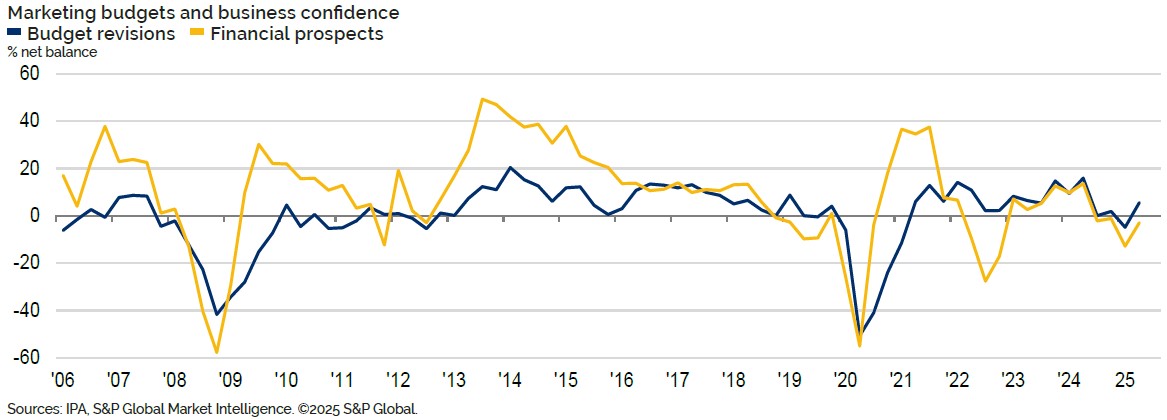

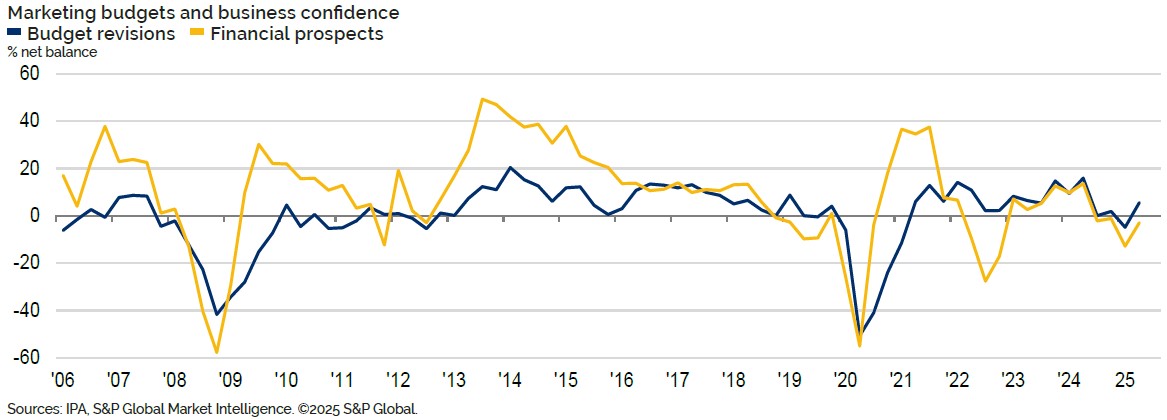

Total marketing budgets rebounded in Q2 after they were revised down for the first time in four years last quarter, according to the latest IPA Bellwether Report.

