‘Fit for TV’ YouTube channels drive higher ad attention than non-premium video

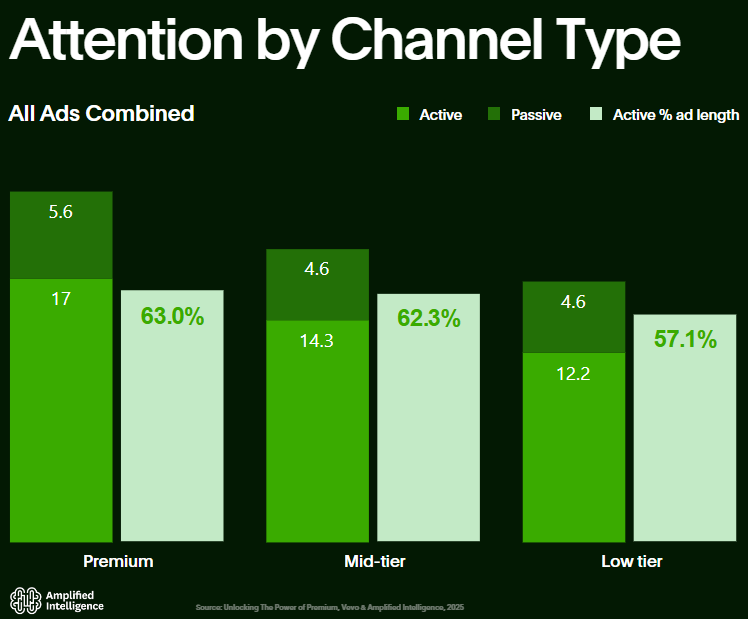

YouTube content that meets Barb’s “fit for TV” standard drives 40% more active attention on adjacent ads than less premium videos.

A new study, Unlocking the Power of Premium, conducted by attention measurement company Amplified Intelligence in partnership with Vevo, also found that “premium” content on YouTube better encourages group viewing.

The study examined three categories of content on YouTube. Apart from “fit for TV” channels, which meet requirements of having editorial input and oversight, complying with prevailing regulation and producing content that provides a safe and suitable environment for advertisers, researchers also considered two categories of “non-premium” channels.

“Mid-tier” channels have some editorial input and oversight, but do not comply with regulation or necessarily provide a safe environment for advertisers. “Low-tier” channels meet none of the standards associated with Barb’s guidance.

According to Amplified Intelligence’s prior benchmarking efforts, the average ad on YouTube receives 14 seconds of active attention. This jumps to 17 seconds for ads against premium content.

Premium videos are also more likely than non-premium videos to be viewed in a co-viewing environment, with 71% of households found to watch premium content with two or more people.

For Vevo specifically, research found the channel’s videos drove 38% more active attention than the benchmark among the core audience of 18- to 34-year-olds.

Bec Brooks, Amplified Intelligence’s head of customer success and operations, told The Media Leader that drivers for higher active attention on ads adjacent to premium content could include the mix of ad types selected (for example, she explained, premium channels favour non-skip, while lower-tier channels see higher volumes of skippable ads), the quality of advertiser and the content itself.

“There is a direct relationship between the attention paid to the content and the attention paid to the ad,” she noted.

Brooks added that premium channels also “tend to have a lower threshold of ads” and, by doing so, “the channel trains the user on what to expect”.

She continued: “Our working hypothesis is that, by having a lower number of high-quality, non-skippable ads, premium channels train their audience to be more tolerant and engaged with the content/ads, whereas low-tier channels with high volume of clutter, skippability and often lower-quality creative encourage avoidance.”

According to the study, there is also less “ad wastage” — the proportion of an ad that is not viewed at all, either actively or passively — on ads against premium content. Whereas 16% of the ad is not viewed against premium content, this rises to 22% against lower-tier content.

