Rebranded BVOD services create an increase in claimed usage

Opinion

Mediatel Connected’s head of research takes a look at the broadcaster VOD market in the UK and the impact the recent rebrands have had on ITV and Channel 4.

When Thinkbox’s first CEO Tess Alps coined the phrase “TV isn’t dead, it’s just having babies”, it successfully hushed some of the crazy talk about the death and demise of TV.

Some may still say that linear TV is dying, but let’s be honest, if that was the case, why does everyone care quite so much about what has been happening at This Morning?

The reality is that TV has evolved, driven by the consumer embracing technological advancements, and pushing forward the TV-everywhere-and-anywhere concept.

For broadcasters, their VOD offerings have evolved since inception, and now provide first views and exclusives as well as catch up opportunities, whilst providing the broadcasters with a rich dataset of logged in and engaged viewers.

Successful rebrands

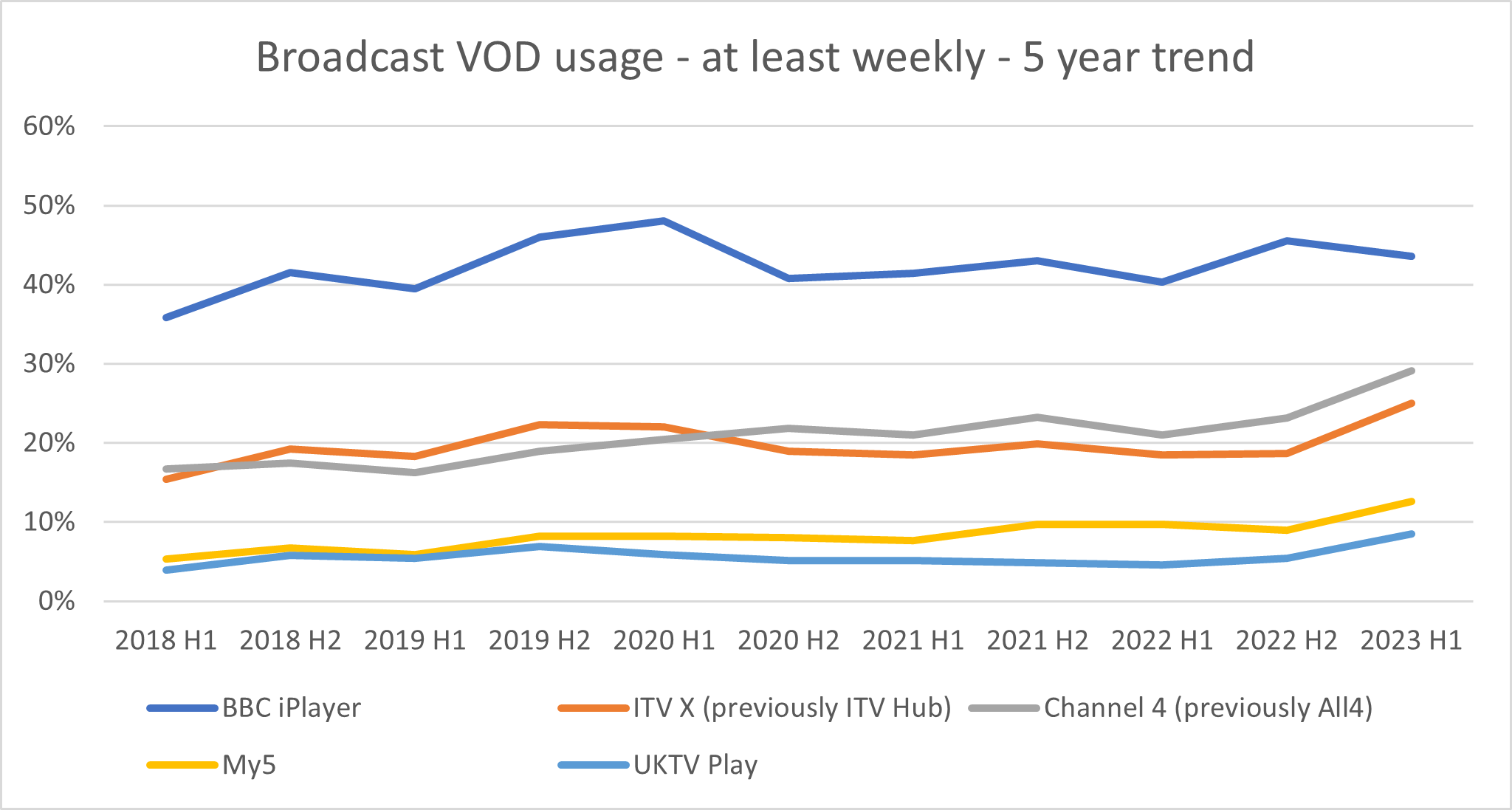

The latest findings from May 2023 in our exclusive tracker survey Video & Voice, which is run by YouGov, shows how these broadcaster VOD services have performed over time, with the chart below showing claimed usage at least weekly for the main free broadcaster VODs in the UK.

Interestingly you can see an uptick for Channel 4 and ITV’s services in this newest wave, coinciding with each company’s active promotion of their relaunched services.