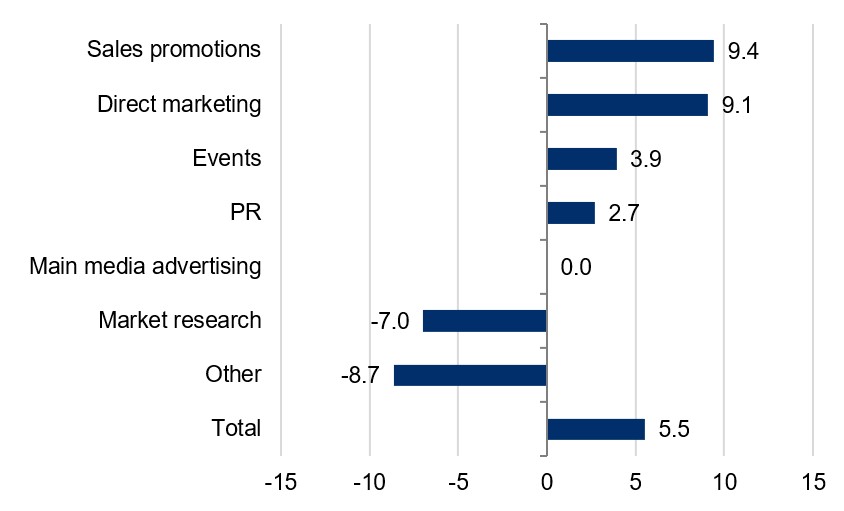

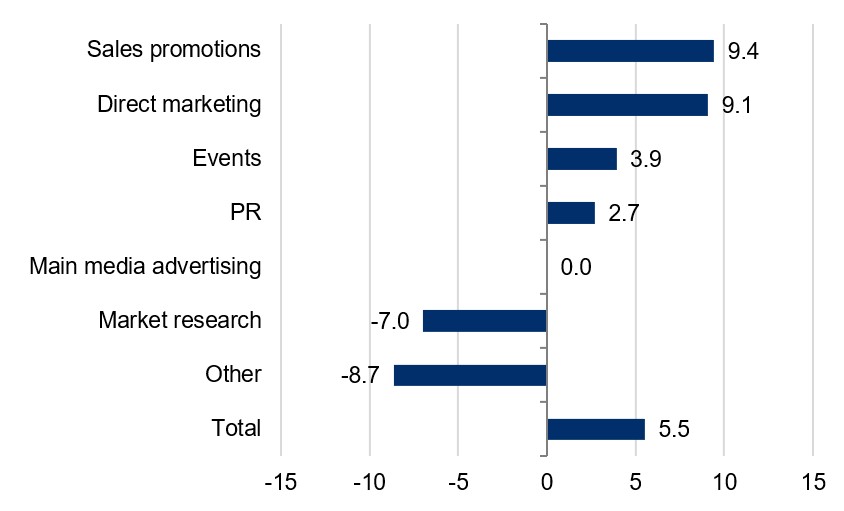

A net balance of +5.5% of businesses reported a rise in total marketing budgets — a substantial improvement from a net balance of -4.8% in Q1.

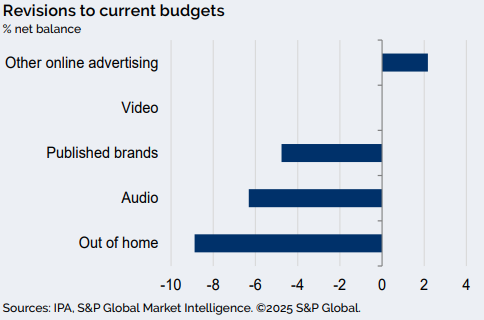

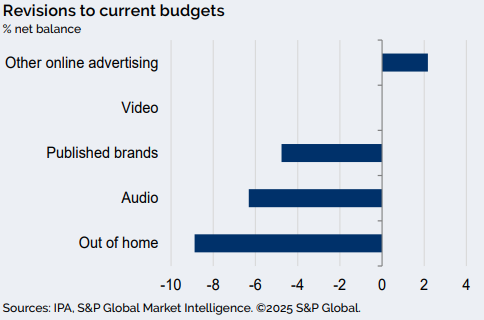

However, Bellwether found that main media budgets remained flat amid a period of extended macroeconomic uncertainty and a continued move to short-termist marketing strategies. This follows two previous quarters of contraction in main media spending.

The only main media sub-category that saw growth in Q2 was “other online”, with a net balance of +2.2% businesses increasing budgets. It is the third consecutive quarter that other online advertising was the only segment to register growth within main media.

