ITV: advertisers in wait-and-see mode after TV market’s gloomy start to 2022

The UK TV advertising market is being held back as advertisers wait for more positive economic news, ITV’s CEO indicated today amid a gloomy outlook for spot advertising this year despite robust growth in digital and content production.

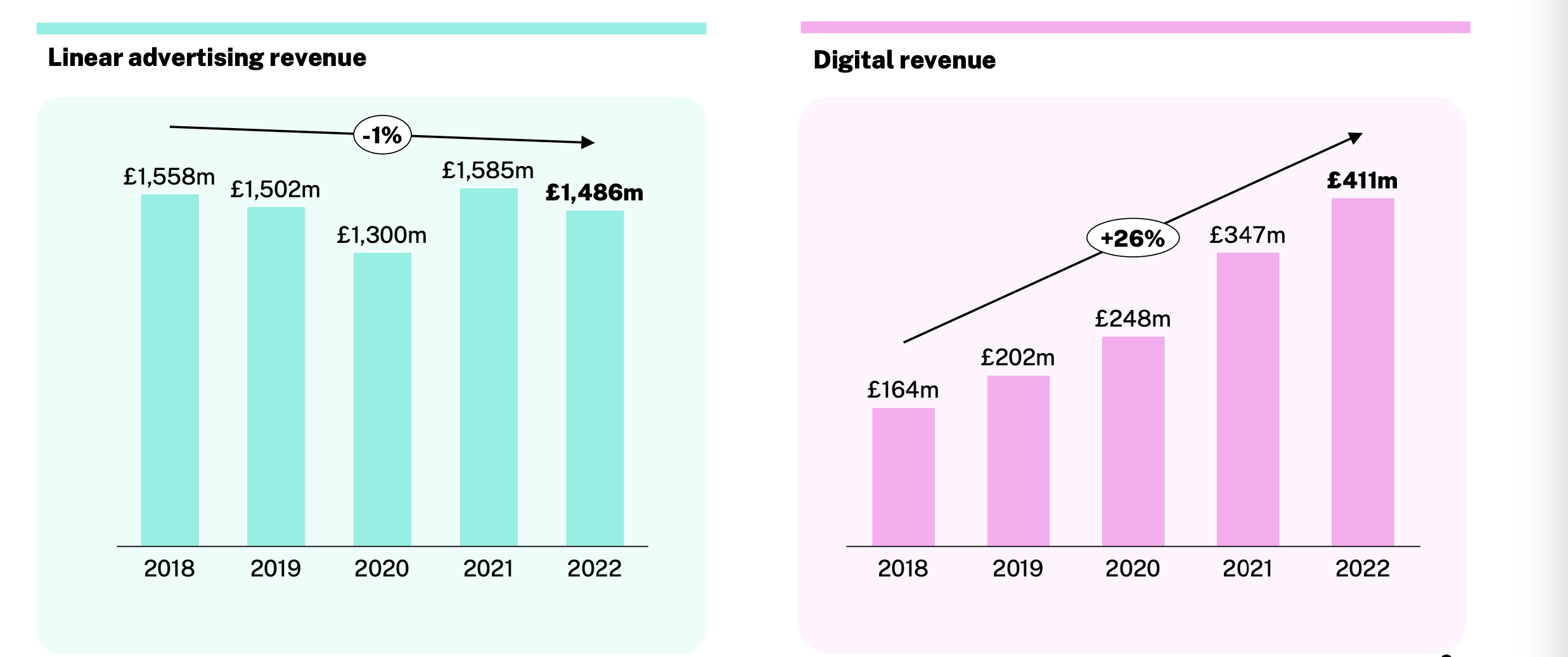

Only a third of ITV’s revenue now comes from traditional spot advertising, Carolyn McCall said today as the UK’s biggest commercial broadcaster revealed annual earnings for 2022.