Both ITVX and Channel 4’s streaming services claimed weekly usage increased from H2 2022 to H1 2023 by six percentage points.

ITV’s recent rebrand of its ITV Hub service to ITVX has given the broadcaster fantastic growth figures, with 66.5 million streams in its first week, an increase of 138% year on year, whilst its online user-base grew by 65% in that first month.

Channel 4, meanwhile, has dropped any individual branding of its streaming service. Whilst many still call it 4OD or 4 On Demand, its All4 service with its log-in approach paved the way for other broadcaster VOD services to tailor their services to the individuals. Now Channel 4’s VOD and streaming service is simply called Channel 4, with the move aimed to help audiences “better navigate the abundance of choice in the digital world”, and that can only be a good thing for consumers in the longer term.

The young are still avid video watchers

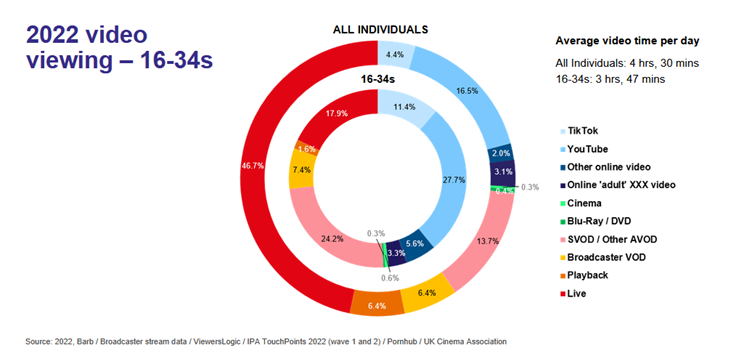

Chasing young TV viewers has always been a task for TV advertisers, as new services and technologies continually engage younger audiences, potentially diluting their leisure time from television and video. However, as Thinkbox’s fantastically famous donut chart shows, they are still avid video watchers, with 3 hours and 47 minutes of video content watched per day.

