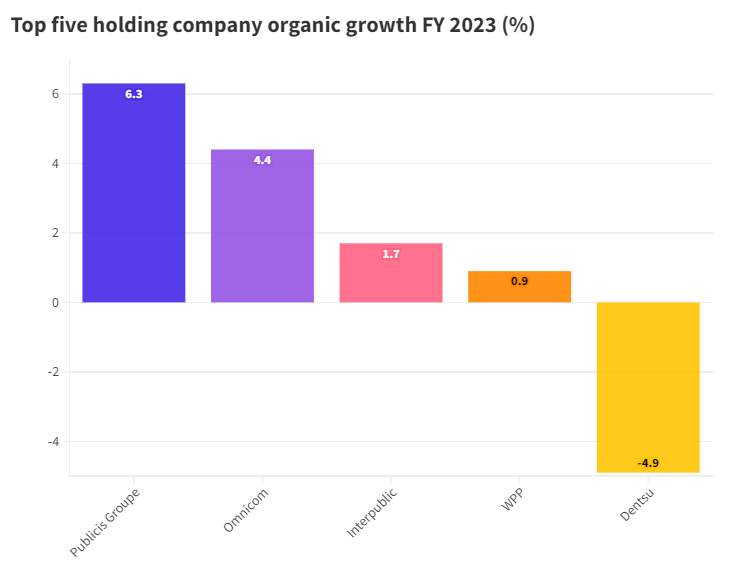

For full-year 2023, Publicis saw 6.3% organic growth; Omnicom posted 4.4% organic growth; Interpublic had 1.7% organic growth; and WPP reported 0.9% like-for-like growth in revenue less pass-through costs. Dentsu posted a 4.9% decline in organic growth.

Analysis: Tech spend still muted

Throughout 2023, agency holding groups noted that a decline in revenue from tech clients was a significant headwind to overall business, with companies that leaned more significantly on tech investment (such as WPP or challenger agency groups like S4 Capital) most affected.

This appears to have continued in Q4 2023, with some holding company bosses not expecting a quick recovery in 2024.

Alice Enders, research director at Enders Analysis, told The Media Leader that tech spend on the whole is still “muted for the moment”, despite tech companies’ increase in spend in online display (+12% in 2023) and search (+10%). This is because tech has spent comparatively less on TV, which tends to be used more for branding purposes and which typically incurs a higher cost.

In its latest earnings report, WPP noted that regional performance was particularly affected by tech clients in North America. Whereas WPP’s UK revenue less pass-through costs grew 5.6% in 2023, North America declined by 2.7%, “reflecting lower revenues from technology clients and in the retail sector”.

WPP noted that such decreases were “partially offset” by growth in consumer packaged goods and telecommunications clients, but that “lower revenues from technology clients had a greater adverse impact on our integrated creative agencies, whilst GroupM grew low single digits in the region”.

CEO Mark Read called 2023 “more challenging than we expected” because of cuts in spending by tech clients, but said the company delivered “a resilient performance for the year” thanks to “disciplined cost control”, despite investments in AI and other new technologies.

Differing fortunes

For Interpublic, “austerity” among clients in the tech and telecoms sector similarly weighed on overall growth to the tune of -2.5%.

Philippe Krakowsky, Interpublic’s CEO, reflected that tech and telco verticals were “stabilis[ed]” in Q4, but that he did not expect to see “meaningful upside” there next year.

“While it’s still not possible to call the timing with a significant upturn in tech spending and marketing activity, we’ve noted a more recent stabilisation in that spend,” said Krakowsky. “However, a return to growth for us in this sector has not been factored into our plan for 2024.”

Dentsu, on the other hand, said during its results that the group “expects technology clients to return to spend in the first quarter”, although the group noted the impact of lost client accounts in the tech sector will be felt until the end of H1 2024.

The weaker tech market similarly impacted Omnicom, with chief financial officer Philip Angelastro reporting a comparable reduction of three percentage points in revenue due to cuts in spend within that vertical.

CEO John Wren added, however, that Omnicom was perhaps better insulated than its comparably tech-reliant competitors when it comes to the decline in spend in that sector.

“I think our competitors have had much greater hits,” he said, adding that Omnicom expects “an uplift from the base of technology clients that we have in the forecast as it rolls through the rest of the year”.