Video adspend outpaces total digital growth in H1

Advertisers’ investment in online video grew 26% to £4.12bn in the first half of 2024 — the fourth year in a row that this channel recorded double-digit H1 growth.

That is according to IAB UK’s latest Digital Adspend update, conducted by independent global media advisor MediaSense. Earlier this year, MediaSense acquired PwC’s Marketing & Media Advisory business, which had previously carried out the report.

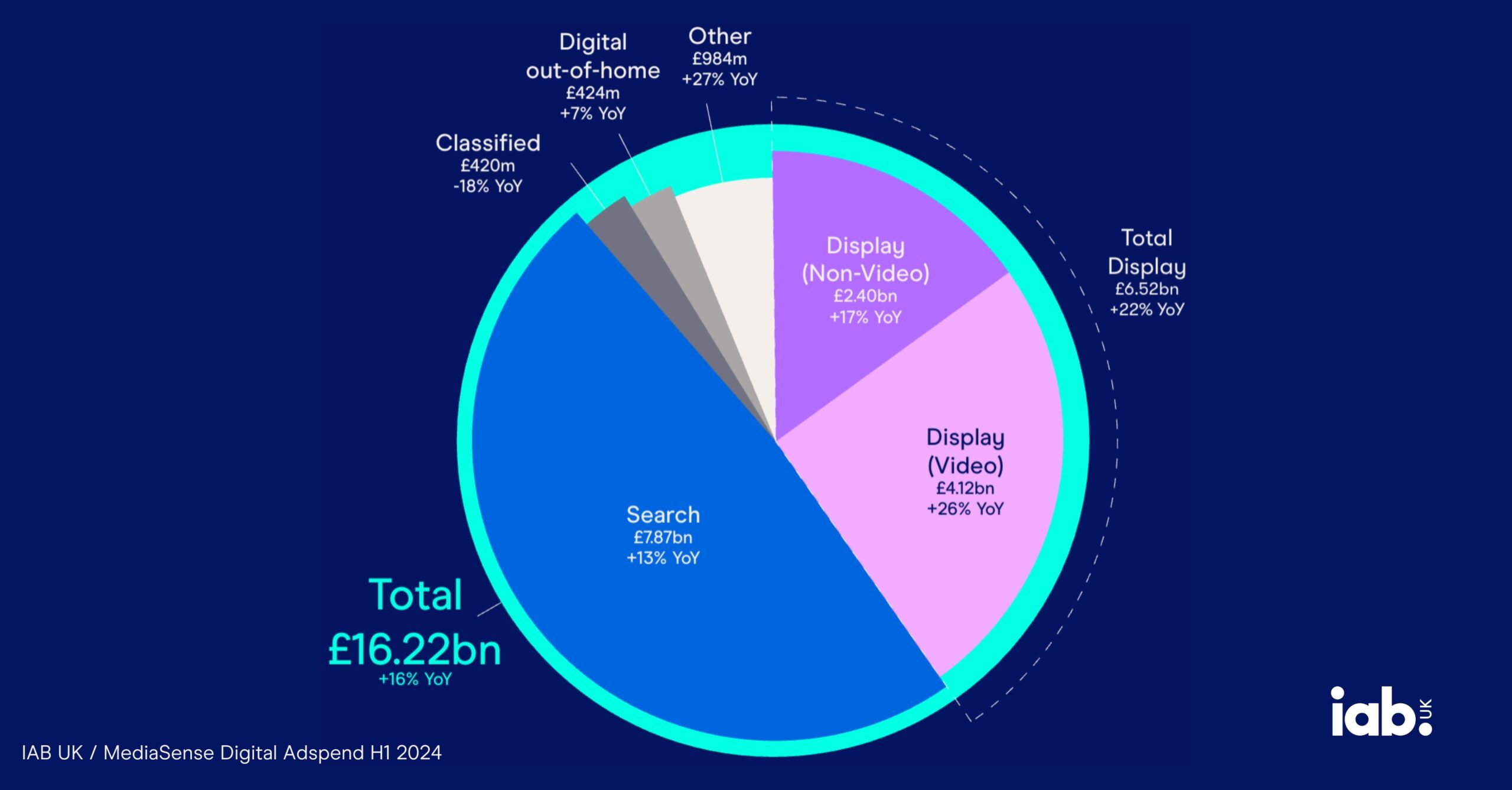

Overall, the UK’s total digital ad market grew 16% year on year in H1 to reach £16.22bn.

Search grew twice as fast as during H1 2023 (13% to £7.87bn) and continues to attract the largest share of total digital adspend (49%).

Within display, the second-largest segment, non-video spend grew 17% to £2.4bn, accounting for a smaller share than spend in video display.

Notably, mobile spend (22%) grew at nearly three times the rate of non-mobile spend (8%), attributed primarily to growth in social video spend.

“This data shows that established trends — particularly the growth of video advertising and dominance of mobile spend — have accelerated in the first half of 2024,” commented IAB UK CEO Jon Mew.

“Advertisers are increasingly utilising digital channels to deliver across the marketing funnel and build brands, with recent effectiveness research showing that marketers believe online channels deliver more emotional impact than offline media. I see that reflected in the fact that video — a highly engaging and creative format — is leading the charge when it comes to spend growth.”

In the latest IPA Bellwether report, video was identified as the only key area of budget growth looking into the rest of the year. A “strongly positive” net balance of +11.7% of surveyed companies recorded higher spending on video-related marketing activity in Q3, up from +7.8% in Q2.

However, marketing budgets more generally stalled for the first time in more than three years as uncertainty about Labour’s new budget, to be released on Wednesday, has caused negative business sentiment.

The IAB also noted that “the impact of the autumn 2024 budget on market confidence is a notable variable”.

Still, IAB analysis suggests that total digital adspend growth is expected to remain in the double digits for the rest of the year and in H1 2025, driven by expected growth in video and retail media.

Rik Moore, managing partner, strategy, at independent media agency The Kite Factory, previously told The Media Leader that the trend towards video is unsurprising and is likely to have occurred even if the economic mood was more positive.

“Marketers are thinking about all touchpoints available to us, trying to create audience interactions that harness earned media and then fanning the flames in paid, with video becoming a very efficient and targeted way of doing that,” he said.

IPA Bellwether: Media budgets to expand despite total marketing ‘on ice’

Future of Media London takeaways: confidence, trust and risk taking

IAB: Podcast, CTV and social video ‘outperform’ digital ad market