Media Nations: YouTube influence on the big screen grows — will TV ad budgets follow?

Analysis

“TVs are rapidly growing in importance for YouTube, accounting for 34% of YouTube’s viewing inside UK homes in 2023, up from 29% the previous year.”

That’s one of the key takeaways from Ofcom’s 2024 Media Nations report, the UK media regulator’s annual overview of audience trends for broadcast media. The report collates data from 2023.

Broadcast (known as “linear”) TV continued its long-term decline in 2023, Ofcom said, with declines seen across most age groups. However, the rates of decline have slowed down for every age group due to the “lockdown effect” appearing to wear off. Among Gen Z (16-24s), there was a much steeper decline for linear in 2022 (down 26%) than last year (down 16%).

In general, older age groups tend to be most loyal to broadcast TV viewing, with 16-24s watching 33 minutes on average last year.

This on its own should not be surprising, as innovation has created a wealth of new TV and video providers, most of which are also available on an internet-connected TV as well as smartphones and tablets.

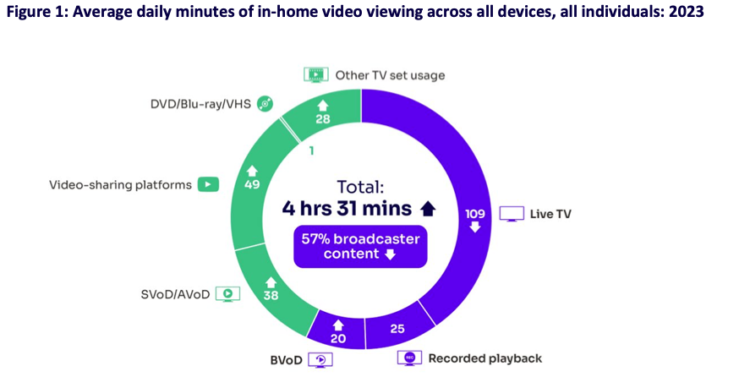

Indeed, the report confirms that video viewing overall is up. On average, individuals (aged four and above), spent four hours and 31 minutes per day watching video content at home last year, which is a six-minute (or 2%) increase.

Spend is also following audiences online.

The latest Advertising Association/Warc data, published last week, cited broadcasters VOD (BVOD) as being about to cross the £1bn threshold for the first time (up 14% year on year), with sport being a big driver as audiences watch Euro 2024 on mobile devices while not at home or second-screening during games.

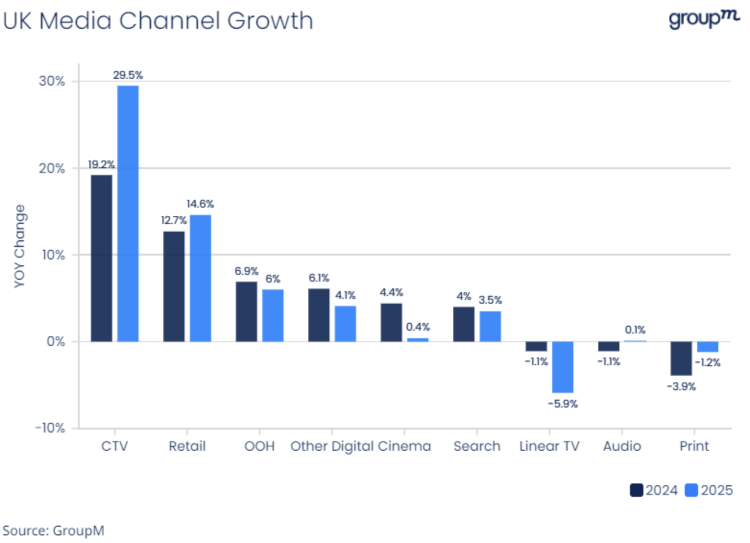

GroupM figures in June for 2024, lumping YouTube with BVOD as “connected TV”, suggest the channel will grow by 19% this year and a further 30% in 2025. Linear spend, meanwhile, will fall by 1% in 2024 and another 6% next year.

What are people watching and how are they watching it?

Which brings us back to YouTube and how, according to Barb data, more than a third of YouTube’s viewing comes from inside UK homes.

Video-sharing platforms, of which YouTube is by far the largest, accounted for just under a fifth (18%) of video content watched across all devices at home last year.

What’s not in the data is important to consider too. Any public-transport commuter will now see a familiar sight on trains, buses and trams: a packed carriage of people staring at their phones. Many of us are downloading or streaming content on our phones from VOD providers and YouTube, but this audience is not counted by Media Nations.

In the small print, Ofcom’s report clearly states that video-watching data is taken from Barb, whose Kantar measurement systems count only what is streamed on home Wi-Fi.

Liberty Global board member Andrew Cole’s proposal to create an alternative measurement platform is a reminder that streaming on the go is not being measured. This may disproportionally impact YouTube as opposed to Netflix, because people are perhaps more likely to stream a five-minute user-generated video rather than an hour-long episode of Bridgerton.

