European super-aggregators seek handful of streamers to bundle, not dozens

Connected TV World Summit 2025

Two leading European pay-TV providers made it clear this week that they are not interested in a super-aggregation or super-bundling offer that numbers dozens of subscription streamers, and that having a handful of top-tier streamers feels like the right number.

Peter Wassong, head of TV content, Europe, at pan-European telecoms giant Deutsche Telekom, noted that over-the-top (OTT) streaming services want to be the hero proposition in a bundle and have a strong “share of voice” in marketing and presentation, limiting how many it is practical to present.

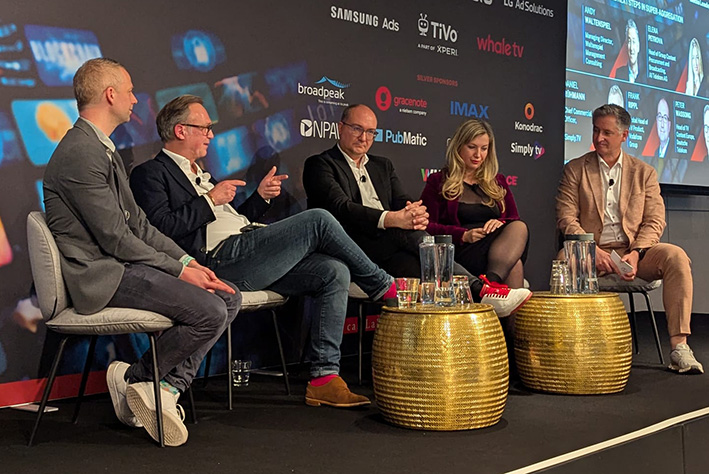

“And how often can you change the consumer proposition,” he asked during a panel at Connected TV World Summit in London. “We want a simple offer and having too many [hard and potentially discounted] bundles [of streaming services] would be a challenge.”

Pushed on whether the right number was about four or five, Wassong said it depends on the commercial arrangements.

Frank Rippl, global head of TV product at Vodafone Group, reckons four to five streamers is “more or less the right number” for a super-aggregation offering, especially if it includes hard bundling.

“That is the maximum. In most markets, we are trying to bundle two or three OTT subscription services. We must also consider the rest of our line-up [of content] and we have been streamlining our packages so we can discount, and we do not want to fragment the consumer offer to the point where customers do not understand it any more.”

Rippl emphasised that it is not feasible to aggregate and bundle dozens of streaming services.

Super-aggregation strategy

Elena Petrova, head of group content partnerships and broadcasting at A1 Telekom, offered her views on what a winning super-aggregation strategy looks like — and it is “diversity of content and making the pay-TV proposition easy to use”.

The most important thing is the content, she noted. “Content is king, but distribution is queen, and the magic wand is the technology that makes it easy for viewers to access the content they like and watch it right now.”

Offering their view on winning super-aggregator strategies, Wassong said localised content is key to differentiating a pay-TV service, so you are not offering the same apps as everyone else. Rippl agreed that you need relevant content for each market.

Nobody disagreed with the need to offer more types of media as part of the modern aggregation offer, with Petrova listing fitness, cooking, gaming and esports apps or content as ways to broaden engagement on a platform.

She was adamant that any pay-TV offer must remain a tightly aggregated, premium offer — it is all about quality and not quantity of apps partners.

YouTube is good to have as part of the aggregated pay-TV offer, according to Wassong, who described the video-sharing platform as the classic “frenemy” and a great content partner that helps create stickiness, especially since young people are fed a constant diet of new content from their favourite creators.

“YouTube offers great content for young people and it’s professionally produced,” he said.

YouTube is integrated into the Vodafone TV product, meanwhile, and Rippl added: “It offers relevant content to our customers, so we work with them and give them access [to viewers on their platform].”

Wassong, Rippl and Petrova were joined on the panel by Daniel Rühman, chief commercial officer at Simply.TV, and Andy Waltenspiel, managing director at Waltenspiel Management Consulting.

Bundles help customer retention

Earlier at Connected TV World Summit, Richard Broughton, executive director and co-founder at Ampere Analysis, noted that growth in the number of subscription streaming services that consumers take in US and UK homes has stalled, with consumers increasingly switching out their subscriptions — unsubscribing and then later resubscribing — rather than adding to their household collection.

“In the UK, about half of new customers last year [to subscription streamers on average] were not actually new to the service but were consumers who had left and were returning,” he revealed.

The insights come from mass-scale consumer panels that Ampere Analysis operates in the US and UK. Broughton presented this as a challenge for subscription VOD services, saying “one way to deal with this is the pay-TV bundle”, before pointing to a range of new hard bundles launched in the US that combine different streaming services with substantial discounts.

“These [bundles] are a compelling offer and are great for acquiring new customers. Bundles also have a positive effect on customer retention,” he declared.