Proportion of UK businesses increasing marketing spend hits 10-year high

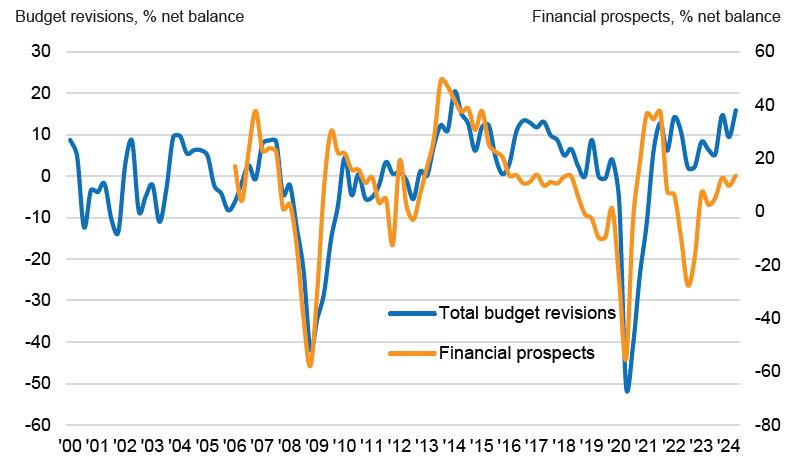

The net balance of UK businesses that expanded their marketing budgets in Q2 was at its highest level in over a decade, according to the IPA’s latest Bellwether Report.

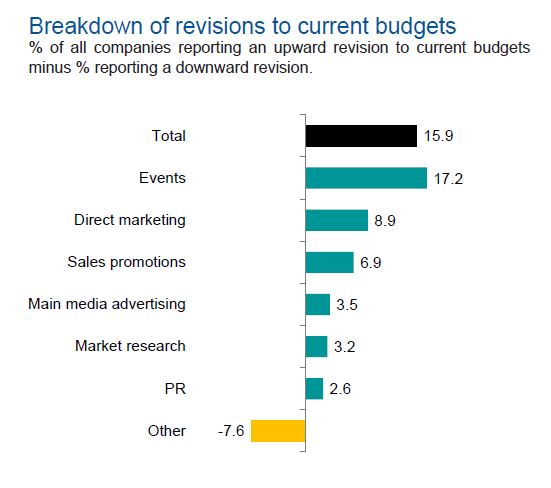

A positive balance of 15.9% of UK companies were raising marketing budgets, compared with +9.4% in Q1 and +14.7% in Q4 2023. The balance is the difference between the proportion of marketers who intended to upwardly revise their budget and those who intended to revise it downwards.

The findings follow several years of challenging macroeconomic headwinds, with brands now signalling increased optimism about the rest of 2024 and beyond.

“In line with the brightening economy, decreasing levels of inflation and a new government, this quarter’s Bellwether Report reveals real vim and vigour regarding UK companies’ marketing spend intentions,” said Paul Bainsfair, director-general of the IPA.

The key beneficiary of the net upward revision was events (+17.2%), followed by direct marketing (+8.9%) and sales promotions (+6.9%). All of these categories had seen upward budget revisions in the previous quarter.

Main media advertising, meanwhile, returned to growth following a marginal reduction in Q1. The net balance of companies recording upward main media budget revisions was +3.5% (compared with -0.7% previously).

Practically all main media budget growth was driven by other online (+15.3% versus +7.1% in Q1) and video (+7.8% versus +0.8% in Q1).

Other main media categories either stagnated (OOH recorded a 0% net balance) or declined — audio (-5.5%) and publishing (-6.3%) continued ongoing trajectories of decreased budgets.

Richard Broughton, executive director and co-founder of Ampere Analysis, said: “The Q2 Bellwether results will be welcome reading for broadcasters (and streaming services looking to grow their burgeoning ad-supported businesses) alike as we head into the second half of the year.

“And we can expect a more positive pattern in net ad revenue for the major media owners.”

Election certainty

The survey was conducted ahead of the 4 July general election, meaning the optimistic sentiment reflected in the results occurred before Labour won control of parliament.

As Broughton explained, whereas elections might normally result in a degree of uncertainty that would negatively affect business confidence, “Labour’s clear pro-growth stance during the campaign period will likely have helped marketers’ confidence that, whatever the result of the election, it would not pose any obstacles for return to wider economic growth”.

Such sentiment was confirmed by Dan Pimm, co-founder and director of independent media agency December19. He told The Media Leader that it was “not a surprise” to see advertiser confidence returning following a difficult first half of 2023, given he has seen spend levels “come back to full confidence” this year.

Clients are “ready to stick their neck out a little bit”, he noted, given they had been confident that a Labour-led government was likely to be elected and that it would positively impact the economy.

Pimm further suggested that an expectation of an interest rate cut, in tandem with a “big sporting year”, has also helped drive business confidence.

“The cost of living is still tough, but at least there’s a sense that things are moving in the right direction,” Pimm added.

Expectation of declining interest rates

The Bellwether found that the proportion of companies that were optimistic about their own financial prospects remained broadly unchanged since Q1 at 29%, but negative sentiment fell, with 15.4% expressing pessimism compared with 19.5% previously.

Despite welcoming the positivity, Bainsfair warned against unfettered optimism too soon.

“It is worth noting that while inflation levels have come down, this hasn’t yet translated into prices and, as such, strains on many household finances prevail,” he said, citing recent IPA TouchPoints data that found more than a third of consumers are struggling to cope on their current income.

“Companies would benefit from being cognisant of this in terms of their communications approach and messging to their consumers. I suspect that those brands that can bestow their sense of value, trust and reward will fare well here.”

Still, with inflation now under 3%, it is plausible that interest rates could ease. The International Monetary Fund recommended in May that the Bank of England reduce interest rates to 3.5% by the end of 2025.

Joe Hayes, principal economist at S&P Global Market Intelligence, said there was an “expectation of an imminent interest rate reduction” — and this has provided “more fertile grounds for companies who wish to invest in their brands and position themselves for long-term growth”.

Focus on value pivotal for brands as consumers get more cost-conscious