Dip in gaming CPMs presents opportunities in Q1 and Q3

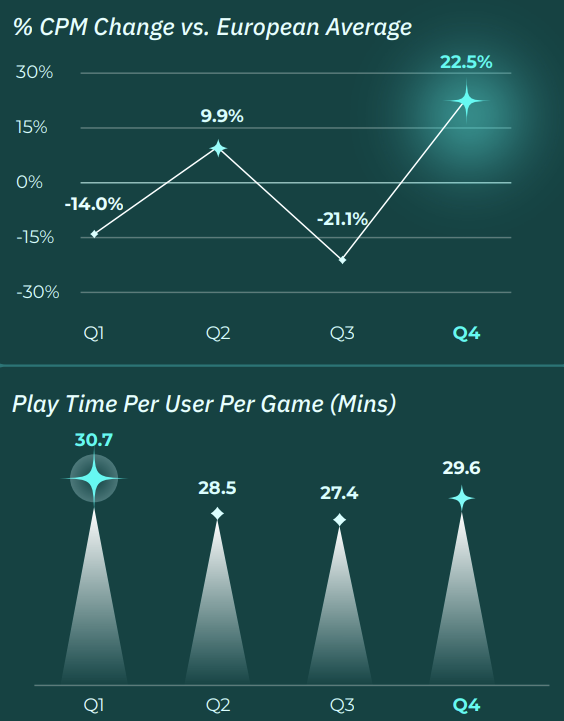

While playtime and session volumes among gamers peak “slightly” in Q4, gaming remains a relatively consistent year-round activity, creating potential opportunities for advertisers seeking greater efficiencies during Q1 and Q3.

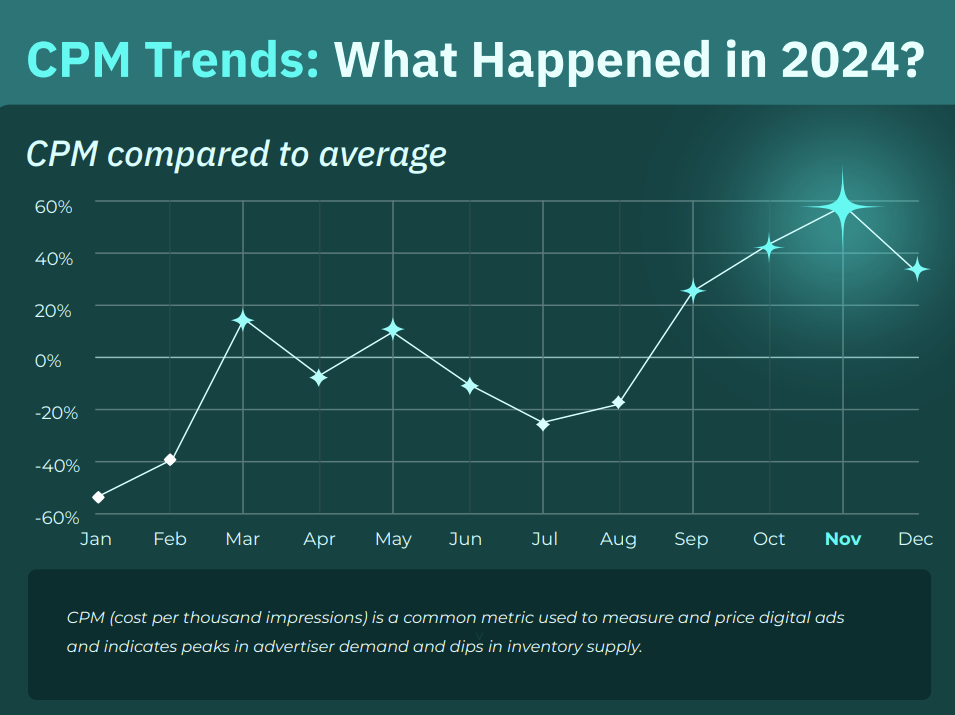

According to a new report from in-game advertising company Anzu, in 2024 global CPMs for in-game ads peaked in November, as advertiser demand grew amid the holiday period.

