‘Embrace simplicity’: Why TV needs to borrow from Big Tech’s playbook

The Future of TV Advertising Global 2024

The TV ecosystem needs to “embrace simplicity”.

That was the core message delivered by James Rooke, president of Comcast Advertising, at The Future of TV Advertising Global 2024.

Speaking in front of a sold-out crowd, Rooke pleaded for the TV industry to learn from the “Big Tech playbook” and adopt practices to simplify the TV buying process and make it more flexible.

He explained that, in conversations with advertisers, they have conceded that TV is held to an unfairly high standard relative to tech platforms. Third-party ad validation is seen as a “nice-to-have” for platforms, rather than a requirement, as it is for more traditional channels like TV.

The reason for the lower standard, Rooke surmised, is that tech platforms are simply easier and quicker to buy on.

Rooke offered one quote from an unnamed global media lead at a major healthcare company that highlighted the issue TV faces: “[Buying on platforms is] an easier process than TV. The lack of transparency is frustrating and I’m pushing for more buy details, but it takes less time, resources and internal rationale to buy [walled gardens].”

Rooke summarised: “The process of TV is too difficult. The Big Tech platforms make it easy. And easy matters.”

Opportunity in the long tail

But it’s not all doom and gloom, Rooke assured delegates. “There is a genuine opportunity for premium video as a category to go on offence”.

He said there is “latent demand” from millions of small and medium-sized enterprises around the world “that have built their businesses on social and YouTube, but are frustrated and looking for a viable alternative to get to the next stage of growth”.

Rooke said that case studies of new-to-TV advertisers have shown a “hockey stick effect” — spiking search results for their brand in the 10-14 days after their first TV campaign launched.

Are AI ads the future of TV? With ITV’s Jason Spencer and Alan Hall

“That is significant and meaningful,” argued Rooke. He explained that, in the US, new-to-TV direct-to-consumer advertisers currently spend $4bn on TV advertising and this is just “scratching the surface” on the “latent demand market”.

He continued: “They want desperately to buy in and leverage the category of premium video, because they know it will help them to build credibility for their brand. But it is too difficult for them to do so.”

Similarly, agencies looking to spend on quick-turnaround ad campaigns for bigger brands are currently funnelled towards platforms that make it easy for them to do so, even if they know it may not be the most effective option.

