Radio, podcasts, and music streaming supported by advertising now reaches three-quarters (76%) of UK adults every week, up two percentage points from the year prior.

Reach is highest among the 35-54 cohort (82%) but is also above average among 25-34s (80%) and 15-24s (79%).

That is according to the latest report produced by audio industry trade body Radiocentre in partnership with research consultancy MTM, which found the commercial audio market has “reached critical mass” and is still expanding, with 5.3m weekly listeners added over the past six years.

Of that reach, commercial audio’s market share accounts for roughly 90% of total listening according to Rajar Midas data — 56% via broadcast radio (FM/AM and DAB) and 28% via linear radio over IP. The market is rounded out by podcasts (11%) and streamed music (5%).

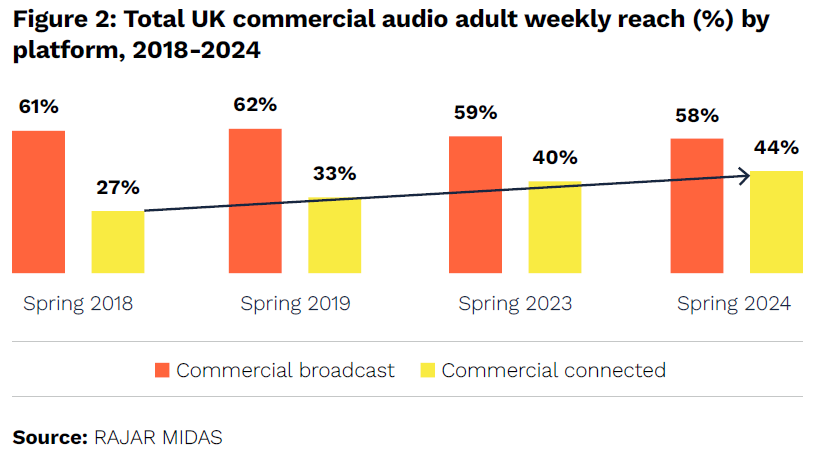

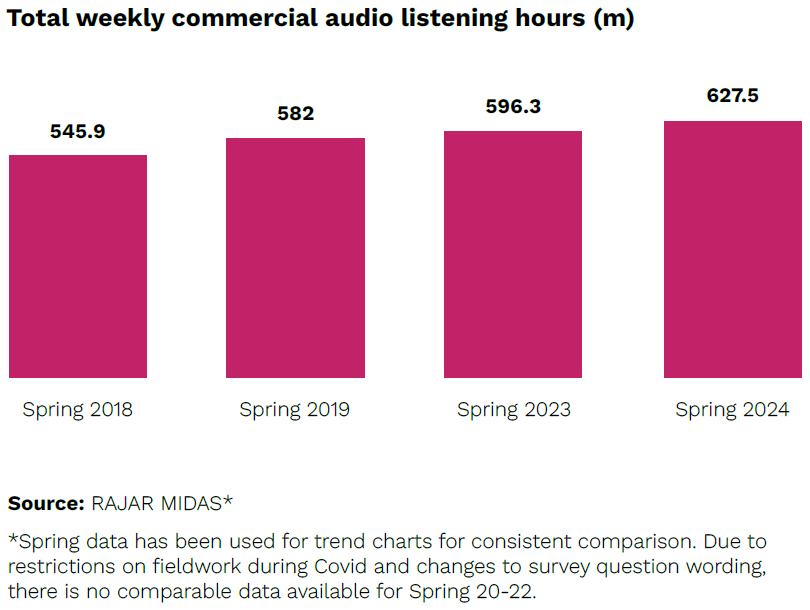

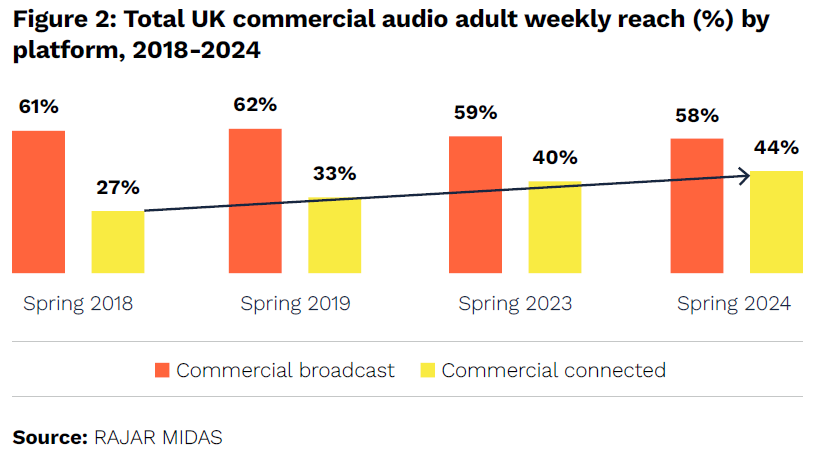

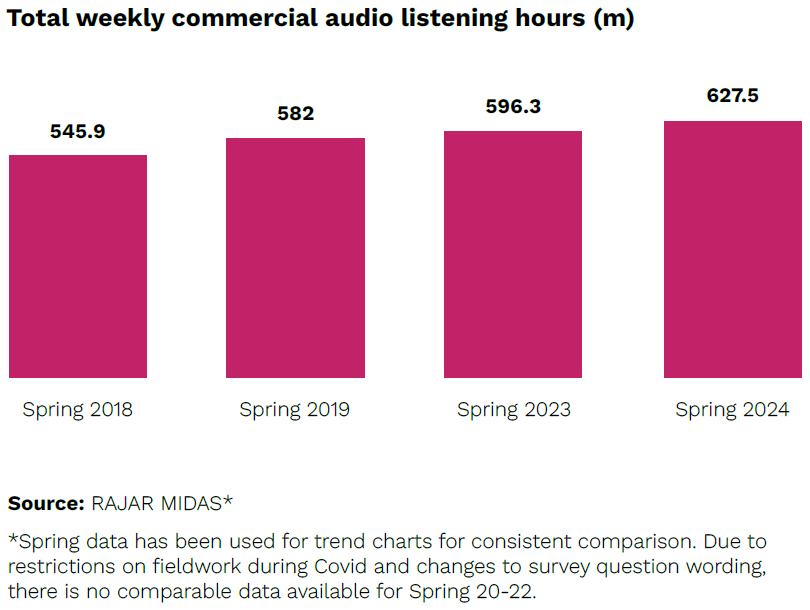

The Speed of Sound report revealed the “thriving” UK audio sector has been driven in part by the widespread adoption of connected devices, particularly smart speakers. According to the report, nearly half (44%) of of UK adults listen to ad-funded connected audio weekly, up from a quarter (27%) six years ago.

Listening hours have also continued to grow over time, according to Rajar Midas figures. Since 2018, total weekly commercial audio listening hours have grown 15% as digital listening device uptake has increased and audio listening has expanded beyond commuting hours.

The upward trend in audience has correlated with increased growth in ad revenue for the sector. In the 12 months to Q3 2024, audio saw a 5.5% year-on-year increase in revenue to £863.4m, according to AA/Warc.

Radiocentre CEO Matt Payton said the report “demonstrates that the audio advertising opportunity is bigger than ever” and that “broadcasters lead the way still” despite strong growth from digital players.

“To unlock the best results, advertisers need to work with commercial broadcasters,” he continued. “They not only provide access to 90% of UK ad-funded listening hours, but also offer a valuable multi-platform approach that maximises reach and amplifies impact”.