All of this would appear to strengthen YouTube’s case for being considered as a serious rival to UK broadcasters, despite the latter remaining dominant (57% of in-home video viewing is live TV, recorded playback or BVOD, such as ITVX or BBC iPlayer).

Ofcom focus on broadcast decline ‘disappointing’

And when it comes to commercial video viewing, the sector’s marketing body, Thinkbox, points out that total viewing declined by just 2% last year — the smallest fall since 2016 (not including the pandemic).

Matt Hill, research director at Thinkbox, said it was “disappointing” that Ofcom chooses to focus so heavily on live TV every year in its report. “Live TV remains vital, but it’s only one side of TV,” he said. “On-demand is where TV is rapidly growing — which is why every TV company has been devoting so much energy and investment in developing on-demand services.”

On the rise of YouTube, Hill told The Media Leader: “YouTube is increasingly playing a role in driving incremental TV-set reach, especially for younger audiences. But it’s worth bearing in mind that YouTube only accounts for 7% of TV-set viewing time amongst 16-34s.

“And whilst there is TV-quality content on YouTube, advertisers need to assess what is and isn’t the right content environment for their brand and the difference in the implicit signals delivered by advertising within video-sharing platforms versus professionally produced, regulated environments.”

Among all adults 16-plus, TV content accounts for 95% of all TV-set viewing. The UK broadcasters account for 80%; YouTube accounts for 5%.

But the size of YouTube as a video platform on the TV set is not just about the online video giant disrupting the status quo and eating into broadcasters’ market share.

Behaviour matters too.

“Consumers don’t see this like we do,” warns Kate Brinkley, head of digital planning at independent media agency The Specialist Works. “As an industry, we have defined linear TV in a way that make the likes of BVOD, SVOD and YouTube ‘different’… [Consumers] choose the content they want to consume and will navigate around platforms to get to it.

“Therefore, YouTube is of course a challenger to linear, as it’s another place consumers can and are choosing to watch TV — more and more often, if you read some of their reports on consumption. Add its ability to target audiences and content without seeing the huge rise in CPM you’d get if you attempted to replicate that in a linear or BVOD space, you can see the appeal. It does lean in to individual viewing versus broadcast moments, though, so you lose that stature and conversation that is sparked from appearing in big linear spots.“

Effectiveness killers = skipping and muting

Effectiveness of ads, according to how the platform encourages audiences to consumer them, is also important.

In an otherwise overwhelmingly staunch defence of TV at The Media Leader’s Future of TV Advertising Global conference in December 2023, effectiveness expert Peter Field cited System1 statistics that show meaningful attention only exists once a video ad has been watched for two-and-a-half seconds — something that both TV ads and unskippable YouTube spots can easily manage.

Sound is also important, according to Dr Grace Kite, founder of consultancy Magic Numbers. She told The Media Leader Podcast this week: “One of the really key things is default sound on, [like] YouTube where default sound is on outperforming something like Meta [owner of Facebook and Instagram], where the default sound is off for video.

“So there’s quite a stark difference [and] there’s only so much you can do with a default sound off when someone’s kind of thumbing through their feed rather quickly.”

Regulation is another important area where comparing YouTube with other VOD platforms like Netflix and Disney+ — let alone UK public-service broadcasters — becomes problematic.

YouTube remains a mostly user-generated content platform, meaning it does not have to abide by the same commercial restrictions that broadcasters have faced for decades, such as due prominence of editorial versus commercial content, product placement or ads minutage per hour.

As a Barb-hosted roundtable of media experts last summer demonstrated, some of YouTube’s most popular content would not be considered “fit for TV” because, for example, they contain native ads and product placement that would deter advertisers from buying spots in an ad break.

What’s next for YouTube?

Laura Chaibi, a streaming TV expert who is director of ad marketing insights (international) at Roku, told The Media Leader that investigating the “TV-only breakdown” for YouTube audience would be important data, too, for advertisers.

She said: “When I mined Tubular Labs data (general worldwide), the lead content was music (Vevo), geared for audio as priority, children’s content and a thriving gaming community along with general media and entertainment.”

This would point to YouTube being largely additive to the video-watching ecosystem, rather than replacing TV.

If anything, it is fast becoming part of the establishment. Earlier this week, The Media Leader revealed that YouTube has quietly rejoined Barb after a temporary absence last year, as have Netflix, Disney+ and Amazon Prime Video.

Google, YouTube’s owner, has been able to dictate its own terms in areas of media where it has become dominant, such as online search and display advertising. To really make headway with taking more of advertisers’ TV spend, either YouTube needs to change by adapting with the norms of the existing UK TV ecosystem or seek to change it by imposing its will.

What YouTube does next will be a fascinating sub-plot for industry watchers. Perhaps someone will even make a TV show about it.

Omar Oakes is UK editor-in-chief of The Media Leader. He founded The Media Leader in 2022

Read more

Fit for TV? YouTube hits Mr Beast and ‘Chicken Shop Date’ put to the test

You can’t compare YouTube with Netflix: Media’s risk conundrum

Andrew Cole interview: How telcos will shake up TV trading and measurement