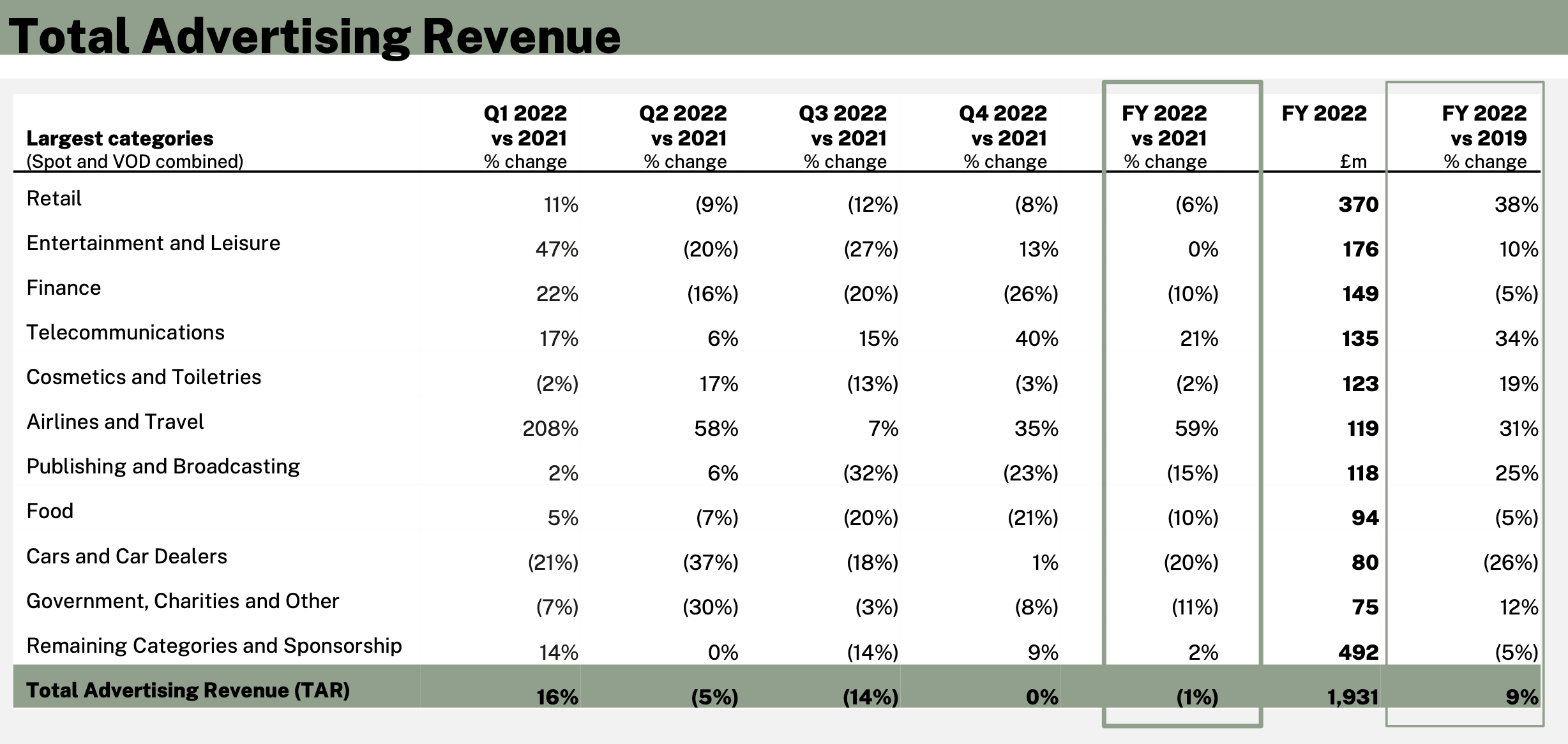

ITV forecasts double-digit ad revenue declines for March (down 16%) and April between 11%-15%). This comes after a 1% growth in total advertising revenue (TAR) to £1.93bn in 2022, up 1% year on year.