All other sub-categories within main media remained in negative territory, albeit showing an improvement from Q1. OOH again saw the largest negative balance (-8.9%, from -18.9% in Q1), followed by audio (-6.3%, from -10.8% in Q1) and publishing (-4.8%, from -8.3% in Q1). Video remained flat.

Looking at the bigger picture, it would suggest total marketing budgets were driven by short-termist investments. Sales promotions and direct marketing showed the highest positive net balances (at 9.4% and 9.1% respectively), with events and PR also seeing upticks in budgeting.

The IPA pointed to several potential factors for the rise in overall marketing activity, including a recognised need for more direct audience targeting and many brands launching new products during the quarter.

IPA director-general Paul Bainsfair welcomed the broad-picture news that UK businesses have revised their marketing spend upwards, but warned the increase is “largely driven by tactical approaches” rather than long-term investments.

“While agility is crucial in today’s fast-paced market, it’s essential that short-term activation efforts are balanced with sustained investment in long-term, emotionally driven brand-building strategies,” he said. “By striking this balance, companies can position themselves not only for immediate success but also for enduring growth in an increasingly competitive landscape.”

Short-termism a ‘significant gamble’

The UK economy remained remarkably stable through a tumultuous first half of 2025, which has been marked by severe uncertainty around US president Donald Trump’s tariff policies.

S&P Global Market Intelligence upwardly revised its expected UK GDP growth from 0.6% in 2025 to 0.8% in response to a better-than-expected H1, but downgraded its adspend forecast from 1.3% to 0.7%.

“Uncertainties related to recent tariff changes from the US and ongoing geopolitical tensions in the Middle East are likely to dampen business and household sentiment,” Bellwether concluded.

UK media agencies have reported mixed levels of resiliency to the expected decline in business sentiment. While WPP released a trading update this month warning it had cut its guidance for 2025 amid “continued macro uncertainty weighing on client spend and weaker net new business”, Omnicom announced this week that it had achieved 3% year-on-year organic revenue growth in Q2.

On its earnings call, Omnicom chief financial officer Philip Angelastro said: “In an uncertain market, our performance through the first half was solid. As we begin the second half, less uncertainty in the macro environment may allow marketers to normalise spending levels. Although it is still too early to say that the uncertainty in the macro environment has been eliminated.”

Bellwether author and S&P Global Market Intelligence economist Maryam Baluch called Q2 “more upbeat”. Given the latest survey also found reduced pessimism over financial prospects at both company and industry levels, this suggests “businesses are becoming more acclimatised to the current market conditions”, she added.

Such macro factors have led to what Scotland IPA chair Jim Kelly referred to as a “fragile confidence”. In this context, “boosts in spending for any category need to be welcomed”, he said.

However, VCCP Media CEO James Shoreland told The Media Leader that the short-termist consensus amounts to “a significant gamble” for brands.

“According to our own research, less than 16% of advertisements are recalled and correctly attributed by the public. Pumping money into lower-attention channels risks being inefficient and adding to the noise that consumers are already adept at ignoring,” he said.

Phil Duffield, UK vice-president at The Trade Desk, agreed: “As marketing budgets rise, CMOs must take stock and resist the temptation of short-term wins at the expense of long-term brand growth. And the latter will come as a result of brands investing in high-impact premium environments where audiences are most engaged.”

Such environments, both suggested, include those presently under-invested in by Bellwether respondents, with Duffield noting that omnichannel campaigns are more effective than disconnected ones.

Indeed, Mike Follett, CEO and founder of Lumen, stressed: “Channels such as TV and DOOH are some of the best places to build brand recall and awareness.”

Meanwhile, noting the “improvement” in publishing, Ozone chief revenue officer Craig Tuck said this “offers a glimmer of hope for quality, trusted media”.

Shoreland added that brands should lean in to counter-cyclical investments in high-attention media environments.

“While competitors retreat from channels like OOH, which saw a net budget reduction of -8.9%, there is a rare chance to build a dominant brand presence,” he said.

“When consumer spending returns, it will be the brands that invested in being unmissable today that become unforgettable tomorrow.”

How to hack the attention economy — with VCCP Media’s Will Parrish

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.