In comparison, CPMs fell far below average during the months of January and February, as well as in June, July and August.

However, Anzu pointed out, gaming engagement during these periods remained strong.

For example, global average playtime per user per game in Q1 (20.8 minutes) exceeded Q2 (19.7 minutes) and Q3 (19.8 minutes), falling just behind Q4 (21.6 minutes).

And although gaming session lengths were found to be slightly shorter during spring and summer (“as consumers game on the go”), overall session volumes were found to remain steady.

Anzu’s inaugural study, The Intrinsic In-Game Advertising Key Trends Report, collated insights from Anzu’s own campaigns alongside data and contributions from Dentsu, the IAB, Integral Ad Science, Comscore, Lumen, Claritas, Gameloft and Miniclip.

It suggests that the CPM dip in Q1 presents a good opportunity for advertisers looking to maximise efficiency, especially in sectors such as travel, fitness and wellbeing, where sales tend to peak earlier in the year.

Meanwhile, Q3 offers an especially cost-effective window in Europe, with a 21.1% decline in CPMs during the quarter despite just a 5.7% fall in playtime per user per game relative to the year-long average.

Dentsu senior vice-president of global gaming strategy Magali Huot commented that cost efficiencies are particularly exciting in emerging regions outside Europe and North America, “where brands can still tap into massive growth […] and make a real impact from the ground up”.

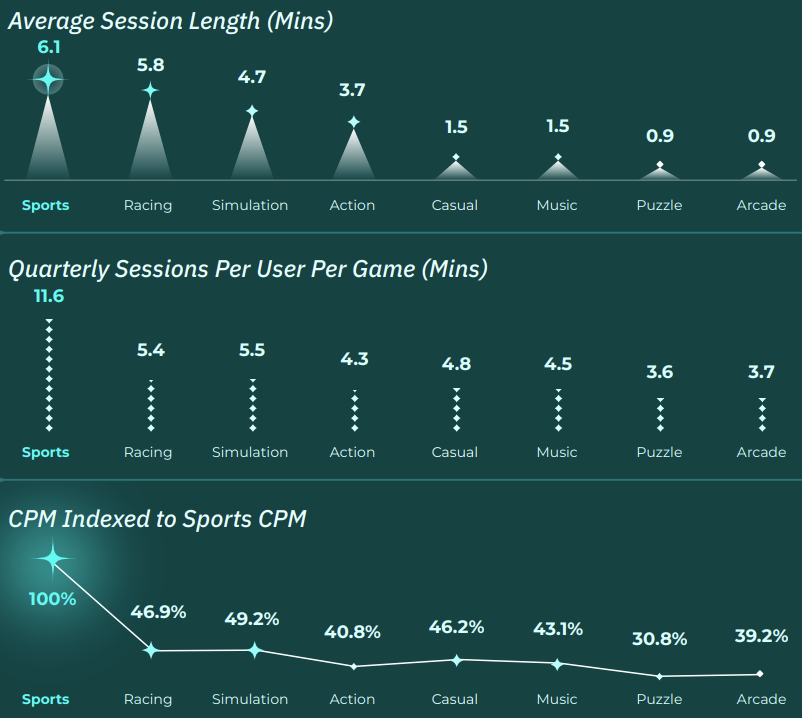

The study found that sports titles tend to have the highest CPMs of any gaming genre, driven by high, predictable player engagement — especially during the latter half of the year.

But it suggested that alternative genres such as racing, simulation and action offer the greatest efficiency for ad buyers, with a “sweet spot” of relatively high playtimes at considerably lower CPMs than sports games.

“Gaming isn’t just another channel,” added Anzu executive vice-president of marketing and strategy Natalia Vasilyeva. “It’s uniquely positioned to drive significant cost and performance advantages for advertisers.”