IPA Bellwether: Media budgets to expand despite total marketing ‘on ice’

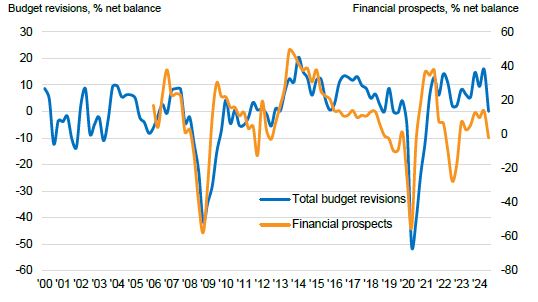

Total marketing budgets stalled ahead of the UK government’s autumn Budget announcement, failing to grow for the first time in 14 quarters.

That is according to the latest IPA Bellwether report, which found that total marketing budgets were “put on ice” in the third quarter.

Whereas a net balance of +15.9% of budgets were revised upward in Q2, a net balance of 0% of budgets were revised upward in Q3; in other words, as many IPA survey respondents said they had revised their marketing budget upward (21.6%) as those that implemented cuts.

Despite this, main media budgets expanded at the fastest rate in a year (+4.3% net balance), driven entirely by increases in budgets for video campaigns.

Bellwether also found net increases in companies budgeting for expenditure in PR (+11%), events (+9.9%), direct marketing (+9.9%), and sales promotions (+3.2%). The IPA also upwardly revised its adspend predictions for the rest of the year (+0.6%).

Lucy Bristowe, CEO, UK & Western Europe at Kantar Media, said: “It’s been a year of cautious optimism for consumer sentiment and these figures put the emphasis back on ‘caution’ for UK marketers as we come to the end of 2024.

“Advertisers might not be slashing budgets, but they are holding tight for more certainty – and that’s no surprise with the Autumn Statement and a US election on the horizon.

“Although many consumers are still feeling the pinch, brands know they cannot stand still or risk getting left behind.”

However, IPA director-general Paul Bainsfair said advertisers are “pressing pause until they know more about the Government’s economic plans.” He explained that “negative hype surrounding the impending Budget has no doubt created choppy waters for UK companies and their marketers to navigate”.

Bainsfair added: “[O]ur adspend forecast has been revised up for 2024 and 2025 because the economic data has been so strong so far this year, and that main media growth strengthened to a one-year high while sales promotion budget growth slowed — both of which are signals of bullishness.”

Fiscal uncertainty, monetary optimism

The Labour government will release its autumn Budget on 30 October. Reports this week described that Chancellor Rachel Reeves is pursuing a mix of tax rises and public spending cuts to the value of £40bn in order to avoid real-terms cuts to government departments.

Rik Moore, managing partner, strategy, at independent media agency The Kite Factory, warned that the “gloom” around the economy “is permeating into our industry”.

“The public and our clients are clearly unnerved by the prevailing narrative around the economy,” he told The Media Leader. “The budget on 30 October will either validate and exacerbate that negative view, or potentially provide some relief and buoyancy — and it is anyone’s guess which way it will go.”

Apart from uncertainty around the UK government’s fiscal policy direction, Bellwether also revealed “another layer of instability” causing companies to adopt a “wait-and-see approach” to budgeting: the US presidential election.

“The potential shift in leadership could see changes in foreign policy, trade agreements, and economic strategies, all of which are critical for businesses operating on a global scale,” the report notes.

Likewise, ongoing wars between Russia and Ukraine, and Israel, Hamas and Hezbollah risk “intensification” that could lead to disruption in the global economy.

Domestically, however, the recent easing of interest rates and a drop in inflation to 1.7% in September were cited as reasons for revived business confidence.

“A stuttering economy seems to be one of the only constants of the last 10+ years — and the one lesson from the last few years is that everyone everywhere feels like they have less money,” Adam Foley, CEO of independent media agency Bountiful Cow, told The Media Leader.

“Although inflation is starting to fall, a gear-changing budget has the potential to derail confidence in the market — and that means brands will focus on tried-and-tested patterns of investment. In that context, it’s no surprise that marketers are leaning harder than ever on video.”

Video remains strong. Other media, not so much

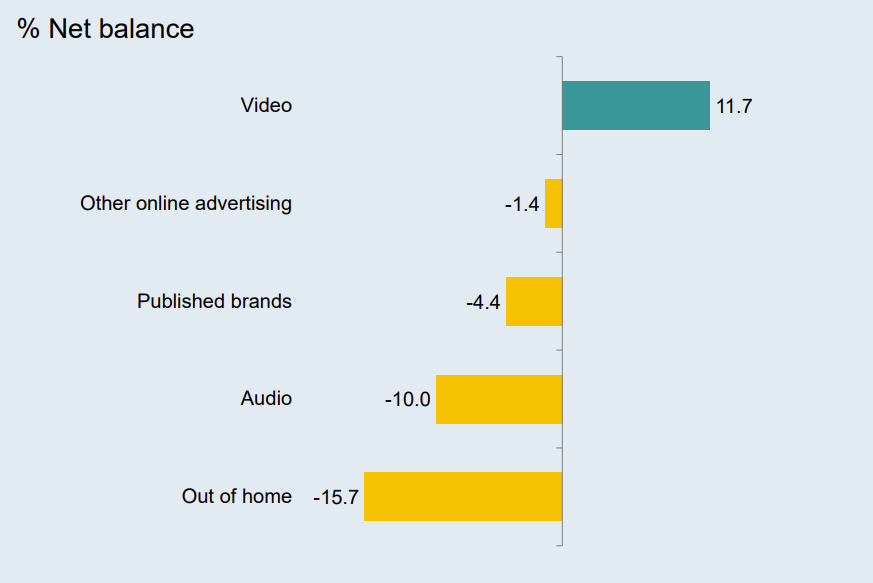

Main media budget growth was indeed notably confined to video marketing in Q3.

A “strongly positive” net balance of +11.7% of surveyed firms recorded higher spending on video-relate marketing activities, up from +7.8% in Q2.

The strong performance of video more than offset contractions in investment in other main media channels.

Out-of-home (OOH) was the worst-performing media channel — with a net balance of -15.7% of firms reporting they would increase investment in Q3. It is the sharpest downgrade to OOH budgets since Q2 2022.

Audio also continued its negative trend, with expenditure being slashed for the sixth consecutive quarter (net balance: -10%). Published brands, while still seeing a net decline in investment (-4.4%), ticked up slightly from Q2 (-6.3%).

Of note, however, is other online advertising registering a downard budget revision for the first time in four years (-1.4%, from 15.3% in Q2).

Moore told The Media Leader that regardless of the uncertainty around the broader British economy, he believes “we’re seeing trends in channel investment that we would have seen anyway, even if the overall mood was more positive.

“I think we would have seen that increase in video campaigns, alongside the increase in PR and events,” he said. “The reason for this is marketers are thinking about all touch points available to us, trying to create audience interactions that harness earned media and then fanning the flames in paid, with video becoming a very efficient and targeted way of doing that.”

Foley added that Amazon Prime Video, which launched its default ad tier in January, is a “particular game changer”, but noted that “as advertisers stampede towards VOD [video-on-demand], that creates relative advantage for brands willing to explore media channels where there might be a greater share of voice opportunity”.