Total UK SVOD subs stay flat as ad tier users grow at pace

Amazon Prime Video’s default ad tier currently reaches 11.5m UK homes, according to the latest Q3 estimate from Barb — the largest consumer base of any streaming ad tier in the UK.

Netflix and Disney+, meanwhile, are estimated to reach 3.8m and 1.2m households respectively.

Compared with the prior quarter, that amounts to a 36.7% increase for Netflix and a 46% increase for Disney+ in terms of ad tier households. Barb only began estimating Amazon Prime Video ad tier users in Q2.

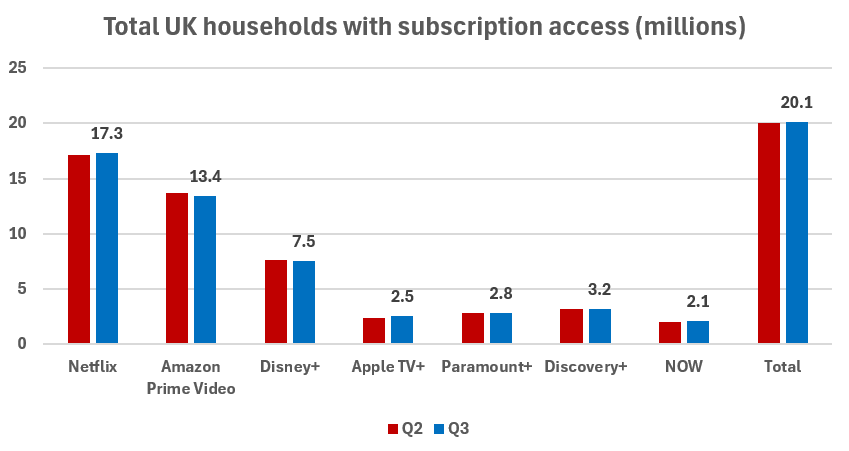

Netflix remains the top streaming service in the UK by total household users across its ad-free and ad-supported products (17.3m), up marginally from Q2.

On the other hand, both Amazon Prime Video (13.4m) and Disney+ (7.5m) saw slight declines in total household users across their subscription products.

Amazon had previously announced that Prime Video’s average ad-supported monthly reach in the UK exceeded 19m users.

Doug Whelpdale, Barb’s head of insight, told The Media Leader that the discrepancy is due to Barb’s reporting of household survey data as opposed to individual user data.

On Tuesday, Netflix revealed it now has 70m global monthly active ad tier users.

The latest figures were part of Barb’s quarterly Establishment Survey, which found that, on the whole, 68.8% of UK households had a subscription VOD (SVOD) service in Q3. That amounts to a plateau from Q2 (68.7%).

“After strong growth in Q1 and Q2, it was perhaps inevitable that the growth in homes accessing SVOD services would slow,” said Whelpdale.

“The overall number of homes accessing at least one SVOD service remained above 20m, but the number with more than two services dipped below 14m homes, suggesting viewers continue to remain wary of economic turbulence.”

Whelpdale added that the general stability in total SVOD subscriber numbers “further demonstrates why services are exploring other avenues to continue revenue growth”, namely through the incorporation of advertising into cheaper tiers.

“Amazon is likely to be the biggest ad tier for some time,” he predicted. Amazon Prime Video’s unique strategy of defaulting all of its users into the ad tier and increasing the price of the ad-free tier (as opposed to Netflix and Disney+, which offered an optional lower-cost ad tier) has been viewed as a point of difference that has led to wider adoption of the ad tier.

“It’s interesting to see the growth of the Netflix ad tier towards 4m homes and Disney+ past 1m homes,” continued Whelpdale. “With darker evenings and the festive season on the horizon, the number of ad tier homes for Netflix and Disney seems likely to grow.”

Netflix’s ad tier hits 70m users as it rolls out in-house adtech in Canada