Trust in advertising bolstered by the young but remains low

Does the public trust advertising? More than it used to.

That is according to the latest Value of Trust report conducted by advertising think-tank Credos in partnership with the Advertising Association (AA).

Whereas for the past decade advertising has ranked as the least-trusted industry in the UK (in 2021, just 23% of Brits said they trusted the industry), its ranking rose in 2023. Currently, 29% of Brits say they trust the advertising industry.

That is more than those who say they trust the government (26%) and media (26%), but less than those who trust the energy (32%), telecoms (43%), banking (48%) and medical (73%) industries.

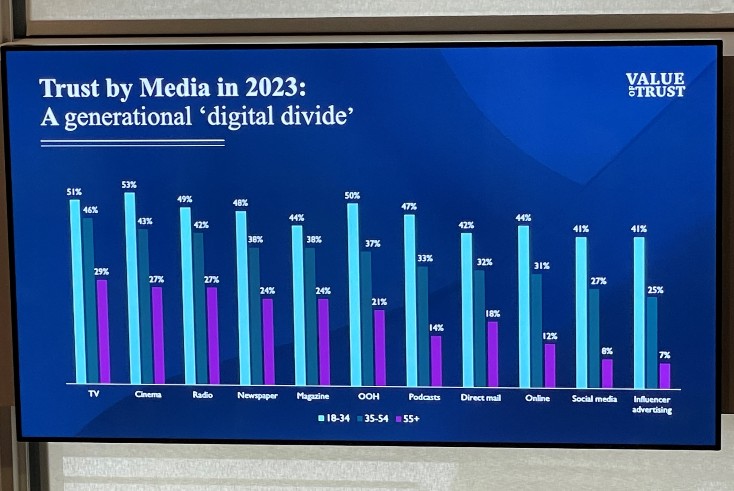

As previously reported, the improvement in trust is in part being driven by a generational divide — young people are much more likely to say they trust the ads they see or hear (50%) than over-55s (22%). This is true across all channels, but especially digital channels, including social media and influencers.

Dan Wilks, director of Credos, presented the findings at Havas UK’s headquarters in Pancras Square on Tuesday. “In 2023, trust in both the ads and the industry increased significantly,” he explained. “We have six months of available data so far from 2024 and what it suggests is levels of trust are increasing or at least remaining constant.”

Wilks primarily attributed the uptick in trust to a positive Christmas ads period, as well as last year’s Advertising Standards Authority’s ad campaign, which was found to have boosted trust in the industry among those who viewed the ads.

Improved perceptions of trust benefit the industry by helping to drive better business results, creating improved leverage for negotiation around government regulation and recruiting from a larger talent pool, according to Wilks.

“As we look, as an industry, to recruit and retain the next generation of talent, particularly from diverse backgrounds, we need to take [into] account of the impact trust can have on the available talent pool,” he argued.

Generation gap: Youth more trusting of advertising than older people

MPs not widely trusting

In addition to surveying the public, Credos also polled MPs about their perceptions of the ad industry. Just 39% of MPs surveyed said they trusted the industry, with one-third saying they distrust it.

The findings have implications for the future of regulation for advertising and for media agencies. With the make-up of parliament likely to shift substantially following July’s general election, unfriendly regulation of the industry may be considered. As Wilks noted, Labour MPs are traditionally more distrusting of the industry, adding: “MPs that do not trust the ad industry are five times more likely to support greater intervention to regulate advertising,” he said.

Guy Parker, CEO of the Advertising Standards Authority, argued during a Q&A session that not all regulation is inherently bad, but warned that additional restrictions around advertising, including for HFSS, alcohol and gambling, could come down the line even if evidence that such policy changes would led to demonstrable changes in behaviour is scant.

Isba director-general Phil Smith, also in the audience, added that the government is “rightly” looking at child safety online and that the industry needs to demonstrate it is effective at keeping ads for age-restricted products away from children.

Stephen Woodford, AA CEO, added: “Being seen to regulate is being seen to do something, regardless of the evidence.”

What drives trust and distrust?

Meanwhile, Wilks described core drivers of trust and distrust in advertising among consumers.

Chiefly, whether a consumer finds an ad enjoyable is most important to creating trust. Other main reasons cited for trusting ads include whether the ad provided useful information, whether there existed a clear value exchange for viewing the ad and whether it made some social contribution.

On the other hand, distrust is driven primarily by “bombardment”, or the feeling that ads are not only seen too frequently but also get in the way of enjoying the content they are bought against. Additional distrust drivers include whether ads target vulnerable groups, issues related to data privacy and targeting, and advertising deemed “unhealthy” to people or the environment.

Wilks noted that, for some consumers, advertising will never be considered a trustworthy enterprise based on their worldview. In particular, for individuals who are sceptical of the benefits of “living in a consumer society”, advertising will be seen as “at best, a necessary evil”.