Netflix’s ad revenue is up — but by how much?

Netflix reported 16% year-on-year revenue growth in Q2 and upgraded its full-year forecast to reflect both a weakening of the US dollar compared with other currencies as well as “healthy member growth and ad sales”.

Q2 marked a substantial milestone for the streaming giant, as it completed the roll-out of the Netflix Ads Suite, its proprietary first-party adtech platform, across all of its markets where there’s an ad tier.

The suite had been live in Canada since November 2024 and the US since April. As Netflix vice-president of EMEA advertising Damien Bernet previously told The Media Leader, it grants advertisers “new tools, better measurement and more creative formats”.

On the company’s earnings call, co-CEO Greg Peters called the roll-out “generally smooth” across all markets, with “good performance metrics” and early results “in line with our expectations”.

He continued: “The most immediate benefit from this roll-out is just making it easier for advertisers to buy on Netflix. We hear that benefit, that ease, from direct feedback talking to advertisers. They tell us that it is easier. [We] see it in our overall sales performance. We have seen an increased programmatic buying.”

The long-term roadmap for the suite, Peters explained, includes efforts to improve targeting and measurement, as well as leveraging advertiser and third-party data to improve personalisation for users.

“Now we can shift into this steady release cycle where we are dropping new features all the time, both for advertisers and for members,” he added.

‘We’ve evolved’: Netflix to start rolling out in-house ad suite to EMEA next week

Mike Proulx, research director at market research company Forrester, indicated that the “hardest part is in Netflix’s rear-view mirror” now that the adtech platform has been rolled out.

He further suggested that the better-than-expected Q2 was the result of “great content, increased pricing and advertising momentum hitting all at once”.

However, the lack of transparency into Netflix’s business is befuddling analysts now that the company no longer releases quarterly updates to its subscriber total. Nor has it begun releasing ad revenue figures.

The latest ad tier update that Netflix released was in May, when it announced the plan reached 94m monthly active users globally, up from 70m in November 2024.

In its Q2 earnings, the platform reiterated it is on track to “roughly double” ad revenue this year — but it has not given any indication on what baseline it is doubling from.

Media analyst Brian Wieser, who publishes the Madison & Wall Substack, estimated that Netflix’s ad revenue likely accounted for “several percentage points of the year’s overall growth”, but it is not possible to say with certainty.

Bernet previously told The Media Leader that Netflix counts over 1,000 unique advertisers in the EMEA market alone.

While Netflix has been opaque in its quarterly reporting, it has sought relative transparency in audience measurement as one of the first streamers to sign up to UK TV joint industry currency Barb.

According to Barb data, just over a quarter (28%) of Netflix’s UK audience is on its ad tier.

In lieu of subscriber figures, the company has also announced its latest Engagement Report highlighting watch time in H1.

“Watch time — or engagement — is our best indicator of member happiness,” the report noted.

Netflix claims its global users combined to watch 95bn hours’ worth of film and TV in H1.

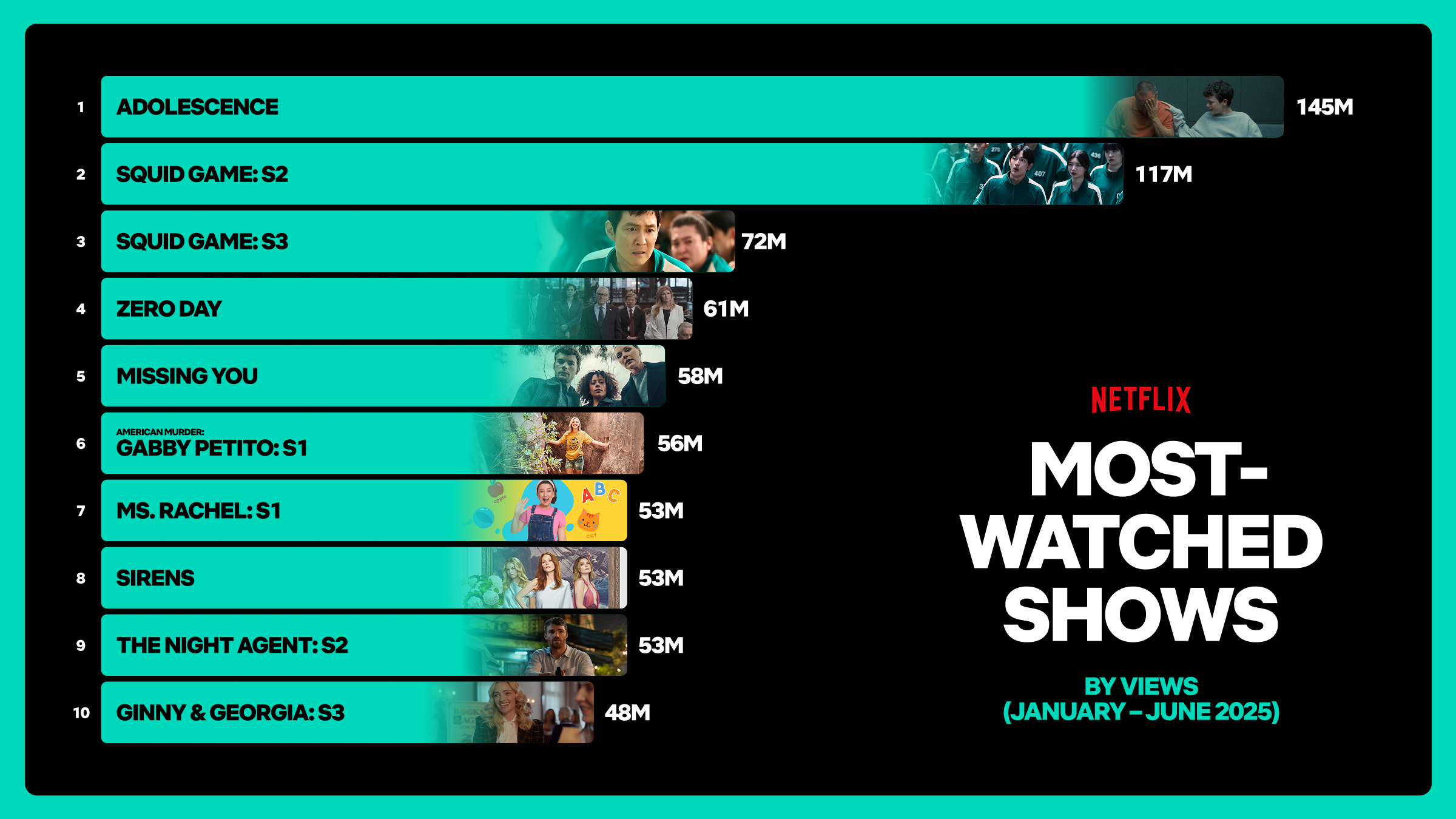

UK production Adolescence was the most-watched programme during the period, with 145m views (although it is unclear how precisely Netflix is defining a “view”). It was followed by series two and three of tentpole title Squid Game.

Notably, one-third of all Netflix viewing in H1 came from non-English-language shows.