In a conversation with The Media Leader, Payton added that the “conventional wisdom” that linear radio is merely good for reach and digital audio is merely good for targeting doesn’t tell the full story.

“The analysis here is that you can get demand generation benefits from digital audio as well as from the mass reach from linear radio. And by the way, you can get demand conversion benefits from linear radio as well as digital,” he said.

Payton explained the report “provide[s] more clarity on how the market fits together” and that it is part of Radiocentre’s expanded remit to study and promote more than just linear radio.

“We want to grow the whole market,” he added.

Growing demand in podcasts

One key area of growth for audio is in the podcast market. UK adult weekly reach for podcasts has more than doubled from 8% to 16.4% since 2018 and now accounts for one-tenth (11%) of total commercial listening.

Advertisers have taken notice in that timeframe. In the two years leading up to 2023 (the latest year in which UK IAB spend data is available), podcast ad revenues jumped 43%, representing nearly half (47%) of total UK digital audio spend. According to AA/Warc forecasts, global podcast revenue is expected to grow a further 7.9% in 2025 and 6.5% in 2026.

The report suggests commercial broadcasters are well placed to take advantage of that revenue growth given they can easily promote podcasts to existing audiences via linear radio, driving both trial and repeat listening of their podcast inventory.

The Speed of Sound report further suggested that new digital audio formats, such as in-game audio, are gaining popularity among forward-thinking advertisers.

“Podcasts have seen exponential growth and a whole new audio sector [has] developed, providing a high-engaement environment,” Howard Bareham, co-founder of specialist audio agency Trisonic, which edits The Media Leader Podcast, told The Media Leader.

He added that the evolving audio market gives agencies and brands “new performance and attribution metrics via digital audio, combined with new dynamic ways of interacting with listeners via apps and ad formats.”

“This has helped in attracting digital-first brands alongside traditional broadcast radio spenders,” he noted. “It’s fair to say that audio may have something for everyone.”

The full report can be accessed here.

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.