Media agency or media supermarket?

Opinion: 100% Media 0% Nonsense

If network agencies run their business like supermarkets, their double-digit margins are unsustainably high, writes the editor-in-chief.

“It’s beginning to look a lot like Christmas…”

Yes, it’s not even close to Halloween and retailers are already decking the halls with festive fodder. As the high street continues to bleed money to online shopping, shop owners are doubling down on Christmas as the last tactic to grab whatever disposable income UK shoppers have left. The clocks won’t even have gone back this year and you’ll be sick of Mariah Carey.

The festive season is, of course, why Q4 is the most important time for media and advertising too.

And the similarities between retail and media trading don’t end there.

Christmas quiz time

Tell me which UK business sector this applies to: supermarkets or agency networks?

>> Four dominant companies that control market share

>> It’s hard to tell them apart because their stated strategies and brand positioning seem so similar

>> Their size means they can drive hard bargains with suppliers…

>> …which means they can offer discounts to customers

That’s right, it’s a trick question — it’s both.

Four roughly similar-looking businesses, all facing similar issues, all bolstered by scale that large brands depend on. Whereas supermarkets leverage their retail footprint and their distribution net, agencies leverage their office footprint and their trading relationships with media owners.

In many instances, media agency networks are media supermarkets. They buy inventory in bulk and resell to clients. Just like Asda is agnostic about whether you should buy shampoo from Unilever or Procter & Gamble, it will decide to discount one over another and thus increase sales of one over the other, for reasons that are nothing to do with whether Tresemmé or Herbal Essences is a better product.

There is one big difference between these sectors, though: profit margin.

Big, fat profits

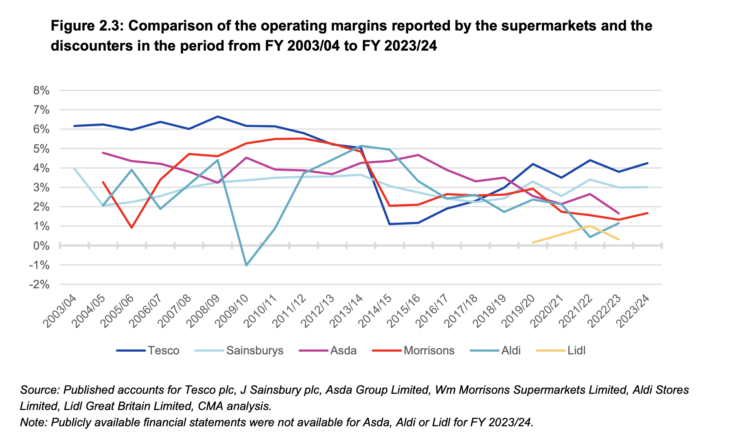

Supermarkets are famously low-margin beasts that are forced to compete fiercely with rivals — even more so in the last two decades with the emergence of Aldi and Lidl. No wonder they wish it could be Christmas every day.

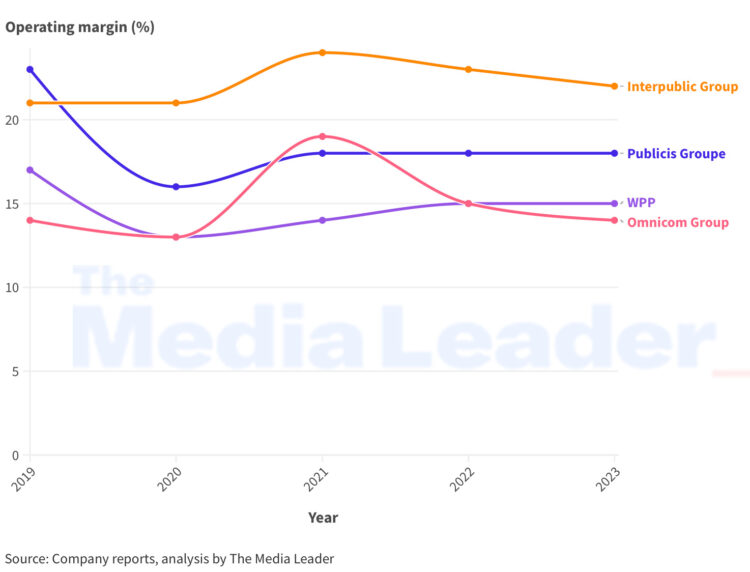

The agency networks, however, never seem to let their operating margins dip below double digits. It’s not even close.

