A net -4.3% of companies surveyed by the IPA reduced their main media marketing spend in Q4 2024.

That is according to the latest Bellwether Report, which found the fall was the most significant since early 2021 amid Covid-19 lockdowns.

It follows two consecutive quarters of growth in this segment.

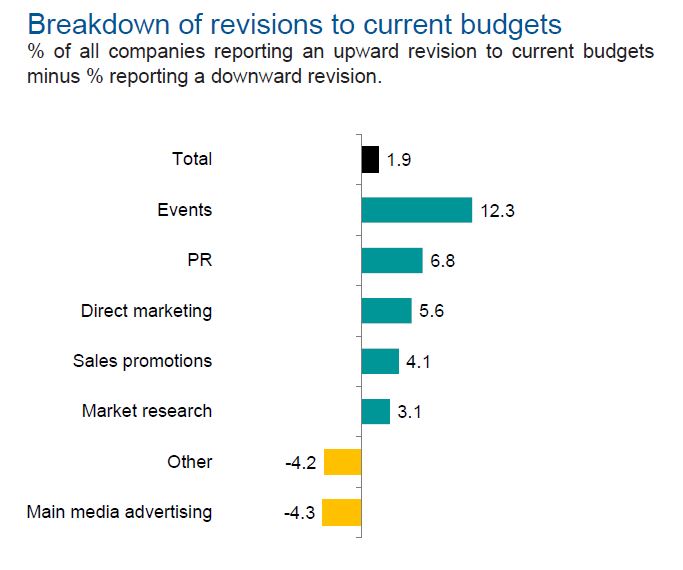

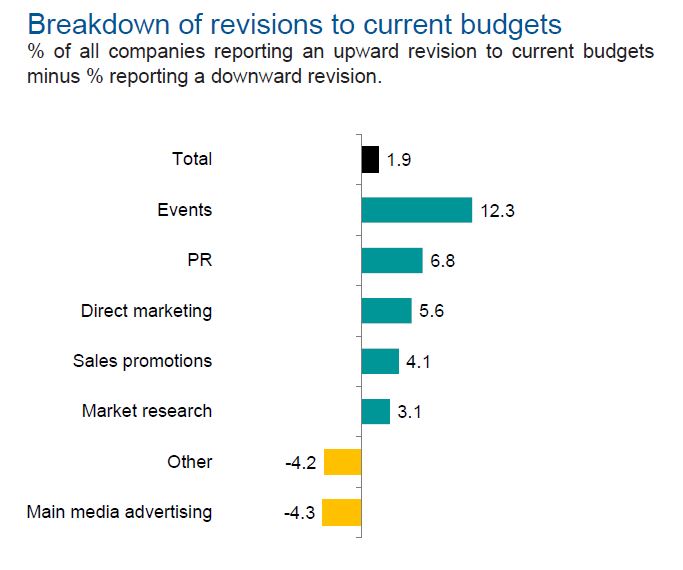

The net balance is the percentage of companies reporting an upward revision to current budgets minus the percentage reporting a downward revision.

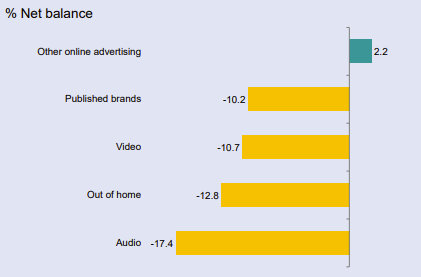

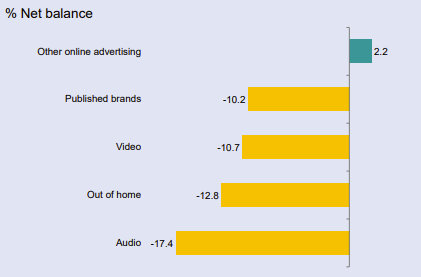

With the exception of online advertising (+2.2%), all sub-categories within main media saw double-digit drops in Q4.

Notably, a net balance of -10.7% of companies reduced spend in video — the first time in four years that the segment saw a decline. The video sub-category includes TV, cinema and online.

The change amounts to a significant reversal from the previous quarter, in which a net balance of +11.7% grew video budgets, driving overall growth for main media.

Elsewhere in main media, a net balance of -17.4% lowered their audio spend in Q4 — the seventh consecutive quarterly decline and the most substantial fall in four years.

OOH spend, meanwhile, saw a net -12.8% reducing spend — the second straight quarter of decrease. Publishing also saw its worst decline since Q3 2022 (at -10.2%).

IPA director-general Paul Bainsfair called it “disappointing” that main media budgets saw reductions in Q4, especially as they “remain the most effective channel for sustaining and growing brands in the long term”.

He continued: “Cuts to this category are not uncommon in tougher times given their need for greater financial contribution, which is also why we’ll often see concurrent increases by marketers to other shorter-term media. All of which reflects companies’ concerns on profitability following the budget.”

Short-term mindset ‘deepening’

Those surveyed by the IPA noted that the government’s autumn budget, which included increases in national insurance and minimum wage, could create “a significant cost-related challenge to overcome”.

Donald Trump’s victory in the US presidential election, and his pledge to levy tariffs on foreign goods, were also mentioned as potential threats to business confidence and the global economy more broadly.

Parry Jones, CEO of The Specialist Works, echoed such sentiments, telling The Media Leader that the autumn budget “pissed off a vocal part of the business community”.

