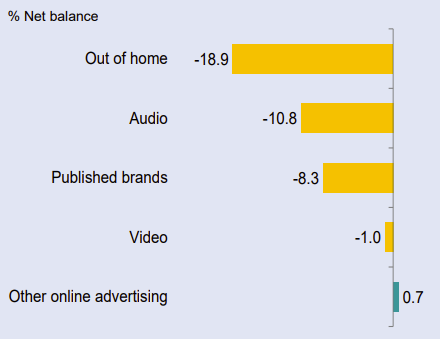

A net -6.7% of businesses surveyed by the IPA reduced their main media marketing spend in Q1, as companies adopted a cautious, short-termist approach amid uncertainty brought on by US president Donald Trump’s tariff fiasco.

It is the second straight quarter of contraction in main media spending, following a net -4.3% of companies reducing their budgets in Q4 2024.

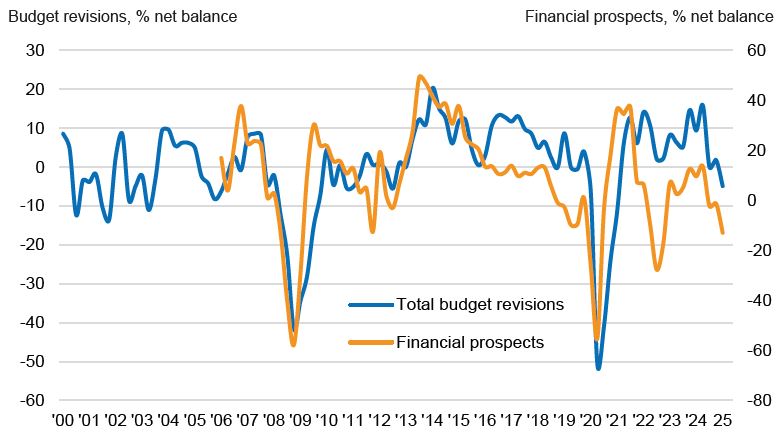

Notably, the latest Bellwether Report also indicated that total marketing budgets were revised down across the UK for the first time in four years. A net balance of -4.8% of businesses said they cut their overall marketing budgets in Q1.

The net balance is the percentage of companies reporting an upward revision to current budgets minus the percentage reporting a downward revision.

‘Wait and see’ approach

The survey was conducted before Trump’s wide-reaching tariff announcements (dubbed “liberation day” by the administration) on 2 April.

While the UK was levied a 10% tariff on all imports, higher tariffs were announced for others, including the EU (20%), Vietnam (46%) and China (eventually increased to 145%). Although Trump later “paused” some of the tariffs for 90 days, this did not apply to China and a blanket 10% tariff remains on countries for which tariffs had already been announced.

The resultant economic uncertainty has shaken confidence in the US and global financial markets. Broad US indexes such as the S&P 500 and tech-heavy Nasdaq are both down year to date (by 9% and 14% respectively), while US treasury bonds — normally a safe haven during economic turmoil — have also fallen sharply, putting at risk the dollar’s status as a global reserve currency. On the other hand, the UK’s FTSE 100 is flat year to date.

IPA director-general Paul Bainsfair directly attributed the decline in marketing budgets to the Trump administration’s fiscal policy, as well as adjustments that businesses have needed to make following Labour’s autumn budget.

“In the face of president Trump frequently overturning political and economic norms, it’s understandable that more UK businesses have adopted a cautious, ‘wait and see’ approach to marketing spend this quarter,” he said.

“Even before the introduction of US tariffs on 2 April (thankfully now paused), the anticipation alone — combined with rising costs from National Insurance increases and minimum wage hikes — was already influencing budget decisions.”

‘Agencies may get squeezed everywhere’: US tariffs cause ad industry angst

According to Bainsfair, business uncertainty has led to a “familiar” short-termist pattern, with increased investment in sales promotions and cuts to main media budgets.

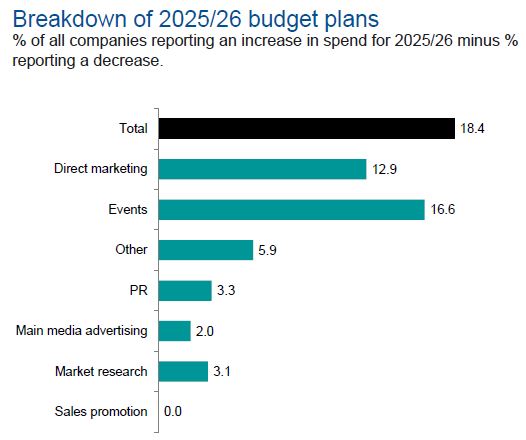

Indeed, a net +9.0% of companies upwardly revised their digital marketing efforts, with similarly positive net revisions for sales promotions (+8.0%), events (+5.4%) and PR (+3.4%).