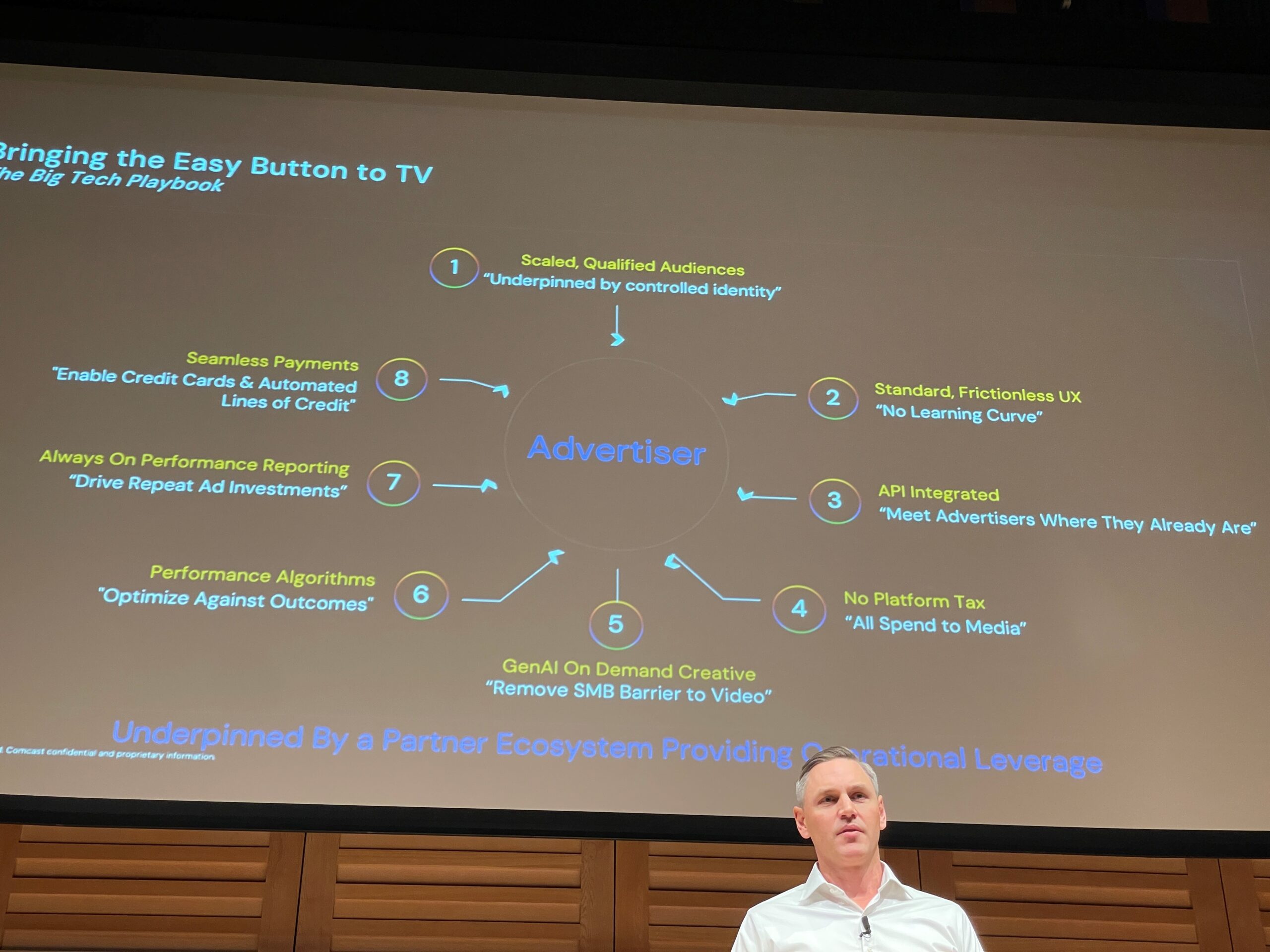

‘Bringing the easy button to TV’

Rooke argued that the TV ecosystem must take lessons from Big Tech’s drive to make it easy for brands to part with their marketing budget.

“There is a playbook and Big Tech has done an incredible job at simplifying the ability of merchants to be able to buy their inventory,” he explained. “And television has not done this and needs to do this.”

Rooke outlined eight “ingredients” to the playbook. They are:

1. Offer scaled, qualified audiences

2. Offer a standard, frictionless client user experience

3. Meet advertisers where they are through an API-integrated experience

4. Don’t have a “platform tax”

5. Use generative AI to help develop on-demand creative

6. Use performance algorithms that optimise against outcomes

7. Deliver always-on performance reporting

8. Offer seamless payments for clients through credit cards and automated lines of credit

“There has to be no learning curve,” Rooke added. “Because these small businesses haven’t got time to learn things and these small businesses have been conditioned over the past few years on what simple looks like.”

A unified go-to-market approach

Rooke warned that it is not enough to shift to a more simplified model as individual TV companies, but that an industry-wide effort is needed to offer a unified go-to-market approach that provides scale to compete with tech platforms.

That would require moving from a “publisher-centric approach” to an “advertiser-centric approach” by creating a consistent, single access point for small and medium-sized businesses to buy premium video, be it with a specific company or a specific audience.

“All of us, including Comcast, lack the necessary scale when you’re up against other categories,” he admitted. “You have to bring scale and it has to be standardised and unified.”

He added that creating simplified, always-on, full-funnel performance measurement will be key to increasing TV’s competitiveness in the ad market.

Currently, although efforts are made to accurately measure TV’s impact (including performance impact), “it’s too difficult to measure impact in a timely way”, according to Rooke — and the TV ecosystem needs to be able to not just prove its worth but do it at pace.

“It’s about speed, speed, speed — not just about proving that it works,” he said. “If it’s too slow, it doesn’t matter.”

Furthermore, to future-proof the TV business as watching live events and sport via streaming becomes more common and ads are increasingly served programmatically, Rooke warned that the media supply chain must become more efficient to avoid a “bigger and bigger downstream issue” where user experience is impacted.

He concluded that it is well within the TV industry’s capacity to create such changes and start better competing for ad budgets in what has become a tech-dominated industry.

“Advertisers want this. We have the technology to do it. We have great products. We just need to execute it now.”

Global ad industry to grow 9.5% this year as revenue flows to tech giants