Reduced churn can counterbalance discounting and make SVOD bundling work

Connected TV World Summit 2025

Bundling subscription VOD (SVOD) services together, with a discount, is likely to be an effective anti-churn tactic for subscription streamers. And while they will each have to accept lower revenue per user (at least initially), the higher customer retention rates could mean per-customer revenues actually improve within approximately one year.

These were the projections offered by Richard Broughton, executive director and co-founder at Ampere Analysis, last week when he showed the Connected TV World Summit audience how the growth rate in SVOD stacking (where households take multiple services simultaneously) has plateaued since 2022.

“The streaming industry has a problem: it is increasingly difficult to get consumers to take more services in their stack,” he declared. The market is still growing but in the UK that growth increasingly comes from expansion beyond the 78% of homes that have one or more SVOD contracts already.

“Of the market that does take a service, consumers are increasingly switching out their subscriptions, actively managing their stack.”

On average in Western Europe, about 60% of homes take one or more SVOD services, according to Ampere figures.

Broughton told the audience that, of the gross customer additions to SVOD in the US last year, half were not new customers at all but returning ones — households that had taken the same service before and cancelled before signing up again.

The same is true in the UK: on average across the SVOD services, approximately half of new sign-ups in 2024 were returners. The data comes from Ampere’s large consumer panels in the US and the UK, and relies on tracking rather than survey data.

There was more bad news for SVODs wary of their customer acquisition marketing costs, according to Broughton: “They are going to do this [leave and return] again and again and again.”

Broughton produced slides showing US subscription over-the-top stacking rates at 4.3 services in 2022, 4.4 in 2023, 4.5 in 2024 and 4.5 in 2025. In Western Europe, the average household stack has numbered 2.2 every year since 2022. In the US during 2024, 51% of new Netflix customers were returners. For Amazon Prime Video, the figure was 57%. At Disney+, the number was 30% and it was 44% for Max, 38% for Peacock and 71% for Paramount+.

In the UK in 2024, “re-subscribers” accounted for 40% of new Netflix subscibers and 65% at Amazon, 29% at Disney+, 54% at Paramount+ and 33% at Now (with the Entertainment pass).

Focusing on H1 in 2024, Ampere data shows that of all UK Netflix sign-ups, 38% were re-subscribers and, from that returner group, 57% then churned and then resubscribed again — all by the end of that year. This means they were originally won and lost, won back, lost again and then won again.

Bundling and churn

Broughton turned to the potential solution: bundling of subscription streamers, whether that bundle is created by a pay-TV operator or between the streamers acting without a platform aggregator. He pointed to the US, where this bundling is already active, with four offers announced in 2024 including Comcast’s combination of Netflix, Apple TV+ and Peacock, and the streamer-organised bundle of Disney+, Hulu and Max.

Both these bundles provide hefty discounts versus the value of the streaming services if bought individually — with the Comcast proposition giving consumers 42% off and the Disney offer saving viewers 43%.

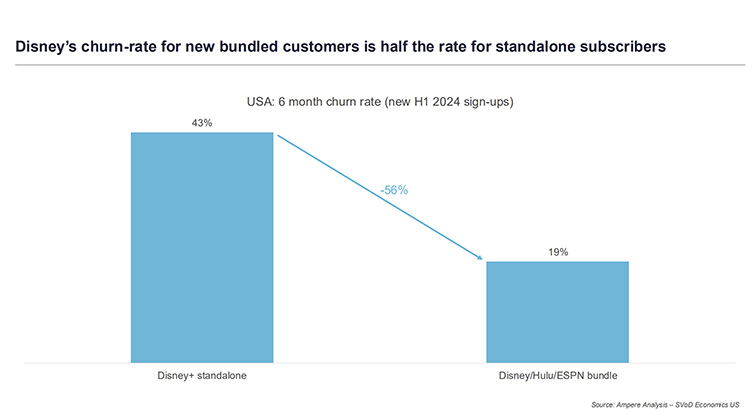

Disney also appears in a Disney/Hulu/ESPN+ bundle (it owns all three) in the US, with options for its ad tier or premium tier, and Ampere has calculated the churn rate for Disney+ customers taking this bundle versus those taking Disney+ as a standalone offer. Looking at sign-ups during H1 2024, the six-month churn rate for those taking the standalone option was 43%, but for those taking the bundle it was 19%.

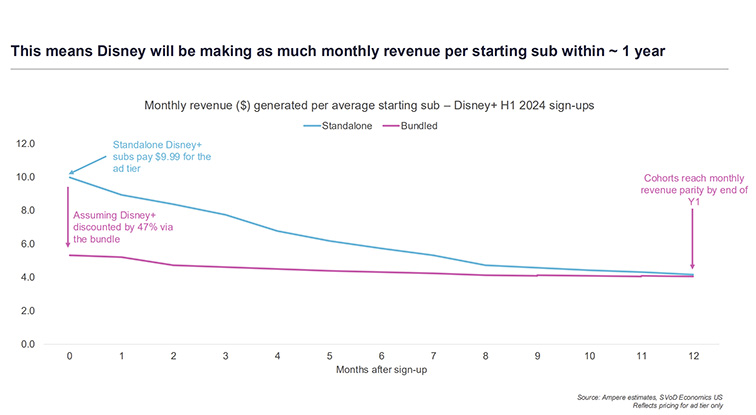

Do the economics stack up, given those sizeable discounts? The Disney with ads plus Hulu and ESPN+ bundle comes with a 47% discount versus taking the three services separately. Ampere analysed the revenue per user for Disney’s ad tier version and assumed that all three streaming brands were taking the same revenue hit as each other — meaning Disney with ads brings Disney 47% less than it would outside the bundle. The company then tracked the churn rates with and without bundling to look at revenue per user for those options after 12 months.

The standalone package starts with much higher revenue per user but suffers from a higher churn rate, while the bundled option raises less per user but has much lower churn. Broughton revealed that, after 12 months, there is revenue parity between the two options. He added: “In years two, three and four, they will make more money [from the bundled version].”

Next, Broughton analysed the types of bundles that will work, noting that if two subscription streamers already have a large, shared customer base, there is limited scope to sell service B to service A customers. This is the situation with Netflix and Amazon Prime Video in the UK, for example.

Instead, there are latent bundling opportunities “where you can find a degree of compatibility and people are interested in the other services [in a bundle] but there is still room for upsells,” Broughton observed, before looking for comparably sized services with mid-level customer overlap and revealing that each of Disney+, Max, Peacock and Paramount+ could mutually benefit from a combined bundle in the US.

His chart declared: “Between any two [of these four] services, the [customer] overlaps sit between 33-56% — suggesting a high-level of compatibility without already being saturated.”

Broughton concluded: “There are bundles that could be created to drive uptake in a saturated market, but it is crucial who you partner with.”