Commercial radio revenue grew 5% in H1, according to the latest figures from Radiocentre.

H1 revenue totalled £359.8m compared with £342.6m in H1 2023, led by 14.8% growth in digital revenue in Q2.

National advertising generated £192.7m in revenue in H1 (+5.6%), while local advertising generated £60.2m (+5.4%).

Matt Payton, the radio industry body’s CEO, revealed the figures to a packed crowd at Radiocentre’s annual Tuning In conference on Tuesday.

“While it’s probably a bit early to be making end-of-year predictions, if that level of growth can be maintained in line with the Advertising Association’s forecasts, we could be looking at one of the best-ever years for commercial radio,” he said.

Total ad revenue reached £372.9m in H2 2023. The Advertising Association and Warc had previously predicted radio ad revenue would grow 2.3% in 2024.

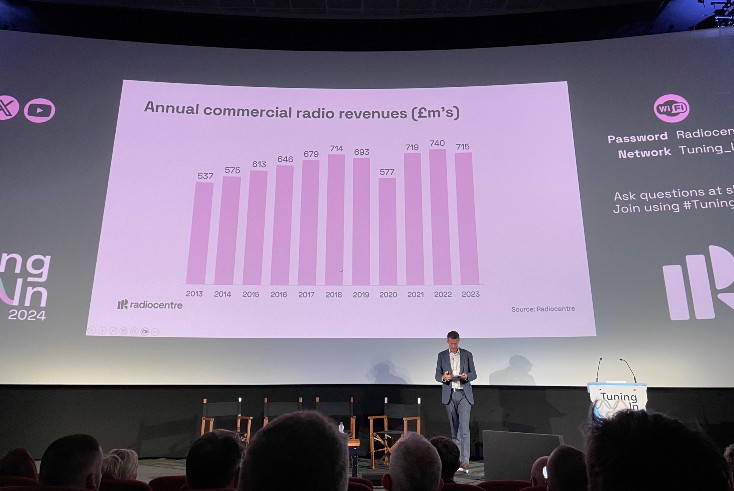

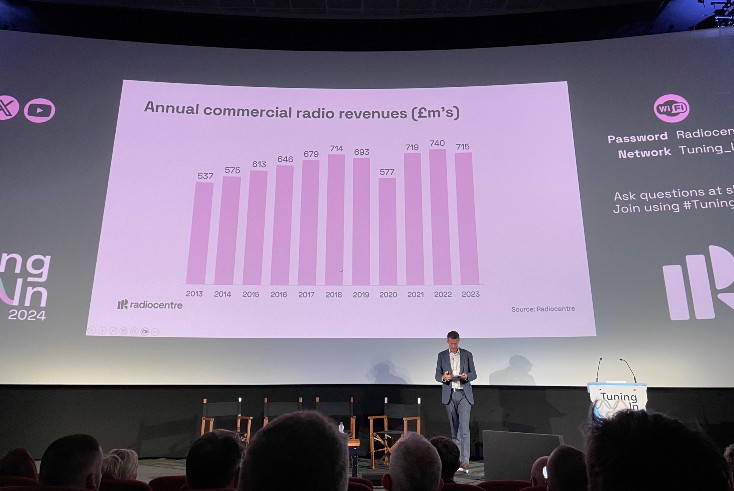

Payton noted that commercial radio revenue has seen significant growth over the past 10 years, despite continuing shifts in ad budgets towards digital channels. And despite the pandemic-era dip, revenue now remains consistently ahead of pre-pandemic levels.

Political stability

During his opening remarks, Payton championed the passage of the Media Act during the wash-up period this year as helping to future-proof the radio business as smart speaker listening continues to increase in popularity.

He said: “Radio is becoming even more reliant on tech platforms, particularly Amazon and Google, to reach audiences. While these relationships have been positive so far, this creates real risks for the future, especially for platforms looking to exploit their position as gatekeepers to radio content.

“But I’m pleased to say, following a lot of hard work, we managed to secure support for radio to address exactly these issues in the Media Act.”

Payton added that Radiocentre was “pleased to see at least some familiar faces” have assumed responsibility for overseeing radio, media and advertising in the new Labour government, including culture secretary Lisa Nandy and under-secretary Stephanie Peacock.

Industry trade bodies react to new government

“On the political and regulatory front, whatever your views, we’ve had a lot of change in recent years. Six prime ministers in eight years is just not normal,” Payton continued. “But given the size of the current government’s majority, you wouldn’t expect that to continue either.”

He added that current Department of Culture, Media & Sport leadership “seems to have the right instincts on a number of issues and are crucially committed to implementing the Media Act”.

BBC competition

Hinting at Radiocentre’s future goals in supporting the commercial radio industry, Payton also addressed concerns around the BBC, which he said needs “proper guardrails in place as it looks to drive its own digital expansion”.

“In many ways, it’s business as usual — we’ve always competed fiercely with the BBC for audiences and we know that competition is a fact of life,” he acknowledged. “But competition also needs to be on terms that are fair and reasonable, and takes into account the huge funding and commercial advantages of the BBC.

“What it shouldn’t mean is the BBC launching copycat radio stations that could put commercial services out of business or starting to run advertising across its audio and podcast output that has already been paid for by the licence fee.”

Commercial radio has continued to grow its share of listening relative to the BBC. According to Q2 Rajar figures, there is now a stark gap: commercial radio has a record 55% share, with the BBC now on 42.6%.

Ad-funded BBC ‘can lead to market failure’

Global’s expansion

Elsewhere at Tuning In, James Rea, chief broadcasting and content officer at Global, revealed that its podcasts would be expanding into live productions, with the first such event featuring The News Agents taking place on 1 December at London’s Royal Albert Hall.

Rea also championed the launch of 12 Global stations last week, expanding the company’s Capital, Classic FM, Heart, Smooth and Radio X brands.

The new stations are aimed at improving incremental audience reach, particularly on Global Player, which Rea described as the company’s “core strategic focus”. As he noted: “It’s about adding more flavours to the menu.”

On a separate panel featuring Capital Breakfast‘s Jordan North, Chris Stark and Siân Welby, the trio made an overt pitch to brands and agencies in attendance to sponsor the show.

Capital Breakfast has benefited from North joining Global from BBC Radio 1 earlier this year. Since his appointment, weekly listenership grew by 10.2% to 2.8m, according to the latest Rajar figures.

“We like to be quite involved in the creative side,” said Stark. “We can have an idea and then we can go to a brand and elevate it.”

Rajar Q2 2024: Top takeaways

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.