Social stands out in Magna 2023 global adspend forecast

2023 looks set to the be the year of social media adspend, a global report by a major media buyer has suggested, in what has otherwise been a tough market.

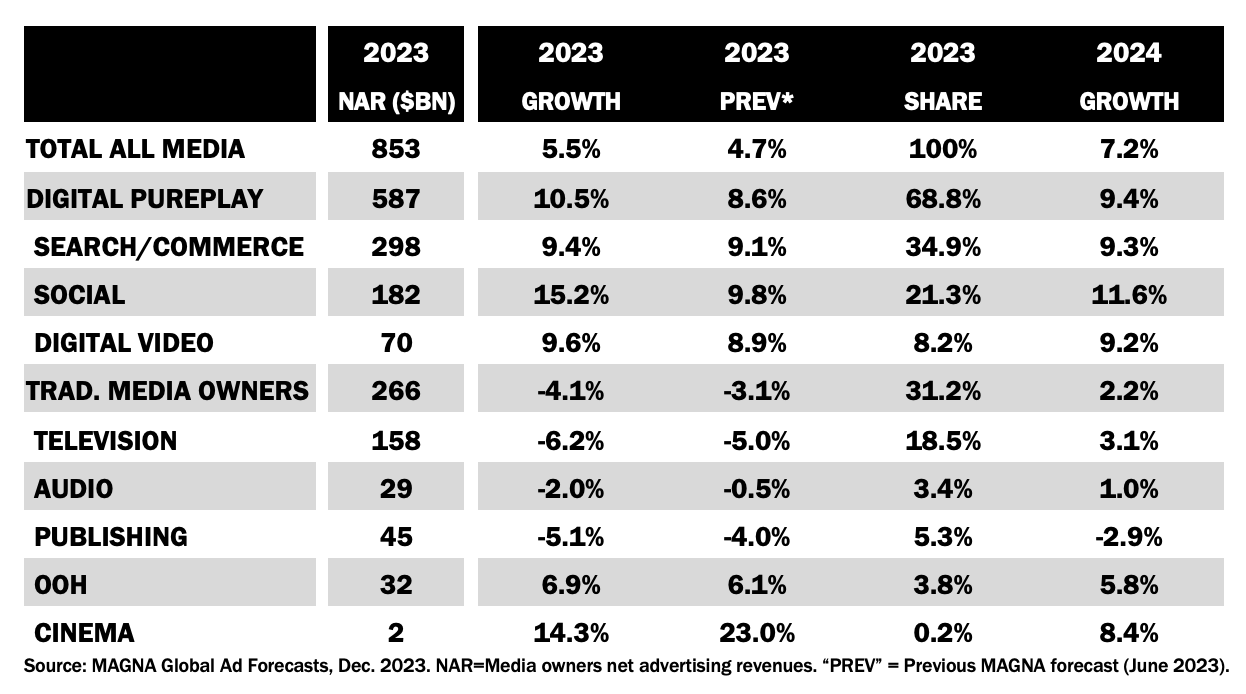

Citing a “slow, uncertain macroeconomic climate”, IPG Mediabrands’ Magna has forecast global adspend will increase by 6% this year to $853bn across all media this year.

Within that total, Magna’s Global Ad Forecast (Winter Update) tells a familiar story of digital formats growing (up 11% to $587bn) and traditional formats falling (down 4% to $266bn).

However, tentpole advertising events in 2024 should mean a return for traditional media formats, such as the US presidential election, the Olympic Games in Paris, and the Euro 2024 football championships.

