Google introduces Confirming Gross Revenue 'transparency' layer to expose hidden fees

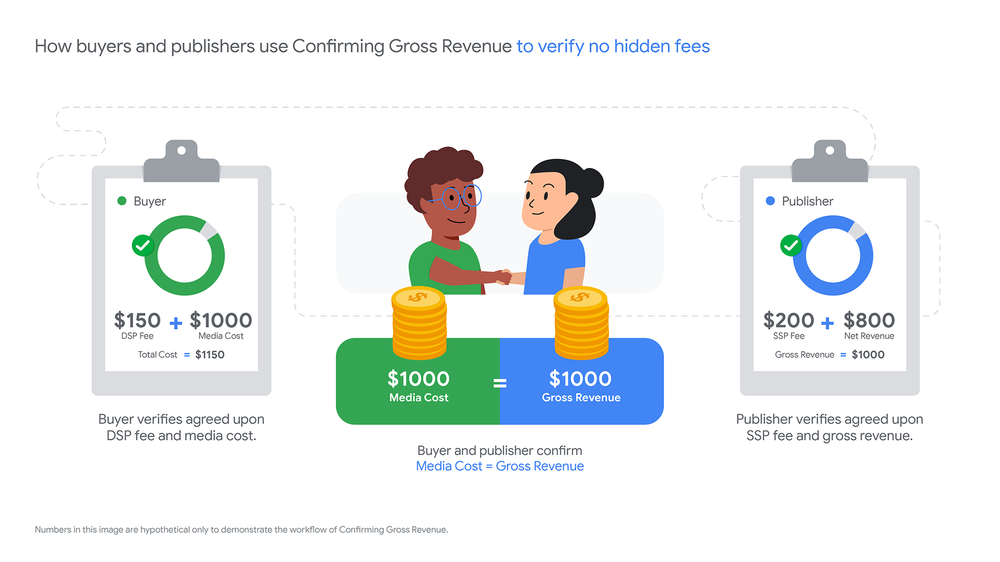

Google has announced Confirming Gross Revenue, a new solution within Google Ad Manager that “gives buyers and publishers a privacy-safe way to verify that no hidden fees are taken from digital advertising transactions”

Through Google’s solution, publishers can use a new Revenue Verification Report to see the aggregate gross revenue received from a specific buyer. The buyer and the publisher can then verify that the media cost from the buyer’s reporting matches the gross revenue received from the publisher.

The added layer of transparency is supposed to significantly reduce hidden fees and ensure that media buyers are getting what they expect to pay for in online advertising.

Image from Google

Google’s marketing platform Display & Video 360 (DV360) is already on board as an early tester as the feature continues to be built out.

Independent ad fraud researcher Dr Augustine Fou praised the development by Google, calling it “super good” in an email to The Media Leader.

“I am sure that agencies and other ad exchanges will hate it… because they thrive on hidden markups. By using DV360 and eliminating all the other supply paths, a buyer can see how much of their dollar actually goes to the publisher to show ads (i.e. working media).”

Nevertheless Fou said he still needs to “see this in action to confirm they are delivering what they promised”, but he called it “one of the most awesome things to come along”.

Google currently operates as both a seller and a buyer of digital media as well as the owner of the DV360 marketing platform, which has prompted criticism. David Dinielli, a senior advisor at investment firm Omidyar Network, testified to the Subcommittee on Antitrust, Competition Policy, and Consumer Rights of the US Senate Judiciary Committee that Google had “illegally monopolized, or illegally obtained a monopoly in, the market for digital advertising” through “a multitude of anti-competitive acts”.

Confirming Gross Revenue appears to be a bid to inspire shaken confidence in digital advertising, after recent reports of leakage in the supply chain and ad fraud.

A 2020 PWC study commissioned by ISBA, the UK’s largest advertising trade body, found that just 12% of ad impressions could be “matched” and that 15% of adspend—around one-third of supply chain costs—is “unattributable”.

A bipartisan bill introduced by the Senate in May seeks to break up Google’s advertising business.