Broadcast media is sitting on an ecommerce gold mine

By creating the right measurement tools for ecommerce brands, broadcast owners will find themselves pushing on an open door. But neither side fully understands the other.

Whenever I speak to people in ecommerce I’m often struck by the apparent gulf in marketing philosophy that exists between those from a traditional brand-led, “mass reach”media background and people with careers that developed through online performance marketing.

On the one hand, I meet CMOs and founders operating at the leading edge of the current Cambrian explosion in ecommerce innovation – people who epitomise a “hyper-growth” mindset that focusses on moving from concept to consumer as quickly as possible.

Then I meet seasoned media and marketing professionals who argue the case for patient investment in long-term brand building and worry that ecommerce marketing is often just a short-term direct response model that over-relies on price discounting.

Surely only one of these views can be true?

Possibly, but thanks to having one foot in each of these camps my view is that neither side fully understands the other.

Given the professional profile of the Mediatel News audience I’m going to focus this article on useful things for media people to know about ecommerce brands.

A marketing arms race

People working at the sharp end of ecommerce report that new online brands are finding it harder to scale successfully.

As one CMO told me recently, it’s relatively easy to launch a new brand these days but competitive pressure for new customers is driving up inflation in customer acquisition costs (CAC), particularly in attributable paid media. The spiralling CAC problem is the overriding challenge that everyone in the market has to overcome.

Ecommerce scale-ups feel they are in a marketing arms race to build awareness, go for market reach and introduce their brands to as many consumers as possible. CMOs need to compete against other brands with tens of millions of pounds to spend on marketing who also have to become big players as quickly as possible, otherwise they don’t survive.

As one founder told me recently, “first to the top of the hill wins.”

But it’s worth considering how these marketers tend to operate. When launching or scaling a new brand, small numbers of initial customers can be acquired through PPC channels for pennies . But to acquire 10,000 new customers brands have to add in many more media channels. Each time they do this it inexorably drives up the cost of customer acquisition in attributable PPC media.

This “moving through the media gears” as growth potential in one channel is exhausted before exploring new channels represents an obvious opportunity for broad-reach media owners.

A good first step on the road to grasping this opportunity is to understand why ecommerce brands have an insatiable appetite for “market response” data. The importance of this tends to be under-appreciated by people with limited experience of D2C scale-up culture.

Live testing is no longer a ‘nice-to-have’

The key to rapid ecommerce growth today is a live capability to test new brand concepts in real-time directly with consumers. The most successful new companies have learnt how to iterate brand propositions quickly as marketing engagement and sales feedback data flow back into sophisticated ecommerce platforms.

This is where media owners who are not headquartered in Silicon Valley should take note. The ability of ecommerce scale-ups to live-test new brand concepts and propositions is intimately linked to optimised investment in attributable media channels like Facebook, Google and Instagram.

Ecommerce brands are built upon AI-enabled platforms that closely monitor site visits (referrals) coming in from individual media channels and automatically compute what each delivers in terms of sales, profit, customer lifetime value (LTV) and CAC.

When a brand launches it usually invests a small exploratory PPC budget to target a relatively broad audience and see who responds by clicking through to the brand’s website. Because it’s relatively cheap to make ads for online, media brands will experiment with a wide variety of copy, image and channel variations for each launch.

The qualitative difference between ad permutations might only be a word here or an image there, but the marginal gains from iterative copy optimisation can add up to significant performance gains.

Once traffic begins to build a real-time market response picture emerges. This reveals not only the creative and channel variants that work best but also the emergent target market for the launch concept.

This information is then used to build out broader reach campaigns across the same and other PPC channels to reach a bigger number of people in the target audience.

This picture reveals how the measurement of marketing and advertising impact is not an optional ‘nice-to-have’ for scale-up ecommerce companies. Automated analysis of market response data is the crucial enabler for them to move rapidly from concept to consumer through an iterative process of building, measuring and learning.

The key insight here for broad-reach media owners is that attributable ad campaign performance is a core and non-negotiable pillar of ecommerce business models.

Media channels that don’t fulfil this existential requirement for market response data will always be at a disadvantage when talking to brands in this market.

Go big or go home

The obvious opportunity for broad-reach media owners is that if they can demonstrably solve the spiralling cost-of-acquisition problem, scale-up businesses will spend with them relentlessly.