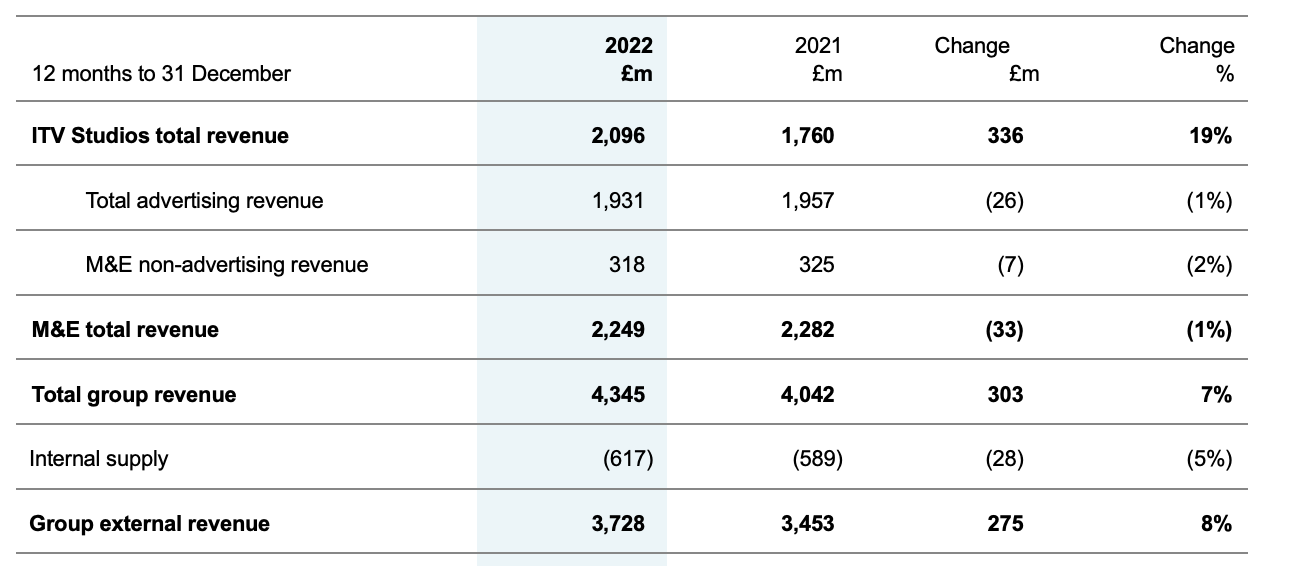

However, TAR has fallen below income generated by ITV Studios, which grew 19% to £2.10bn last year, ITV reported in its annual financial earnings statement today. McCall was particularly pleased with the performance of the Studios division in the US and reiterated that ITV has no plans to sell it off despite market speculation in recent months.

Referring to a “challenging macroeconomic environnment”, TAR is forecast to be down 11% for the first quarter of 2023, or 1% compared to the same period in 2019 (before the Covid-19 pandemic).

The company’s total revenue, meanwhile, was up 8% in 2022 to £3.73bn.

“The conversations we’re having with advertisers at the moment are many of them are protecting profits by being very tight on all their costs until they see more clearly how this year is going to pan out.” McCall said. “However, they also talk to us about the improving macroeconomic indicators that have been emerging most recently. And there’s a growing business optimism.

“Historically ITV has been a business dependent on linear advertising and therefore exposed to the cyclicality of that advertising sector. Our strategy over the last four-and-a-half years has focused on significantly mitigating this. We are now much less dependent on linear advertising revenue, with 66% of our revenues coming from non-spot advertising. By 2026, over two-thirds of our revenue will be digital or from Studios.”

Travel advertisers are “buoyed up” at present, McCall said, as consumer demand for travel is continuing into this year after bouncing back in 2023, while there is also optimism around car advertising after an “end of the supply chain issues that have plagued them,” she told a press conference this morning.

This reflects what ITV reported when breaking down TAR by sector. Airlines and travel spend was up 59%, led by a marked recovery in the first half of 2022, but every other category was either flat or significantly down year on year. ITV’s biggest client sector, retail, was down 6% last year to £370m (19% of the broadcaster’s client base for spot and video-on-demand advertising).

Linear declines mitigated by ITVX revenue surge

Advertisers decided to draw down TV advertising budgets in “Q3 and Q4” last year, McCall explained, in response to “very very negative” news at the time about an impending recession in the UK. However, this environment has “benefited” streaming service ITVX, which has replaced ITV Hub and seen revenues for digital advertising go up by 25%, she added.

“It’s exceeded where we thought it would have been,“ McCall added, referring to digital ad revenue.

Digital revenue, overall, grew by 18% to £411m in 2022. ITV has now set a target for this number to become £750m by 2026 and McCall insisted this “is a floor, not a ceiling”.

While most advertisers think the second half of 2023 will be more positive than the first half, McCall said, revenue performance will be compared the same period in 2022 which was boosted by coverage of the football World Cup.

In the second half of this year, ITV is exclusively hosting the Rugby World Cup and is set to bring back reality show Big Brother and another series of ratings mainstay I’m a Celebrity… Get Me Out of Here!

Studios ‘not for sale’

McCall also repeated an “explicit” commitment that ITV Studios, its production and distribution business, is not for sale, as has been speculated in press reports since the end of last year.

“We believe in vertical integration, i.e. what we call the integrated producer and now streamer model. There are very attractive economics around that for both the media and entertainment division, but also to the studios division, you know, things like cross promotion, basic, solid commissions. There’s just a whole range of very attractive benefits there. And so, you know, we’ve also said that we won’t do anything short term on studios, it’s very much a long term game… Our strategy is to expand studios, and to continue to grow it.”