Cannes Lions 2024 | Partner content

The CEO of Ad Alliance is “pissed off” by the slowness of joint industry currencies (JICs) to innovate in his home market as advertisers and their agencies put pressure on them to deliver new metrics for cross-media measurement.

Ton Rozestraten — who is also chief commercial officer at broadcaster RTL in the Netherlands — complained to an event at Cannes Lions that he didn’t “give a fuck” about cross-media data because his focus lies with total video measurement (combining linear TV with VOD).

Whereas TV JICs across the world, such as Barb in the UK, have operated with some form of panels and survey data, Rozestraten explained that innovation in Netherlands is being slowed down by the extra complexity of having to provide metrics for more ambitious cross-media measurement systems.

‘I’m only interested right now in total video’

Rozestraten told Adwanted Events’ Justin Lebbon that he was “kind of pissed off by the lack of speed of the JICs, especially [when] the advertisers and agencies are asking for a lot of extra metrics… there’s always the difference between the panel and the census data. And we would like to introduce this as right now, learn from it, do it and adapt it if possible.

“But now we have to go back to the operators again, to ask for the census data etc, so they look for cross-media data.

“I don’t give a fuck about this data. I’m only interested right now in total video — combining linear TV, on-demand linear streams.”

Asked by Lebbon how JICs are responding to that, Rozestraten said “negotiations” are at an impasse between the European broadcaster alliance and regional JICs.

“We are in a lot of talks in negotiation about the future… we would like to speed up,” he said. “This way is not going forward.”

Asked to confirm whether that means literally building its own panel, the Ad Alliance CEO admitted: “Yeah, that could be an alternative.”

Will YouTube ever join an established JIC?

Maxime André, director of marketing, innovation and communication at French ad agency M6 Publicité, defended MédiaMétrie, the Barb equivalent TV JIC provider in France.

“We strongly believe in MédiaMétrie and independent measurement,” André said. “We don’t want to be like the US market. There needs to be one independent measurement.

“Recently, we’ve made a lot of progress. Collaboration is working. Four years ago, we launched addressable TV in France with the telcos, MédiaMétrie and all the stakeholders — it’s working very well.”

YouTube has been a significant disruptor to the video ecosystem in recent years and has evolved from a purely social media channel into a key distribution medium for broadcasters. The UK’s Channel 4, for example, distributes full episodes of its owned content after agreeing a revenue-share deal with the Google-owned platform.

But YouTube is not part of an established regional JIC that measures linear TV and online video. As The Media Leader revealed last year, YouTube has been apparently unable to satisfy Barb’s requirements for minimum measurement standards for online video. Barb has since joined the Media Rating Council, which stipulates that two continuous seconds of the video advertisement is played and that at least half the video is viewable on a user’s screen.

But, according to this panel, there is no likelihood of YouTube joining an established TV JIC.

“It will not happen,” Ad Alliance group CEO Frank Vogel said.

Rozestraten added: “I’ve spent a lot of time with them and they [YouTube] are always backing off at the last moment. So I’m not spending any time with them any more.”

“Same in Germany exactly,” Vogel echoed.

Google, as well as Meta, have provided funding and support for new cross-media measurement initiatives, such as Origin, the solution built by advertiser trade body Isba in the UK.

Content guys are ‘the good ones’

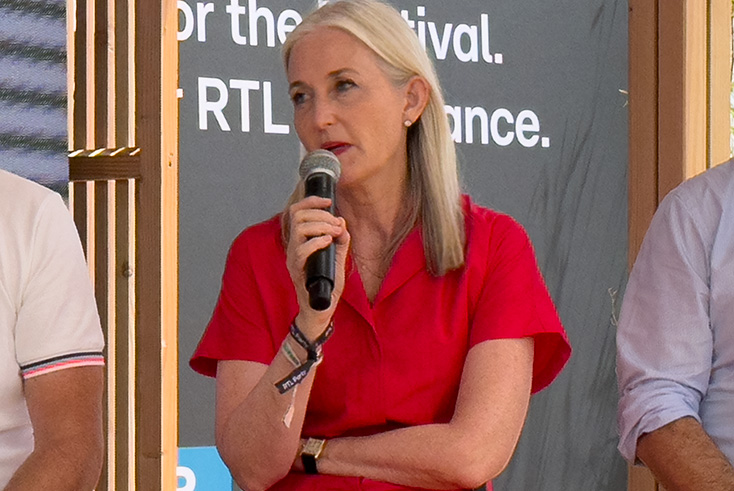

In the second half of the session, Disney’s UK boss Deborah Armstrong (pictured, below) insisted that TV would take money “from social media” over time.

“Any advertiser knows that TV is very high-quality… [due to] viewability, big-brand environment, the fact that it’s brand-safe — we’re getting noisier about it.

“I think that if any marketer is smart, they know that. What they need, though, is they’ve been so used to outcomes-based solutions… there’s no silver bullet; TV just has to take the best of digital while providing what it does really well and we’ll be golden. The reality is it can’t happen the other way around.”

As Lebbon pointed out, Disney’s streaming service presents a threat to traditional TV broadcasters as linear audiences decline and audiences migrate to online video.

But Fabrice Mollier, president of Canal+ Brand Solutions, insisted that Disney+ was a friend rather than a foe, because the idea of global competition between TV sales houses was overstated.

“We are about the joint the NBCUniversal Association on selling international but it’s nothing… we need to align on storytelling but trading is not happening because the currencies are different. What Netflix, then Disney, brought to the market is excellent storytelling about content. Maybe we forgot about that in TV — we were selling bulk and they came back with a bigger story about content. We [Canal+] are with the ‘good ones’, the content guys.”

Partner content: RTL Ad Alliance commissioned The Media Leader to cover these sessions at Cannes Lions, but all reporting is independent. Adwanted Events is the parent division of The Media Leader, part of Adwanted Group.