Founders and VCs will literally just say, “here, have some more money” if sufficiently timely and granular analytics show a that specific creative copy and media channel mix is delivering strong performance.

We know that attribution of advertising response is a tough challenge for broadcast media like TV and radio, but it’s a challenge that can’t be ducked. Not least because the risk for broadcasters who don’t measure their response impact is that someone else will measure it for them, and possibly do it badly.

Broadcasters already suffer the ill-effects of this problem. I’ve spoken to many CMOs about unhappy experiments in the past with either this radio station or that TV channel. The campaign outcomes they tend to describe are often, “not exactly bad but just not good enough when compared to PPC channels.”

However, on closer enquiry, I often uncover a complex mix of poor creative strategy, sub-optimal spot plans, potential misattribution of response and insensitive measurement techniques.

CMOs generally complain that in contrast to PPC channels, the effects of TV and radio ads cannot be captured ‘cleanly’ in a mathematical sense. This can make the attribution picture feel hopelessly complicated for a lot of online brands.

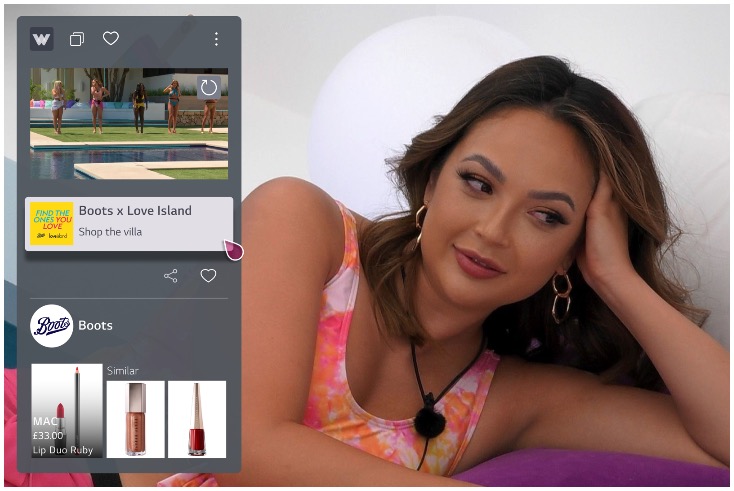

(Picture: ITV)

(Picture: ITV)

Nevertheless, some CMOs who do use TV and radio are beginning to make progress on solving this problem for themselves.

One told me recently, “What we have to do is turn TV on for a month with X amount of spend, then turn it off again right away. That helps us see the actual sales and fluctuations in direct, organic and paid search traffic so we can derive an attribution model from that data.”

Another CMO said, “We’ll create a handful of TV ad variants, put them on air and use tools like Adalyser to see what mix of channel spots and creative variants generate the strongest web response. Optimising our plan to get the best short term response gives us more confidence that a campaign will perform well over a longer period.”

Moreover, some of the ecommerce CMOs I talk to are beginning to invest heavily in monthly econometric market mix modelling (MMM) analytics to understand how specific marketing channels perform.

This doesn’t come cheap (approximately £10,000 per month) and isn’t entirely reliable, but it’s advocates generally consider MMM to be cost effective for companies with big, complex channel plans that want to adapt their marketing mix on a month-by-month basis.

Ecommerce brands are desperate for new solutions

When ecommerce brands figure out this problem for themselves, the benefits to media owners can be eye-opening.

In one recent example a CMO reported that until recently 80% of their marketing investment was PPC, the rest being door drops, inserts, a catalogue, a bit of social and a bit of TV.

But, due to insights gained from monthly econometric analysis, at least 50% of brand spend has now moved to social media and TV. PPC still takes the majority of spend – the budget is anywhere between £500,000 to £1m per month on PPC – but the increased TV spend is purely additive to that.

In summary, ecommerce scale-ups are desperate for new solutions to the spiralling cost of their customer acquisition problem. They need to introduce their brands to as many new customers as possible, which is a perfect fit for the strengths of broad-reach media like TV and radio.

Broadcast owners will find themselves pushing on an open door if they choose to grasp this exciting revenue growth opportunity.

They can do so by assuming a leading role in the development of new attribution and data-modelling technologies that accurately capture the true impact of broad-reach advertising on ecommerce customer acquisition.

Jason Brownlee is the founder of Colourtext, an advertising effectiveness and brand tracking research company