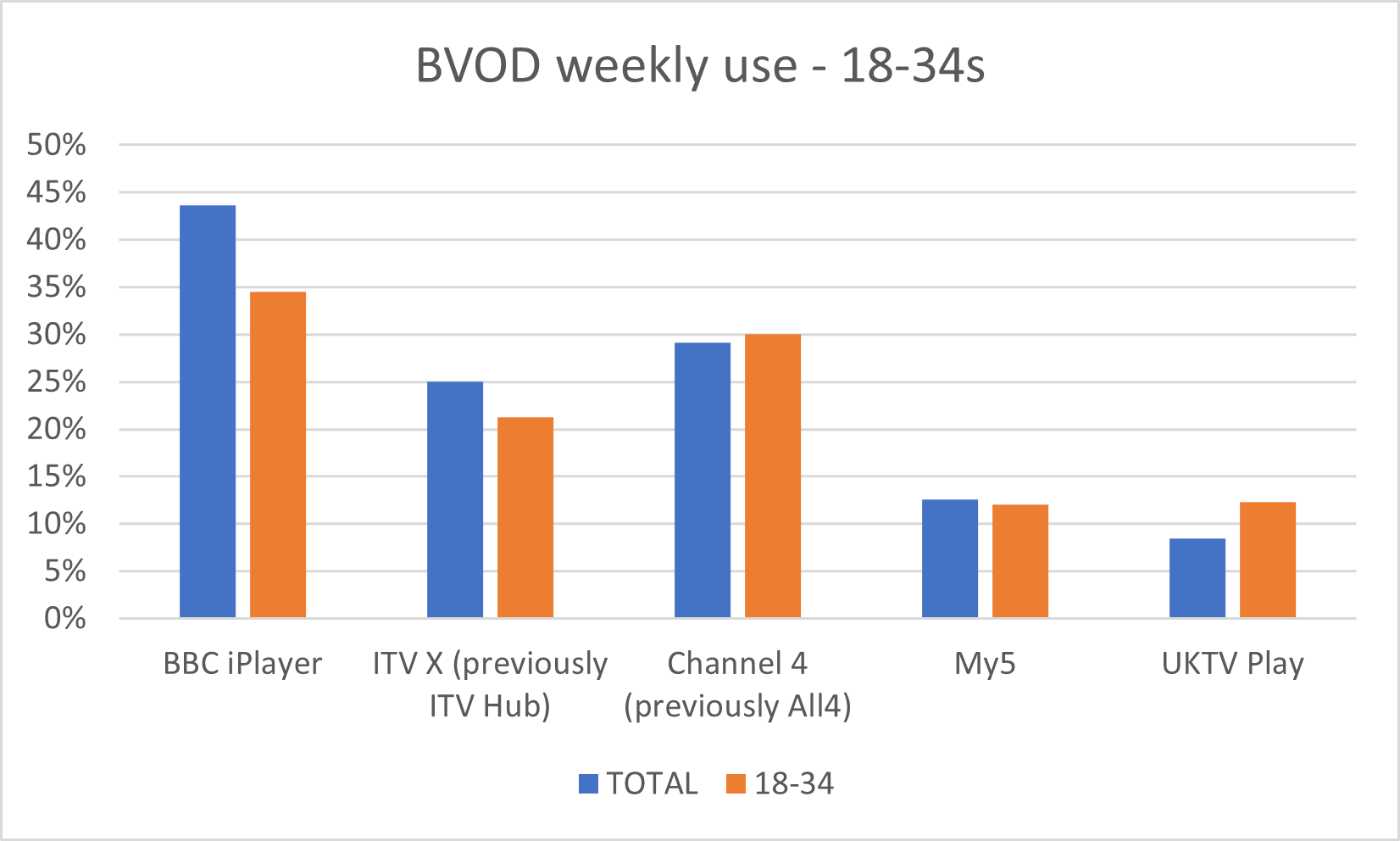

Mediatel Connected’s Consumer Surveys app allows us to dig into the Video & Voice’s H1 2023 survey and look at the different free broadcaster VOD services by audience, since these major rebranding exercises at ITV and Channel 4 have occurred.

As can be seen above, Channel 4’s streaming service has a higher proportion of 18-34s claiming to use its streaming services on an at least weekly basis than its overall total, with an even more exaggerated pattern in place for UKTV Play. Meanwhile, BBC iPlayer doesn’t perform as well for this audience.

To put these numbers in context, from the same Video & Voice survey, you can see how this audience performs for subscription VOD services: explore this data further within the Consumer Surveys product.

Anne Tucker is head of research at Mediatel Connected, under Adwanted Group, which publishes The Media Leader.

Anne Tucker is head of research at Mediatel Connected, under Adwanted Group, which publishes The Media Leader.

The award-winning Consumer Surveys app within Mediatel Connected carries industry leading research covering all media, from RAJAR, Barb, Ofcom, TouchPoints and exclusive surveys Video & Voice from YouGov, and Adwanted UK’s exclusive Connected Screens tracker survey.

To find out more about the Mediatel Connected data product, please get in contact at [email protected].