“While these adjustments may offer immediate relief, they are not a sustainable path to long-term brand growth,” he warned.

Short-term weakness?

Importantly, the decline in business confidence appears to be limited to the short term, at least based on the pre-tariff survey.

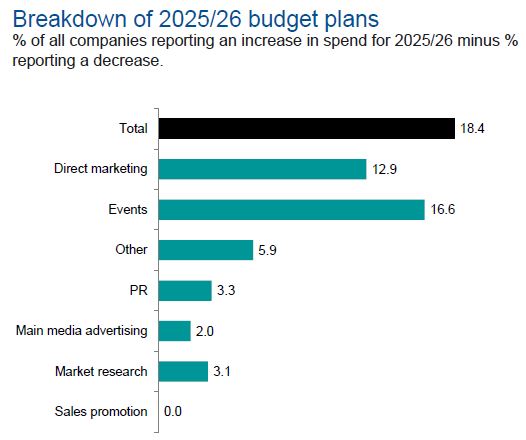

Bellwether companies still indicated positive forecasts for the 2025/26 financial period, with a net +18.4% of businesses signalling that they expect to increase their marketing budgets over the longer term, including a net +2.0% saying they expect to increase main media budgets.

For media agencies, the inconstancy of Trump’s tariff policy could spell hard times if brands pause or make cuts to marketing budgets through the rest of the year. Amid its Q1 earnings report this week, Publicis Groupe CEO Arthur Sadoun warned that advertisers have cut back on large capital expenditure projects and, although clients retained marketing investment in Q1, Publicis “could see some budget reduction across some industries through the rest of the year because of the level of uncertainty”.

The holding group disclosed 4.9% organic growth in the quarter, with a “record new-business run” offsetting “deteriorating macroeconomic conditions”. Publicis still expects to achieve organic growth of 4-5% in fiscal year 2025.

On the other hand, Omnicom, which also reported Q1 earnings this week, softened its full-year guidance. Citing the “uncertainty of the current environment”, CEO John Wren announced the group now expects organic growth of 2.5-4.5%, compared with 3.5-4.5% previously.

“We are being conservative in lowering the bottom end,” Wren said on the earnings call, adding: “We’re striving to get to the top end, always. And we’re still — there is still confusion in the marketplace, especially in the next 90 days, in how some of these tariffs and other moves get negotiated or do they stay in place.”

Traditional channels hit hardest

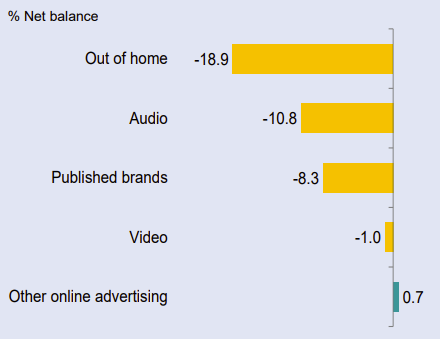

Declines in main media budgets were widespread across the segment in Q1. OOH (-18.9%), audio (-10.8%), publishers (-8.3%) and video (-1.0%) all recorded contractions for the second consecutive quarter.

The only segment to see a net upward revision was Bellwether’s “other online” category, which includes display and social platforms (+0.7%).

That said, the falls in traditional media channels are part of a larger trend. This week, a report from Warc found that just half (51%) of global adspend now goes to professionally produced content — down from 79% six years ago — as brands have embraced advertising against user-generated content.

Reduced budgets have been felt particularly by publishers, with global adspend with news brands notably falling by 33.1% over the same period.

Niamh Burns, senior research analyst at Enders Analysis, told The Media Leader that the latest Bellwether’s main media splits “encapsulate the theme that has characterised the last decade: online is growing (though modestly here) while everyone else is under pressure”.

She added: “This is a well-worn path for business as budgets are squeezed: a flight to direct-response channels, which offer more certainty in the short term.”

Rik Moore, managing partner of strategy at The Kite Factory, agreed that the latest figures are “to be expected”.

“We are in a period of caution,” he told The Media Leader. “Given what we saw here in the UK at October’s budget, and the subsequent spring statement, there has been cautious nervousness around household finances for consumers and things like the impact of employer National Insurance contributions for businesses. It’s reflected in the stable but subdued consumer confidence scores we’ve seen.

“The point of concern is that the survey work for this Bellwether report was in field before Trump’s recent tariff announcements. You would expect this latest dramatic turn in events to shake this already fragile situation and potentially lead to further downward revisions.”

Comparing the current period to the challenges experienced during the Covid-19 pandemic, Moore added that most brands will be forced to ask themselves difficult questions about marketing strategy this year.

“What do you need to do to keep the light bulbs on in the short term and, if you can afford the time and budget, how do you plan and prepare now to maximise your position as the economic situation improves?”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.