Havas Group reports 'very good momentum' with 11.5% organic growth

Havas Group reported “very good momentum” for parent company Vivendi in Q2, with net revenues of €642m, representing 11.5% year-on-year organic growth.

Organic growth was slower than in the same period last year (+15.8%) after Havas began recovering from pandemic declines (Havas Group organic growth declined in Q4 2020 by 7.5%).

However, growth was well above pre-pandemic levels, when Havas saw a 1% decline in organic growth during between FY 2018 and FY 2019.

The performance is on the higher end of competitor media companies’ Q2 reports: Publicis Groupe reported 10.3% organic growth (also a decline from 17.1% organic growth in Q2 2021); Omnicom Group reported 11.3% organic growth; IPG reported 7.9% organic growth.

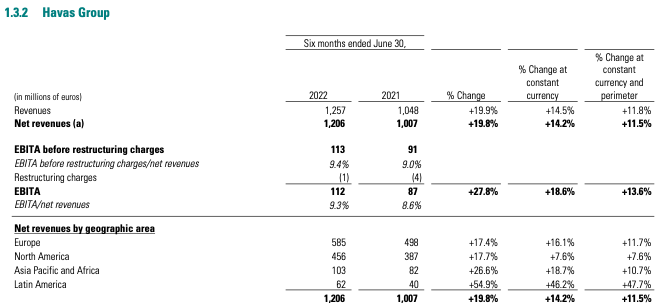

For the first half of the year, Havas Group’s revenues reached €1.26bn, up 19.9% year-over-year (net revenues of €1.21bn, up 19.8% year-over-year).

Vivendi attributed the “excellent half-year operating performance” to robust commercial momentum built over recent quarters in the Creative, Media, and Health & Wellness divisions.

Havas Media highlighted its key account wins that helped to drive growth in the first half of the year, including Matalan (UK), Klarna (US), and Boehringer Ingelheim (US), among others.

Ebita, the company’s measure of profit, was €112m, a 27.8% year-over-year increase from €87m despite a “significant” increase in personnel costs in H1, thanks to solid organic growth and the company’s cost adjustment plan.

Havas reported growth across all major regions during H1 2022: Europe (+11.7%), North America (+7.6%), Asia Pacific (+10.7%), and a strong post-pandemic recovery in Latin America (+47.7%).

Acquisitions made a significant contribution to growth in Havas during H1; Havas’s net growth amounted to 21.3%. Global acquisitions included Tinkle (Spain and Portugal), Inviqa (UK and Germany), Search Laboratory (UK and US), Frontier Australia (Australia), and Front Networks (China).