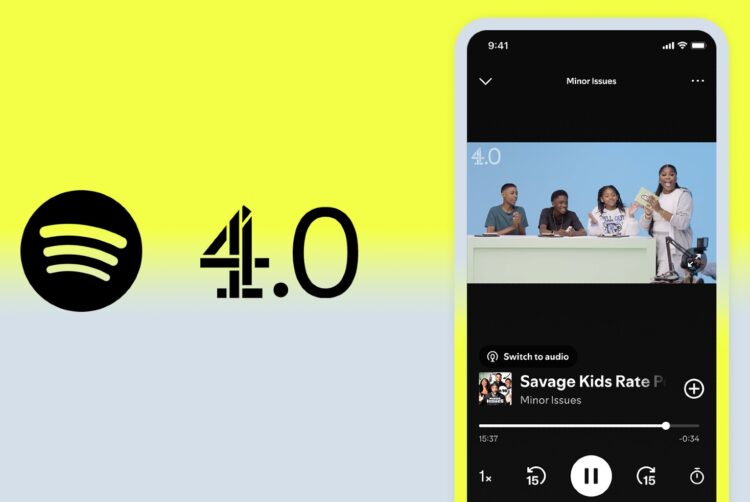

Channel 4 is bringing video programming to Spotify.

Launching this week, content will be supplied from the broadcaster’s digital-first brand, Channel 4.0. Episodes of shows including Minor Issues, Hear Me Out and Secret Sauce will be distributed on Spotify’s mobile and desktop apps.

This is a first for UK public-service broadcasters and is part of Channel 4’s strategy to become a “digital-first public-service streamer” by 2030.

The broadcaster has historically been among the first to innovate its distribution strategy for the social media and streaming era. It launched TV programming on Snapchat in 2018 and on TikTok in 2021.

In 2022, it became the first UK broadcaster to strike a distribution deal for long-form content on YouTube (subsequently followed by ITV in December 2024).

“Gen Z are watching videos across lots of digital platforms as well as on Channel 4 heartland ones and Spotify is very much one of the new, so that’s where we’re going,” outgoing CEO Alex Mahon said. “This new first-of-its-kind approach puts Channel 4 content in another place where people already are.”

Mahon described the effort as a natural extension of Channel 4’s Fast Forward strategy. Launched in 2024, Fast Forward is an official effort by the broadcaster to digitise its content offering and deliver new revenues in the streaming era.

“We’ve always led the pack on digital — and we’re doing it again,” she added.

Channel 4.0 aims to deliver programming for the 13-24 age group, often by collaborating with social media personalities and other creators to devise youth-centred content for different platforms. According to the broadcaster, views of Channel 4.0 content across all platforms doubled (+99%) last year.

ITV finds incremental reach on YouTube

Analysis: Video killed the audio streaming star

The move amounts to a significant effort not only for Channel 4 in its journey to become a digital-first streamer but also for Spotify’s strategy to grow video viewership.

According to Spotify, video podcast consumption in the UK nearly doubled (+95%) year on year.

Roman Wasenmüller, vice-president of Spotify’s podcast business, suggested that the company can act as “a powerful tool for broadcasters like Channel 4 to connect with new and loyal audiences”.

“Video consumption is growing rapidly on Spotify and our platform provides the perfect space for Channel 4 to extend its reach, build even stronger relationships with their audience and drive incremental revenues,” he continued.

At Spotify’s Sparks event this month, global head of sales Brian Berner said the platform is “becoming more visual” by leaning in to music videos and video podcasts. This opens up more opportunities for advertisers to buy new visual formats — something that Berner claimed receive greater attention.

Spotify rolled out its own ad exchange last month to make it easier for advertisers to buy inventory and measure outcomes. While it launched with only music inventory, podcasts will be added by the end of Q2, including video inventory.

In an interview with The Media Leader, Ed Couchman, Spotify’s UK and Northern Europe head of sales, called video “absolutely pivotal” to the success of the Spotify Ad Exchange, adding that he believes “it’s important that our ad solutions match” the rise in video consumption on the platform.

Revenue opportunity?

For broadcasters, while platforms offer great opportunities for distribution, marketing and racking up views, it’s less clear how easily that content can be monetised in a way that materially impacts their bottom line.

Channel 4 News, for example, uploads 25 pieces of content to various platforms daily, achieving 1.8bn total views in 2024. However, Mahon previously admitted that such content is “not making money” on TikTok, noting that “monetisation can be a little problem”.

When asked at last month’s Future of Audio and Entertainment conference whether social and streaming platforms can offer legacy media owners a legitimate new revenue stream, Katie Bowden, managing director of audio at Global, suggested that placing programming on more platforms allows broadcasters greater opportunity to sell branded content.

How Spotify is ‘removing friction’ to pursue the long tail

“There’s lots of opportunity in terms of branded content,” Bowden said. “Social is a huge part of extending the audience that we interact with. But for our [partners], it’s also a great opportunity for them to think about how they can integrate into that content.”

She added: “For advertisers, there’s so much they can now do with that partnership. No longer are you just a static audio opportunity. You have to really think about the 360 [degree] opportunity of how you want to interact with your audience.”

While it may well be true that media owners can increase revenues via brand sponsorship by offering incremental audiences from social and streaming platforms, these deals don’t necessarily grow the pie of advertisers that they are working with.

Whereas the platforms themselves are strong beneficiaries of long-tail advertisers spending programmatically, it’s as yet unclear how quality broadcasters can strongly benefit from that set-up to tap into the growing advertiser pool.

Since January, Spotify has sought to incentivise British creators and publishers on the platform through its new Partner Program, which drives new options for monetisation.

In Q1, Spotify paid out more than $100m to podcast publishers worldwide — a large sum in aggregate, but one that is unlikely to substantially benefit a major entertainment company with high production costs to account for.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.