He also noted Trump’s circle is equally “pissed off” at the Labour-led UK government, alluding to figures such as X owner Elon Musk, who MPs heard this week attempted to “depose” Sir Keir Starmer as prime minister.

In reaction to such instability, marketers “are choosing and/or being forced to move budget to channels that drive short-term response and are (perceived to be) easily measurable”, Jones added.

According to Mehul Ashra, strategist at the7stars, the decline in main media budgets is suggestive of a “deepening” short-term mindset that has “become pervasive in our industry”.

“This is particularly evident in the reduced investment in critical brand-building channels such as OOH and video,” he told The Media Leader. “History has shown that during uncertain macroeconomic times, budgets face heightened scrutiny, with a sharp focus on immediate effectiveness.

“Yet, the brands that weather these periods of adversity most successfully are those that remain committed to investing in their future.

“It’s especially surprising to see a decline in video, given the wealth of opportunities in this space and the rapid growth of platforms. Our own experience managing the migration from linear TV to subscription VOD for clients demonstrates the outstanding results this medium can deliver.”

Jones added that the shift to short-termism creates “massive opportunity for talented marketers and supportive CEOs” willing to invest in long-term marketing.

‘Shallow’ growth in total marketing budgets

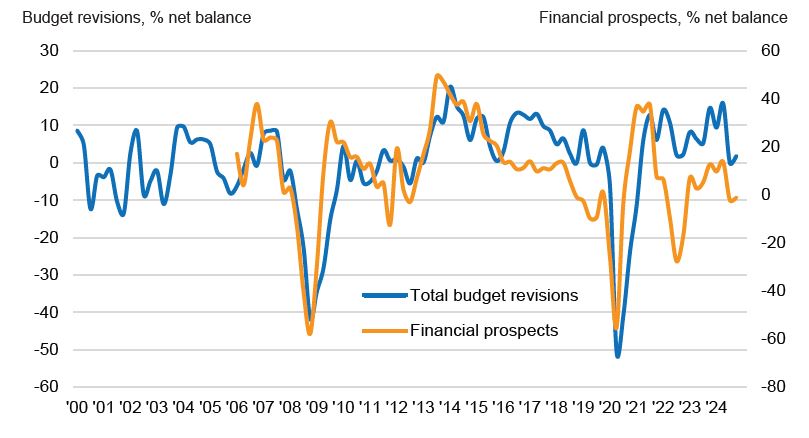

More broadly, marketing budgets returned to growth after being placed “on ice” in Q3 amid uncertainty over what would be included in the budget, suggesting a “shallow” post-budget bounce.

Overall, a net 1.9% of companies surveyed by the IPA reported an increase in their total marketing budgets during Q4.

According to the IPA, while such growth “marked an improvement from the previous quarter”, it is nevertheless the second-lowest figure recorded since the beginning of 2021, suggesting businesses are taking a “still-cautious approach” towards marketing spend.

Primary beneficiaries of the growth in marketing spend were events (+12.3%), PR (+6.8%), direct marketing (+5.6%), sales promotions (+4.1%) and market research (+3.1%).

Speaking to The Media Leader, Lydia Mulkeen, managing director at Wake the Bear, suggested increased spend in those channels is likely influenced by factors including time of year (“Q4 is peak event season”) and because they are deemed “less risky”).

Looking further ahead, a net 15.6% of companies surveyed said they would increase their investment in direct marketing in 2025 and 2026. This was followed closely by events (+15.5%). In comparison, a net 6.3% of companies said they intend to increase main media spend.

“The overarching trend is clear: an increased focus towards targeted, measurable campaigns that directly and demonstrably deliver revenue and ROAS [return on adspend],” Mulkeen added.

Joe Hayes, principal economist at S&P Global Market Intelligence, called the overall growth “encouraging” and noted that 14 of the past 15 quarters have seen increases. However, he indicated that companies “trod carefully” as they continue to assess the impact of new government policies on their bottom lines.

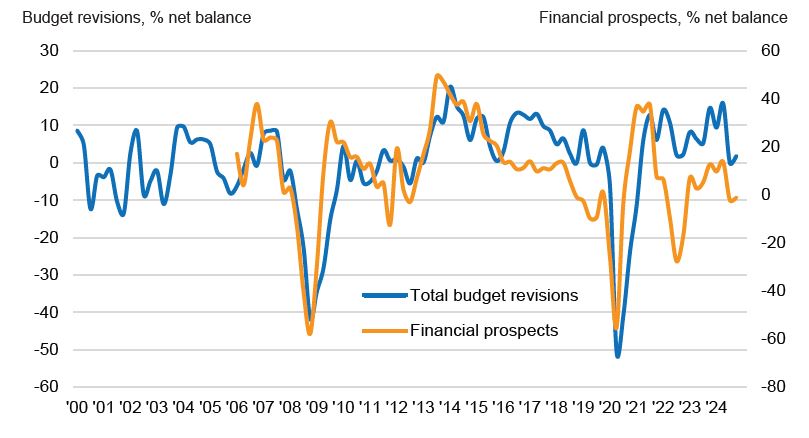

As the Bellwether found, a pervasive sense of negativity has set in. A net balance of -20.1% of respondents “foresee a deterioration in financial prospects at the industry level” — the highest degree of pessimism since Q4 2022.

As Jones concluded: “Marketers are crying out for a few years of boring, normal growth.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.