Rajar Q2 2025: Top takeaways

Rajar Q2 2025

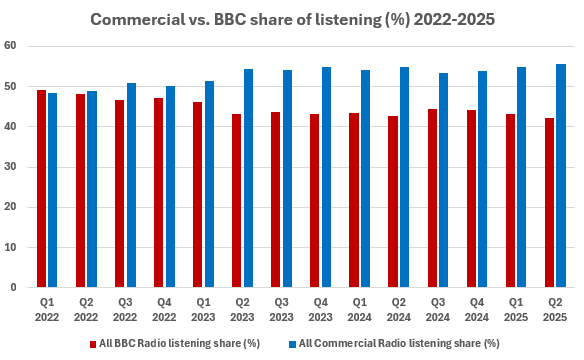

Commercial radio achieved record audience share in Q2, according to the latest Rajar figures.

It now accounts for 55.7% of total listening, compared to the BBC’s 42.1%.

In real terms, commercial radio now has 8.4m more listeners than the BBC.

However, total radio listening declined, now reaching 86% of adult Brits, down two percentage points from last year.

Commercial radio now reaches 68% of the UK population, down two percentage points from last year. The BBC, in comparison, reaches 53% of the population, down four percentage points year on year.

“We’ve seen commercial radio’s share of listening grow consistently over the last few years and this record is a testament to the continued innovation and investment from our sector,” commented Matt Payton, CEO of audio industry trade body Radiocentre.

Online radio listening also hit a record high 29.3% share — now considerably ahead of AM/FM listening (26.6%). For commercial radio specifically, online listening now accounts for one-third of all listening (32.9%), up marginally from this time last year.

“Commercial broadcasters focus relentlessly on ensuring listeners can easily access their favourite stations on any platform, whether that’s via apps or smart speakers,” Payton added. “At the same time, stations are delivering increasingly advanced and more sophisticated opportunities for advertisers to speak directly to their audiences”.

Here are other takeaways from the Q2 Rajar figures.

Digital listening hits record highs

Smart speaker listening hit a new record high at 18.4% share of total listening, up 0.8 percentage points from the previous three months.

Listening on smart speakers is even more common on commercial radio, growing to 22.4% share, up 1.6 percentage points from this time last year.

It came as overall online listening also reached record high listening share, growing 0.8 percentage points to 29.3%, according to the latest Rajar figures.

This was significantly higher than AM/FM listening which now accounts for just over a quarter (26.6%) of total listening.

Nevertheless, total digital listening hours remained flat in Q2 of 753m hours, following a jump in the previous quarter.

The continued growth in digital listening, if modest, as well as the relative ease by which advertisers can purchase ads online, has led to a boom in online ad revenues. According to the latest AA/Warc Expenditure Report, online radio saw strong ad revenue growth in Q1 (+16.4% year on year). Radio revenues more broadly grew ad revenue by just 0.4% in comparison.

Audion EMEA head of sales Elie Kauffmann suggested to The Media Leader this was reflective of “the growing demand for more flexible, immersive and performance-driven media channels”.

Q2 also saw the launch of two digital audio ad exchanges: Bauer’s AudioXi and Spotify’s Sax, while News Broadcasting officially took full control of Octave and Global maintains Dax.

“In the month that we launched our digital audio advertising platform, AudioXi, here in the UK, it’s exciting to see Bauer Media Audio UK leading the way in connected listening,” CEO Simon Myciunka said.

He noted one-third of Bauer’s listening is now occuring online, in app or via smart speakers.

>> View the data: Online listening recorded a record platform share

Global grows audience lead

Both Global and Bauer — the UK’s two largest audio broadcasters — saw modest quarter-on-quarter contractions in weekly reach across their total portfolios (-0.4% and -1.3%, respectively). However, Global notched year-on-year growth of 1% to 27.5m, compared to a -5.2% decline for Bauer to 21.5m.

Correspondingly, Global grew its share of listening to 25.1%, ahead of Bauer’s 19.3%.

Several Bauer brands posted double-digit year-on-year declines in weekly reach, including Greatest Hits Radio (-11.5% to 6.6m), Kiss Network (-10.7% to 3.6m) and Magic Network (-14.8% to 3.6m).

Global’s Smooth brand, meanwhile, led the conglomerate’s portfolio with 6.9% year-on-year growth in weekly reach to 7.7m.

“For Global to continue to grow and extend its lead is a considerable achievement,” commented Global founder and executive president Ashley Tabor-King. “This is all helping commercial radio celebrate its highest-ever share of listening.”

James Rea, its chief broadcasting and content officer, added Global won’t “take for granted” its recent success given the audio market has become “hugely competitive”.

>> View the data: Commercial audience share hits all-time high despite contractions in reach

Sharp declines for a Bauer breakfast stations

The BBC continued to lead during the breakfast timeslot in terms of weekly reach, despite Radio 2’s Breakfast Show reporting a 3.2% decline in weekly reach. Presenter Scott Mills replaced Zoe Ball as host in January.

Radio 4, on the other hand, experienced a 3.2% year-on-year increase in weekly reach.

Top commercial breakfast programme Heart Breakfast with Jamie and Amanda (Global) grew its weekly reach by a marginal 0.9% year on year and saw a quarter-on-quarter decline of 2.7% from Q1 2025.

Meanwhile, Bauer’s Magic Radio Breakfast, hosted by Harriet Scott and Gok Wan, saw a 27.1% year-on-year decline in its weekly reach to 772,000.

Kiss Breakfast with Jordan and Perri also saw a 12.8% quarter-on-quarter decline in its weekly reach to 477,000. The Media Leader unerstands this is a result of rebranding Kiss’ local stations to Hits, meaning Kiss is now a digital-only brand.

Notably, GB News saw a year-on-year decline of 10.7% in its weekly reach to 191,000 listeners, with a quarter-on-quarter decline of 19.4%. This comes after a period of standout growth during Q1, when the breakfast show saw a 25.4% year-on-year jump in weekly reach.

In London, three Global brands topped the charts: LBC London (+11.4%) overtook Heart London (-4.0%) and Capital London.

>> View the data: Magic and Kiss see sharp decline among commercial breakfast pack