These are big, fat profits. What’s not to like?

Apparently a lot, when we look at meaningful industry surveys like the Advertising Association’s All In Census, which reports significant levels of stress, anxiety and feels of discrimination. Industry charity Nabs reported a 100% year-on-year increase in demand for core services last year, including mental health support calls and redundancy queries.

That helps explain why anyone reading this will know that it doesn’t feel like a bumper period.

Jenny Biggam, co-founder of independent agency the7stars, made a startling observation during her talk at the recent Who Cares? symposium, created by Nick Manning and Brian Jacobs (men who know a thing or two about how agencies work).

Giving “proprietary media” and “undisclosed models and rebates” as examples, Biggam described these tactics as “very profitable [but] erodes trust in the long term”.

This lack of trust, she explained, leads to shorter pitch cycles and worse relationships with clients.

Another source of margin, Biggam identified, is staff costs versus fees. Her “working group” for Who Cares? calculated that network media agencies are charging out £135,000 for each employee working on a client’s business, even after taking business overheads into account. However, Biggam said, “most clients are not paying £135,000 for every FTE working on their business”.

Put another way, these agencies are charging 13% of Nielsen billings as staff costs.

“People look at me like I’m mad,” Biggam said. “That [13%] is what is being taken by this group of agencies from out of the ecosystem.”

If you take the actual average salary of what media agency staff earn and multiply that by the number of people employed by media agencies, it’s worth only around 6% of Nielsen billings.

The question is: is this seven percentage point mark-up sustainable?

Not so, according to consultant and author Michael Farmer, who spoke before Biggam at the same conference. He argued that underlying performance of the holding companies has been predominantly “weak” for a long time, but were able to keep their share prices buoyant through acquisitions until around 2018.

Now, Farmer said, agency groups are “doing excessive scopes of work with people that are not trained to do it… [advertising executives] don’t know what works and therefore they try everything… And, as a result, the work is too big, too much for junior people, not generating the value for clients — which leads to agencies being turned over all the time and senior management having to spend all its time on new-business development.”

Lots of junior people manning the shelves, with a “customer is always right” mentality? What sort of business does that remind you of?

‘Agencies aren’t what they were 3 years ago’

Of course that’s as far as the analogy goes — agencies are now much more than a bunch of clever strategists and crafty salespeople.

As the former Publicis Groupe executive Iain Jacob points out, “media agencies aren’t what they were even three years ago. Now, they are platform integrators and product vendors.”

Jacob, a former co-founder of Starcom who sold the agency to Publicis, tells The Media Leader that agencies’ bigger margins are necessary because “the industry is cyclical”.

“You have to take the ups with the downs, and it’s very talent-based and you need to reward them suitably — you need to earn those sorts of margins to be able to do that.

“There’s obviously an additional take being made by the agencies, as we all know, but that’s not necessarily a function of being non-transparent; that could be a function of a company having productised themselves.”

Publicis, the star performer among the agency groups in terms of share price over the last five years, has achieved this best of all by leveraging its 2019 acquisition of Epilson.

But, importantly, this does not show up as a percentage of agency billings.

The bigger agencies have spent so much time productising because it’s a new it’s a better stream of revenue for them,” Jacob adds.

The gift of transparency

Ultimately, advertisers will get what they pay for.

If they are prepared to accept a blanket fee reduction without taking an interest in how a media agency spends its money, then they are signalling that they don’t care about agencies being trusted advisors as opposed to media supermarkets.

But marketers need to play their part too. Tools like the Isba Media Services Framework are there to help them hold agencies to account but, at the same time, the trade body signals to its advertiser members that “no advertiser would suggest a poorly remunerated agency leads to a sustainable relationship”.

Christmas is also the time of charity and giving, amid the rampant consumerism that shops are already preparing for.

Let’s do this industry a favour and be more open about what media is worth and why it’s valuable. Advertising, which is fundamental to an open and accessible media ecosystem, deserves better than supermarket strategy.

Omar Oakes is UK editor-in-chief of The Media Leader. 100% Media 0% Nonsense is a weekly column about the state of media and advertising

The views in this article are expressed by the UK editor-in-chief for publication in The Media Leader UK and do not reflect the views of Adwanted Group.

Lessons from Manchester: Media’s industrial revolution needs you

Who cares about advertising? Those who are willing to say ‘no’