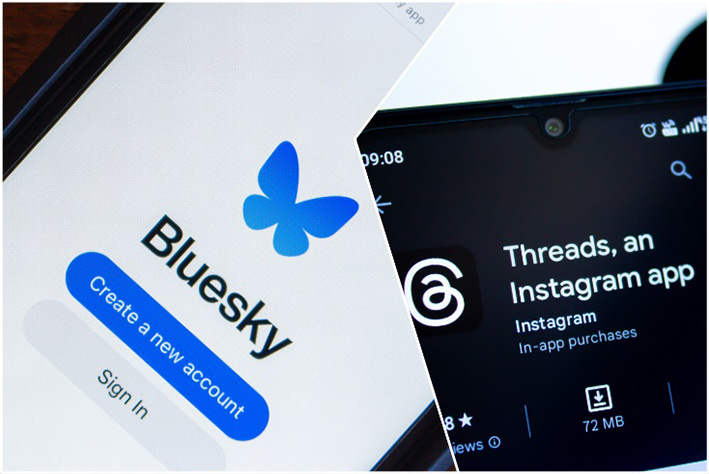

Can Bluesky and Threads capitalise on user growth momentum?

As X owner Elon Musk continues to court controversy, competitor microblogging platform Bluesky has seen an uptick in consumer interest.

Indeed, in the days after the Brazilian supreme court banned X in the country last weekend, over 2.6m users have joined Bluesky — 85% of whom are Brazilian.

Brazil’s embrace of Bluesky follows a similar jump in activity across the pond. In the UK, Musk’s comments about August’s riots, including stating that “civil war is inevitable”, helped drive users to test out alternatives to X.

Accordingly, Bluesky saw a 60% jump in UK user activity in the days following Musk’s statements.

“Oh hello Britain,” the official Bluesky account posted alongside a chart depicting a spike in UK activity in mid-August.

Analysis: Bluesky or Threads?

Among news consumers, much of UK activity on Bluesky has been led by Financial Times journalists, many of whom were early adopters of the platform and have made efforts to post regularly there.

However, while some journalists are seeking to aggressively grow personal audiences on Bluesky and Meta’s own microblogging competitor Threads, many publishers are still in the test-and-learn phase when considering audience strategies.

For example, despite FT journalists’ prominence on Bluesky, Rachel Banning-Lover, the FT‘s head of social media and development, told The Media Leader: “Generally, we’re keeping an eye on how these platforms perform before investing more resources.”

She said the FT posts “a couple of items a day” on Threads, most often focusing on world news, “which we have found works well for engagement”. However, Banning-Lover added that the title is not currently planning on leaving X.

“We think it’s important to maintain a presence on X, where we can offer users a trustworthy source of news,” she said. “A large number of FT readers use it regularly and it remains the platform where our journalism gets shared the most.”

Indeed, one representative from a UK publishing trade body told The Media Leader that, in general, publishers’ audience development teams are still concerned about “where the audiences are for them”, even if that means remaining on X for now. However, it is a topic that is “under constant review”, given X’s reduced global scale and the actions of Musk.

The source added that, for many UK publishers, Threads has “never really taken off” as an X alternative. Bluesky, meanwhile, is still “nascent”, since publishers are “still very much learning about [the platform]”.

When considering scale, among X’s main competitors, Threads currently dwarfs Bluesky.

Threads: we need a safer space for journalists on social media

Thanks to its integration with Instagram, Threads became the fastest-growing app to reach 100m users (accomplished within five days of launch). As of August, Threads counts nearly 200m users, including a number of important US accounts, such as sports journalists covering American football and basketball.

Bluesky, on the other hand, currently has around 8m users. User growth was initially hampered by a lack of server and developer capacity to support a large number of sign-ups. Instead, Bluesky opted to release limited invite codes to allow users to beta-test the platform. The scarcity of those codes meant that audience reach was necessarily limited until the platform opened to the public in February.

Apart from its larger user base, Threads, unlike Bluesky, presently also supports posting videos on the platform. The feature has attracted users interested in sports and entertainment, as well as creators looking to cross-post video content from other apps, including Instagram.

However, Bluesky’s users have pointed to a number of reasons for preferring the platform over Threads as their primary X alternative. Commonly cited motivations include Bluesky’s default chronological feed (as opposed to Threads’ algorithmic “For you” feed), direct messaging features, improved customisation options, a lack of trust in Meta CEO Mark Zuckerberg, Threads’ policy of not promoting “political” content and not wanting to have an account connected with Instagram.

Brands not yet showing ‘appetite’

For brands and their media agencies, Bluesky and Threads remain off the radar for now.

Neither platform has enabled formal advertising formats, although brands can make attempts at organic marketing, as on any social platform.

One head of social at an independent agency told The Media Leader that none of its clients has shown “any appetite” for either Threads or Bluesky, although they noted that it is still “early days” for the apps and agencies that specialise in organic outreach are more likely to have tested the platforms on behalf of clients.

Notably, Meta has not pushed Threads as something for marketers to consider, instead opting to communicate the importance of its AI tools for advertisers.

The social head added that, among clients that have stopped spending on X, the main beneficiaries have been TikTok and Meta more broadly.

In an opinion piece penned in the summer, Phoebe Dixon, social media account director at 26PMX, argued that “until paid advertising appears on Threads, it remains the perfect opportunity for brands to explore and understand the platform from an organic perspective”.

Dixon wrote: “If businesses want people to go to their website or buy something, Threads isn’t the strongest platform. But if they want to build a conversation with their key demographic, there is extreme value to be had there.”

While Meta has said it has “no immediate timeline” for commercialising Threads, Meta has been spotted exploring ads in the app’s code.

Bluesky CEO Jay Graber, meanwhile, has previously communicated a lack of interest in creating ad inventory on the platform, which is itself decentralised.

She told Wired in February: “There will always be free options and we can’t enshittify the network with ads. This is where federation comes in. The fact that anyone can self-host and anyone can build on the software means that we’ll never be able to degrade the user experience in a way where people want to leave.”

X’s downward spiral

The Brazil supreme court’s unanimous decision to uphold a ban on X — in effect since Saturday — cited concerns over the spread of disinformation and X’s decision not to appoint a legal representative for the company in the country.

Musk has continued posting controversial statements and endorsements of the far right on his platform. Last month, he announced his support for Donald Trump in the US presidential election. Most recently, Musk posted (and later deleted) a promotion of an interview between far-right media figure Tucker Carlson and Darryl Cooper, a self-proclaimed historian who has been accused of being a Nazi apologist.

During the interview, Cooper suggested that Winston Churchill “was the villain of the Second World War” and that Adolf Hitler and the Nazis did not want to go to war. In his own tweet, Musk said: “Very interesting. Worth watching.”

Musk has also previously been accused of making antisemitic statements.

Earlier this week, a survey from Kantar revealed that a net 26% of global marketing professionals said they plan to reduce adspend on X in 2025. It also found just 4% of marketers say X provides a brand-safe environment for advertising.

As advertising revenue has fallen for X, so has the company’s valuation. Last month, The Wall Street Journal reported that, for the banks that helped finance Musk’s takeover of Twitter, it has been the worst buyout since the 2008-2009 financial crisis.