Are streamers becoming TV channels again?

Last week, Warner Bros Discovery struck a licensing deal with streaming companies Roku and Tubi to bring Warner Bros branded free ad-supported TV (FAST) channels to their streaming services.

The deal, which will bring shows like Westworld, The Bachelor, Cake Boss, and Say Yes to the Dress to Roku and Tubi audiences, turned some heads. Warner Bros Discovery had spent the latter half of 2022 removing content from its own streaming service HBO Max, much to the chagrin of fans. The loss of Westworld in particular, which at its peak was one of HBO’s most-watched programs, provided a shock.

Warner Bros Discovery, which is dealing with significant debt, has had to make concessions on content to cut costs. But it isn’t the only company to struggle in the contemporary age of the streaming wars. Despite growing user numbers, other broadcasters such as Paramount (Paramount+), Disney (Disney+), and Comcast’s NBCUniversal (Peacock) have continued to burn cash investing in their premium streaming offerings, which are yet to turn a profit.

While some, like Disney and Netflix, have turned to introducing cheaper ad tiers to produce alternative revenue streams, Warner Bros Discovery appears to be signalling that a return to licensing premium content out to other services may become a core strategy moving forward.

Tech, media, and telecoms analyst Alex DeGroote told The Media Leader that Warner Bros Discovery’s partnerships with Roku and Tubi “prove once and for all that the average household has very limited appetite for multiple paid subscription services.”

According to DeGroote, streamers are likely to become akin to traditional TV channels again, thanks in part to the increasing popularity of FAST channels amongst cord-cutters.

“We are seeing content players increasingly shift their focus towards capturing this audience,” he said.

The expansion in premium content like Westworld showing up on FAST channels is a win for content owners and consumers in its ability to reach wider audiences, but also for advertisers, who can now purchase ads against premium content that was previously locked behind the ad-free walls of HBO Max.

Rebecca Candeland, head of AV at Publicis Groupe media agency SparkFoundry, expressed excitement about the deal, saying it “will bring new life and audience to this content.”

She added: “Back-catalogue content is traditionally key for driving large proportions of viewing on the likes of Netflix, so this is a savvy move by Roku and Tubi to bolster their content choice for viewers whilst supporting their existing own content creation. […] It will be interesting to see if further deals like this extend out to other content providers to start licensing content to third parties.”

Whilst Tubi, which is owned by the Fox Corporation, is not yet available in the UK, the added content on Roku will help it better compete against Paramount-owned Pluto TV in Britain.

Though FAST channels are streaming services, they function more akin to regular broadcast television wherein scheduled programming comes on at a certain time and has ad breaks.

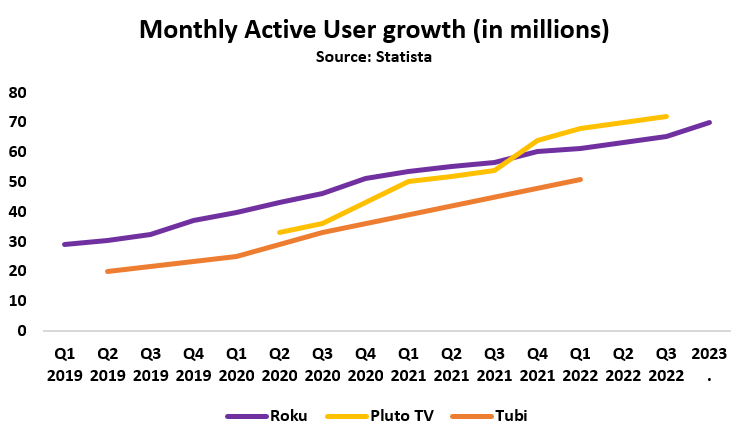

Despite the old model of content delivery, the success has been apparent. Tubi notched 56 million monthly active users in Q3 2022, while Pluto TV topped 72 million monthly active users, a 33% year-over-year increase. Last month, Roku reported it reached its own 70 million monthly active user milestone.

That success for the likes of these FAST channels has caused some critics to pronounce it the “future of streaming“.

“The industry looks to these services as money makers that can bring in consistent revenue without the ups and downs of pulling in subscribers,” added DeGroote.