Magna revises adspend forecast downwards

Interpublic investment arm Magna has revised its 2025 Global Ad Forecast downwards, joining WPP Media in signalling a worse-than-anticipated slowdown in the global ad market this year amid macroeconomic uncertainty.

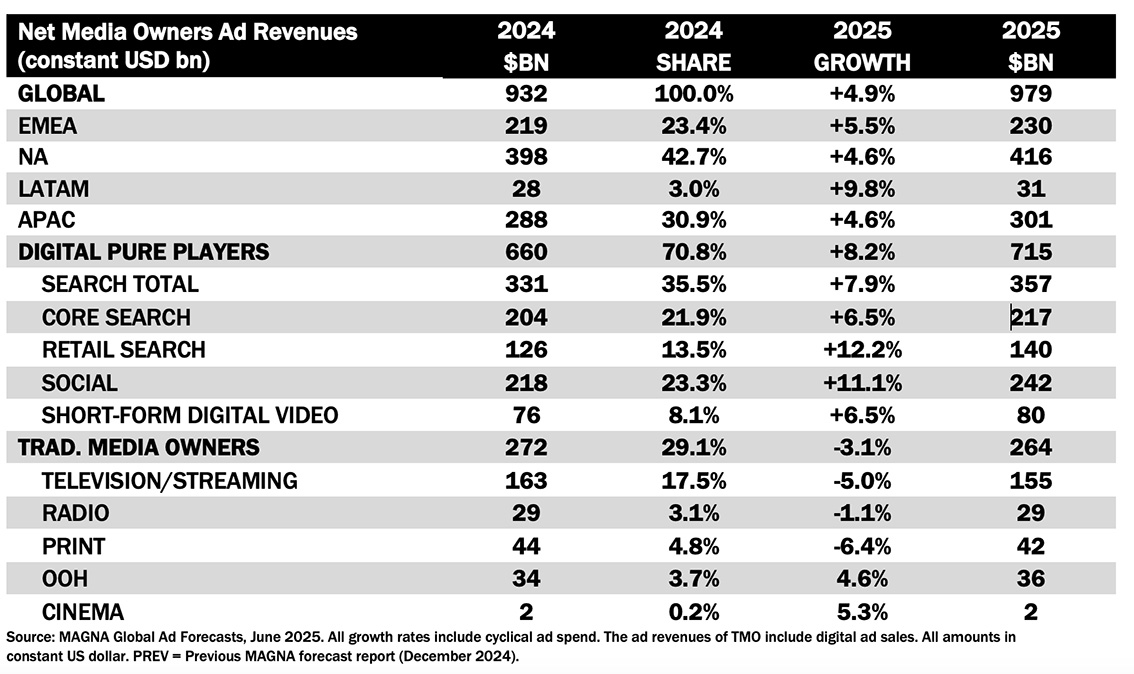

Magna now expects global ad revenue to grow 4.9% to reach $979bn this year, after previously forecasting 6.1% growth to $990bn.

It similarly downgraded the UK’s forecast growth to 6% from 8.4%, citing “economic uncertainty and softer advertiser sentiment”.

In addition, Magna warned that incoming advertising restrictions on less healthy foods “may reduce TV and digital spend” from 2026, particularly for food and quick-service restaurant brands.

In most markets, total ad growth is now expected to range from low single digits (Germany +3%; Japan +4%) to mid-high single digits (Canada, Australia, France +5%; Italy, Spain, UK +6%; India +8%).

“Trade-intensive markets” like Japan, Germany, China and the US “may suffer” depending on the ultimate severity of US president Donald Trump’s tariff efforts.

“Magna had long anticipated a slowdown in the global advertising market in 2025 following an exceptionally strong 2024,” noted Vincent Létang, Magna’s executive vice-president of global market research and author of the report.

“However, the deterioration in the economic outlook and a decline in business confidence since our December update have prompted us to revise our full-year 2025 growth forecast downward by 1.2 percentage points.”

Létang indicated that the slowdown has thus far been “relatively modest”, with digital media in particular performing better than expected in Q1.

“Magna believes that the marketing industry has learned important lessons from the Covid period — recognising the value of maintaining consistent communication and adopting balanced media strategies, especially during times of consumer uncertainty.”

Expected ‘erosion’ for ‘traditional’ media owners

While Magna is still forecasting overall growth, it is likely to be unevenly felt.

Digital pure players are expected to boost revenue by 8% to $715bn to comprise 73% of the total global ad market, with much of the anticipated growth driven by AI innovation, ecommerce and retail media (which alone is expected to generate $163bn).

On the other hand, traditional media owners — including TV, radio, publishing and OOH — combined are expected to see a 3% decline to $264bn. Revenue would be flat year on year, however, when adjusting for the lack of US elections and Olympic Games compared with last year.

Re-acceleration anticipated in 2026

Despite the downgrade, Magna still currently expects stronger growth in 2026.

Currently, the group is assuming the economy “stabilises” by next year, although uncertainty over Trump’s tariffs has thus far shown no sign of abating.

However, 2026 will bring larger cultural moments for advertisers to take advantage of, thus potentially spurring growth. These include the 2026 Winter Olympics in Milan and Cortina d’Ampezzo, the Fifa World Cup in the US, Mexico and Canada, and US midterm elections.

Magna is projecting global ad sales to rise 6.3% next year to surpass $1tn for the first time. By contrast, WPP Media had estimated global spend to have exceeded $1tn in 2024.

News, analysis, comment and community — Join The Media Leader