Online display set to drive record £10.5bn in Christmas adspend

Christmas adspend is expected to surpass £10bn this year, driven by a surge in online display and social media spend.

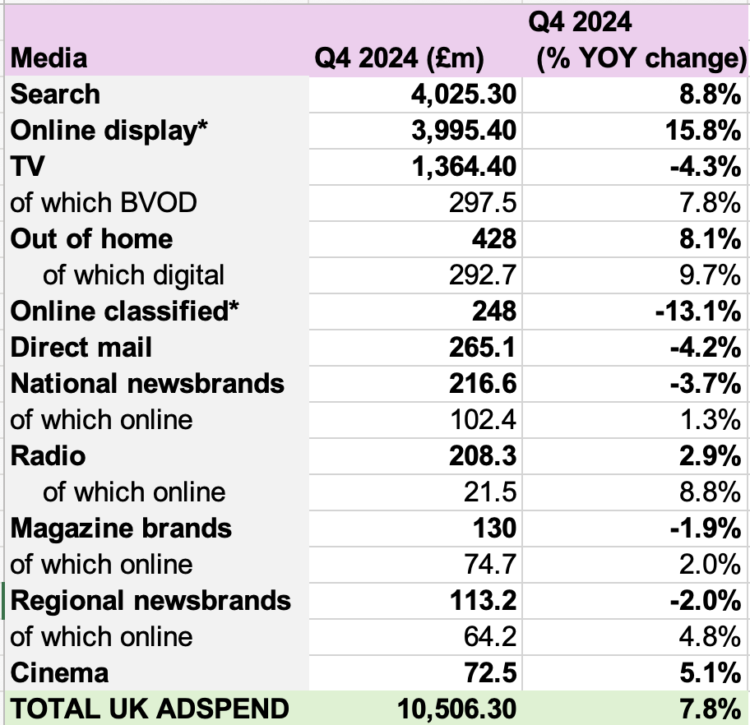

According to forecasts from the Advertising Association (AA) and Warc, adspend is expected to reach a record £10.5bn in Q4, up 7.8% on the same period in 2023.

The anticipated £760m rise in spend would be the largest increase on record excluding the post-Covid-19 recovery year of 2021, according to Warc’s director of data, intelligence and forecasting James McDonald.

Online media channels are predicted to see a boost, including online display (15.8% — which comprises social media spend), online radio (8.8%) and broadcaster VOD (7.8%).

OOH advertising is expected to see an 8.1% rise in spend and cinema is up 5.1%.

McDonald added: “Brands know that a well-crafted Christmas campaign can boost salience, anchor loyalty and drive impressive sales results to boot. It’s the time of year when media budgets swell and creative teams pull out all the stops to deliver memorable messaging that resonates well beyond Boxing Day.

“While the golden quarter typically attracts elevated levels of advertiser investment for these reasons, the anticipated £760m rise in spend this year would be the largest increase on record if the post-pandemic recovery year of 2021 were excluded, with a total above £10.5bn yet another zenith for the UK’s market.”

Similar to quarterly AA/Warc reports, the methodology puts online spend into a single vertical instead of, for example, counting online radio as part of overall radio spend.

The organisations said of their reporting: “Broadcaster VOD, digital revenues for news brands, magazine brands and radio station websites are also included within online display and classified totals, so care should be taken to avoid double-counting. Online radio includes targeted in-stream radio/audio advertising sold by UK commercial radio companies, together with online S&P inventory.”