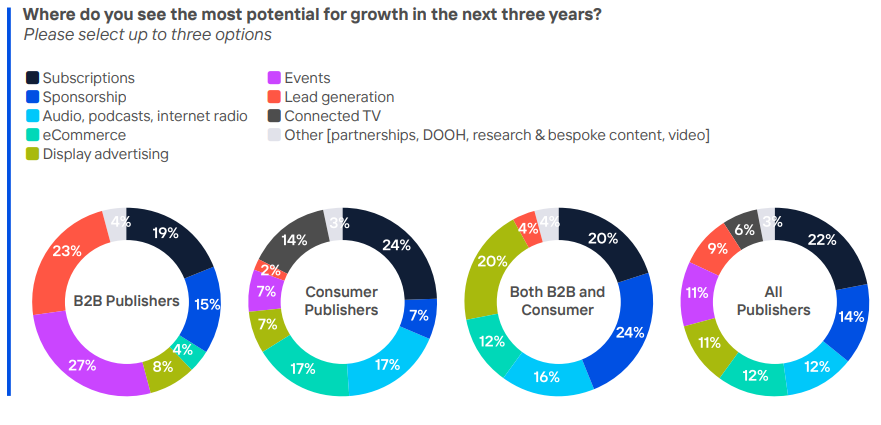

Consumer publishers expect subscriptions (24%), audio and podcasts (17%) and ecommerce (17%) to be the biggest drivers of growth in the next three years, according to the third annual survey conducted by the Association of Online Publishers (AOP).

This year’s results mark a shift in optimism over which revenue streams are likely to drive growth. While publishers last year also ranked subscription as the top potential revenue growth area, the rest of the top three were sponsorship and display advertising.

In comparison, this year, just 7% of consumer publishers surveyed said they saw the most potential in those revenue streams to grow in the next three years.

Given that the top business priority for publishers, according to the study, is developing new revenue streams through product innovation, the shift in focus from more traditional forms of online advertising is notable.

A number of publishers have sought to diversify their revenue streams in recent months by investing in video and podcasting capabilities. The Mail, for example, appointed ex-Guardian sales director Guy Edmunds in 2023 to the newly created role of media director of video and podcast, and also brought in TV and podcast veteran Jamie East as head of podcasts. Additional video producers will continue to be hired for short- and long-form video content going forward, The Media Leader understands.

“Subscriptions for publishers will still be important, as well as sponsorships,” Mail Metro Media chief revenue officer Dom Williams told The Media Leader. “But it’s also right that video and audio are a real, real focus for the business going forward.”

The Daily Mail ranks as the largest publisher on TikTok and, with the added investment, is hoping to better compete against other publishers and media owners for attention on podcasts too.

“It’s future-facing and it’s profitable,” added Williams.

Why 2023 showed ‘video is the next most important thing in publishing’

The drive to diversify revenue comes in part because traffic from social media and search has dipped in the past year, affecting readership and, therefore, ad revenue. Reach, the UK’s largest publisher, attributed declines in revenue last year to “declining digital referral volumes, in particular from Facebook’s deprioritisation of news”.

Within the display ad market, publishers are seeing most ad revenue via direct deals (78%), as opposed to private (11%) or open (11%) marketplaces. Over the next three years, they expect direct deals to continue to dominate and open marketplaces to cede territory to private marketplaces as advertisers seek to avoid wastage.

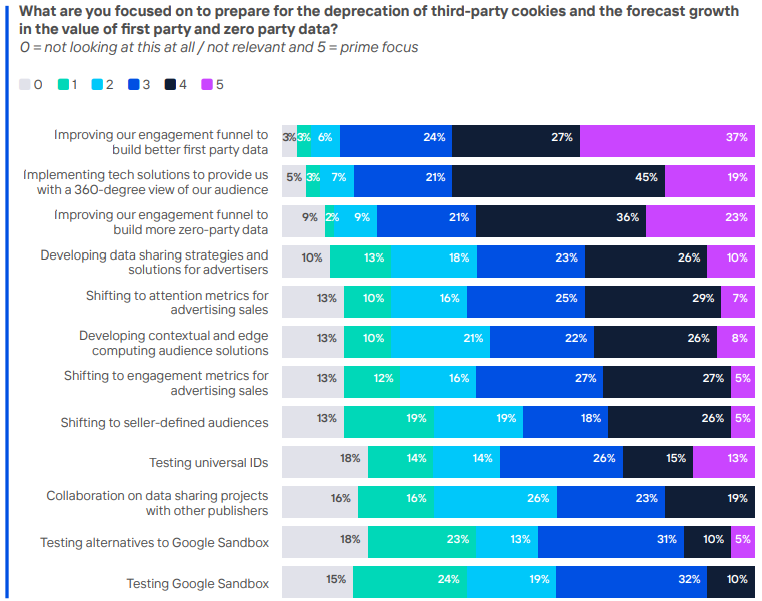

Meanwhile, with cookies deprecating this year, publishers are also highly focused on improving their engagement funnels to build better first- and zero-party data, as well as implementing new tech solutions to provide them with a better view of their audiences.

An additional priority for publishers is recruiting and retaining talent. Nearly half of respondents (46%) confirmed they are experiencing a shortfall in talent within their organisation.

One solution appears to be appealing to potential workers’ sense of idealism, with 70% of respondents agreeing or strongly agreeing that it is important for employees to work for an organisation that is committed to progress on ESG goals.

“This year’s survey reinforces the positive outlook publishers have as they face the challenges and opportunities in the year ahead,” remarked AOP managing director Richard Reeves. “With the industry’s focus on product innovation and high expectations of subscription revenue, 2024 is shaping up to be a promising year of growth and development for digital publishers. I am pleased to see ESG remains high on the agenda, though it will be important to ensure we all maintain the momentum of progress.”

Drawbacks to first-party data in a post-cookie world

The elephant in the room remains how publishers will adapt to the rise of generative AI. Publishers surveyed were practically split on whether AI will have positive or negative repercussions for the industry.

Faced with the uncertainty, 76% of publishers said they are exploring ways to use generative AI to deliver efficiencies. More than half (55%) said they are in the process of defining policies for, and training their editorial team on, the use of AI. Meanwhile, a quarter (26%) have already instigated editorial policies that prohibit the use of generative AI.

The AOP survey was carried out between 5 December and 12 January and included responses from 99 publishers and 19 tech solutions providers.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.