Advertising generates profit, but not all media channels are equal

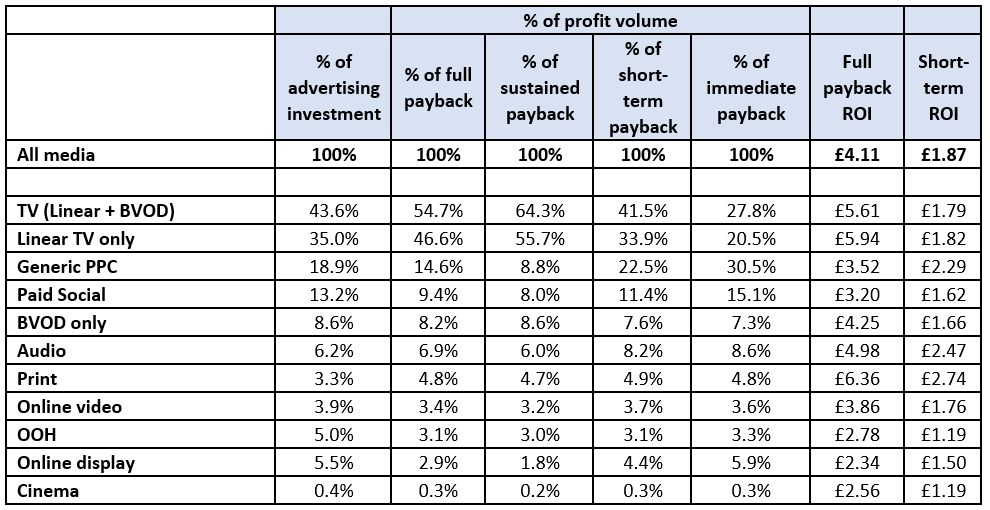

Advertising gives a short-term profit return on investment of £1.87 per £1 invested and this increases to £4.11 when sustained effects are included.

That is according to the latest research from Thinkbox, conducted by Ebiquity, EssenceMediacom, Gain Theory, Mindshare and Wavemaker UK. The study’s goal was to analyse the profit generated by advertising at different stages and through different media channels following a campaign’s release.

Profit Ability 2 is an update and expansion on Ebiquity and Gain Theory’s 2017 Profit Ability study. The latest version offers the first post-Covid-19 and post-Brexit view of advertising’s business performance in the UK.

It examined advertising’s profit generation across four stages: immediate payback (within one week), short-term payback (up to 13 weeks), sustained payback (week 14 through to 24 months) and full payback (total payback over a 24-month period).

The broad finding is that advertising works: all categories studied generated a positive payback from advertising when sustained effects are accounted for.

However, not all media channels result in the same level of profit volume, especially over time. And time does matter — 58% of advertising’s total profit generation was found to occur after its first 13 weeks.

TV underinvestment

The results suggest an underinvestment in TV advertising. TV (including linear and broadcast video on demand, or BVOD) was found to account for 54.7% of advertising’s full payback, despite the medium receiving 43.6% of ad investment.

Other media channels receiving less investment than their percentage of full payback include audio and print.

TV was also found to have the highest “saturation point” among all channels, defined as the last point in which every £1 invested in a given channel generates at least £1 profit. That means advertisers can increase investment in TV to a higher level than other media and it will continue to generate profitable return.

In contrast, generic pay per click (PPC, also known as unbranded online search) offers the highest immediate feedback (30.5%), but its effects diminish significantly over time. Paid social performed similarly.

Following generic PPC in accounting for immediate payback is linear TV (20.5%), paid social (15.1%), audio (8.6%) and BVOD (7.3%).

Meanwhile, the highest full payback ROI was found to be in print (£6.36), suggesting there is still value in a medium seeing declining audiences.

“Despite the upheaval the world has been through, the fundamentals of advertising effectiveness still apply,” said Matt Hill, Thinkbox’s research and planning director. “It’s great to see TV performing so strongly at whatever speed you want to drive profit, but this is about the strength of advertising as a business investment that grows the bottom line and grows the economy. I hope business acts on these findings.”

High profitability in automotive

Profitability of advertising was found to vary significantly by business sector.

Automotive companies saw full profit ROI of £4.65 per £1 invested — more than double the full profit ROI seen by financial services (£1.95).

Likewise, when looking at short-term profitability, advertising’s full profit ROI for large retail was £3.15 — almost triple that of the travel industry (£1.19).

According to Jane Christian, EssenceMediacom’s managing director of analytics and insight, the study will allow advertisers to make better decisions on where to spend their money depending on their brand.

She commented: “It provides a refreshing view on how we use channels, challenging the outdated brand vs performance view of the world.”