Paramount+ sees double-digit user growth amid flat Q1 for SVOD

Paramount+ gained the most new UK household subscribers in Q1 among the major subscription VOD (SVOD) services, according to the latest Barb Establishment Survey.

The streaming service added 430,000 new homes to its user total in the first three months of the year to reach 3.1m — equivalent to 10.5% of UK households.

This equates to 16% quarter-on-quarter and 19% year-on-year growth.

“The latest series of 1923 was a notable content release for the service in Q1, but another factor may be the release of Yellowstone series one to four on Netflix at the end of January,” Barb head of insights Doug Whelpdale explained.

“During Q1, series five of Yellowstone accounts for five of the top 10 most-viewed programmes on Paramount+ that were not new releases. Potentially those viewing on Netflix went on to join Paramount+ to find out what happens at the end of the series.”

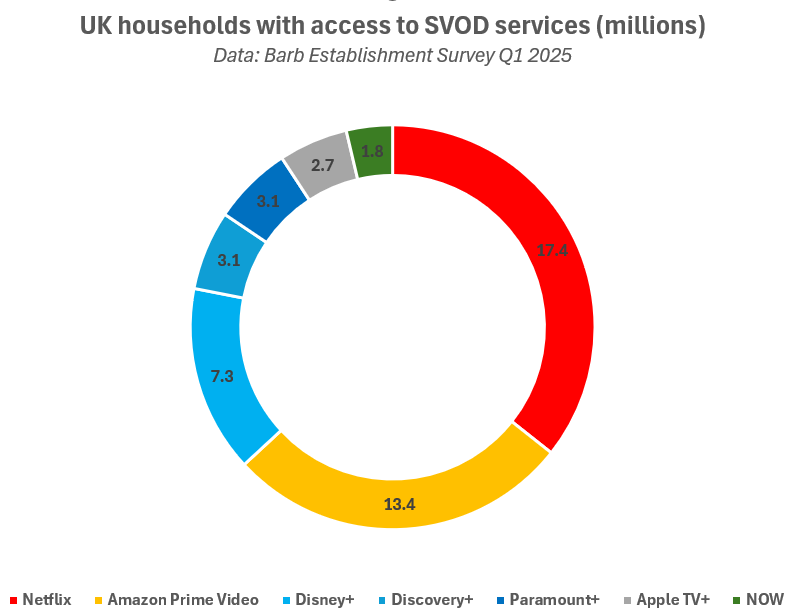

Despite a strong quarter from Paramount+, the service is still dwarfed by its rivals.

Netflix remains the UK’s top streaming service, growing its household reach 1.7% to 17.4m (equivalent to 59.2% of UK households).

Notably, 28% of Netflix homes were on its ad tier in Q1 (4.8m households, or 16.4% of homes). This grew marginally from Q4 2024 (4.7m).

Netflix is followed by Amazon Prime Video (13.4m households, up slightly from 13.3m in Q4). Thanks to defaulting users to its ad tier, Prime Video with ads is used by 87% of households with the service installed, equivalent to 11.7m households.

Meanwhile, Disney+ saw a dip in household reach in Q1, from 7.6m in Q4 to 7.3m. Similar to Netflix, about a quarter (23%) of households are on its ad tier.

The above figure includes duplicate households. There are 29.4m total UK homes.

The overall number of UK households with access to at least one SVOD service grew slightly from 20m homes in Q4 to 20.1m homes (67.5% of households), suggestive of “continued stability” in the market, according to Whelpdale.

That said, the number of homes with two or more services grew for the first time since Q2 2024, hitting a new record of 14.1m homes.

Barb reports only streaming services with a household penetration of more than 5% in its Establishment Survey.