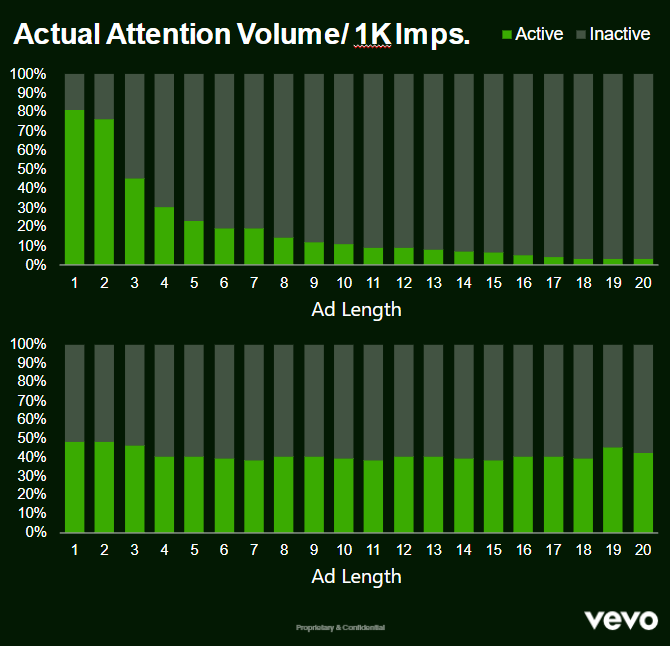

Attention also varied substantially depending on whether the ad was skippable.

For skippable ads (below, top chart), active attention was high for the first few seconds of the ad, but dropped off substantially over time as many users opted to skip it. By comparison, unskippable ads (below, bottom chart) received more consistent high active attention for a much longer duration.

“The prestigiousness and credibility and trustworthiness of the content — it transfers between platforms in association with the ads,” said Rich Brant, Vevo’s senior director of advanced TV, strategy and partnerships.

Brant suggested that the disparity in attention favouring premium videos could also be driven by the difference in intentionality when consumers seek out premium content on YouTube as opposed to “killing time” by watching lower-tier, user-generated videos. For the latter, Brant said it is not uncommon for users to have “something on in the background that [one] is sort of interested in, but not totally engaged with”.

Premium channels on YouTube, in that sense, is comparable to TV, Brant said: “It’s still being watched in the same way that TV is; it’s just the pipes are different. It’s getting to the screen in a different way, but it’s ultimately still as engaging — it’s still the same kind of content, it’s still high-quality.”

The findings would support arguments made by broadcasters that the quality of their content should be highly attractive to advertisers, regardless of whether it is accessed via YouTube or other streaming or social apps.

Channel 4 to relaunch streaming offering as it doubles down on digital strategy

Both Channel 4 and ITV have embraced YouTube by posting full episodes of programmes to the video-sharing service, with the goal of reaching incremental audiences. This has drawn concern from some analysts, who argue that giving away premium content for free could come back to bite broadcasters, as it once did for newspapers.

But Rak Patel, Channel 4’s new chief commercial officer, emphasised to The Media Leader last week that commercialising Channel 4’s content across platforms like YouTube and TikTok is key to the broadcaster’s Fast Forward strategy. He expressed confidence that advertisers will be willing to pay a premium to be placed against Channel 4 content regardless of where it lives.

“Trust is the critical thing — whether it’s YouTube, whether it’s TikTok or any other platform,” he said.

“What viewers will need is trust in order for them to take an action. Whether it’s on a big screen running through linear, whether it’s on social, that implicit trust is there,” he added, suggesting that as long as Channel 4 can get more eyeballs on its content, “the money looks after itself”.

Brant added that he believes “we do ultimately have to have a price premium” for the “prestigiousness, credibility, trustworthiness [and] transparency” of advertising against premium content on YouTube and that advertisers’ desire to sit against quality content they can trust is “only going to escalate” in the years ahead.

The study measured 150 households, who were sent a plug-in media hub and camera to track their attention to their active and passive attention to their TV and identify co-viewing. YouTube-on-TV content and ads were captured via respondent content logs that were sent to Amplified Intelligence on a weekly basis.

During the period of measurement, Amplified Intelligence collected over 19,000 ad views across more than 5,000 unique YouTube channels. More than 240 brands were represented in the study.

Unlocking the Power of Premium is the latest in a string of studies aimed at understanding the differentiation in ad effectiveness for consumers watching premium produced content on YouTube compared with less premium videos. A joint 2023 study by Vevo and Channel 4 found that ads are more effective when placed adjacent to fit-for-TV YouTube videos, but did not seek to address the link to attention.