Media channels

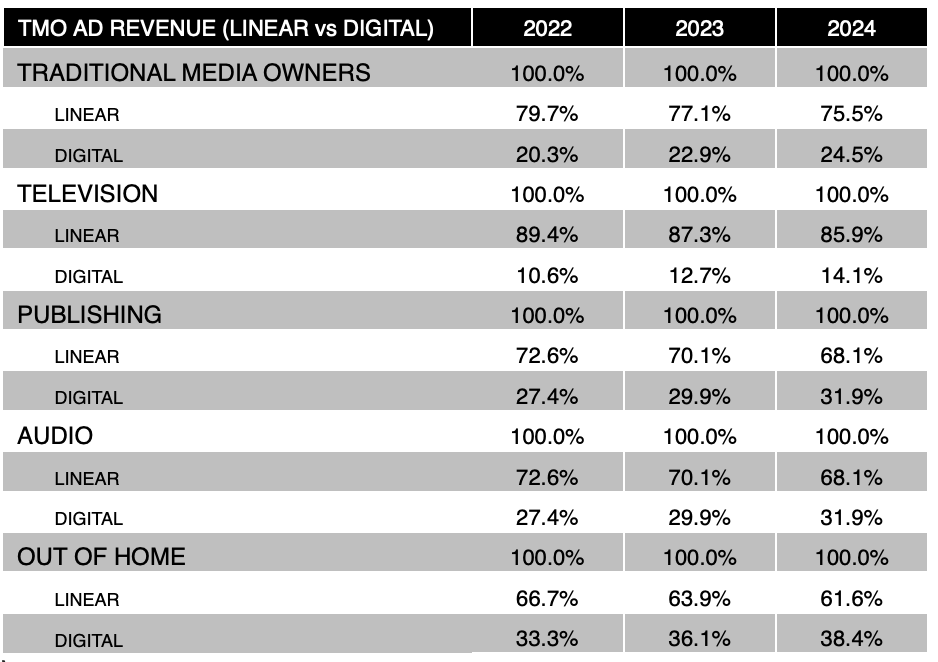

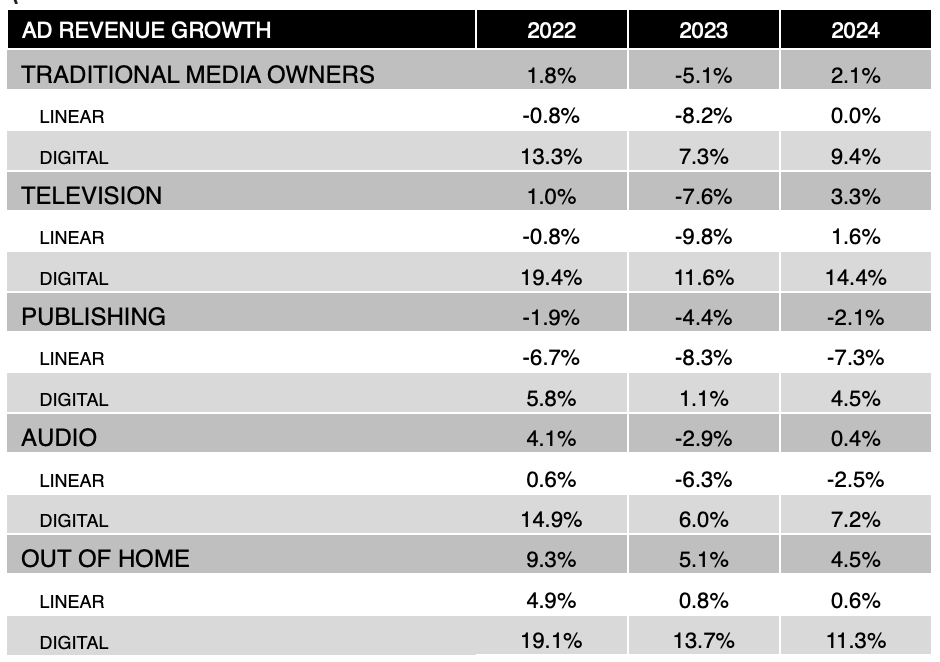

“Traditional” advertising sales is now less than a third of all global media spend, according to Magna’s reporting. “Traditional media owner” revenues include the linear ad sales of broadcasters, publishers, OOH media owners as well as their digital ad sales, such as video-on-demand for TV and digital OOH.

Global advertising’s biggest sector, TV, will shrink by 6% this year to $158, the forecast reveals, while publishing will fall by 5% to $45bn.

Audio is also forecast to fall by 2% to $29bn, while out-of-home (OOH) will continue to recover after Covid-19 depressed 2022 revenue and grow by 7% year-on-year to $32bn, back to its pre-Covid market size, Magna added.

Digital video, according the Magna’s report, is forecast to reach $70bn in net advertising revenue this year (just under 44% of traditional TV’s $158bn).

Keyword search remains the most popular ad format, the report says, and will approach the $300bn milestone this year thanks to a 9% increase.

Social media (principally Meta and TikTok) will benefit from a 15% growth in spend to $182b this year, while short-form video (YouTube and Twitch) will enjoy a 9% increase to $70bn.

The report’s author, Vincent Létang, Magna’s executive vice-president for Global Market Research, said global adspend “re-accelerated” in the second half of this year after four slow quarters beginning in mid-2022.

Létang said: “The recovery is driven by easier year-over-year comparables and stabilising economic conditions (inflation slowdown), and these improvements mostly benefit pure-play digital advertising formats.

“Search formats are driven by retail media; Social and Video formats are recovering to double-digit growth thanks a better monetisation of the fast-growing short vertical video impressions.

Markets and spenders

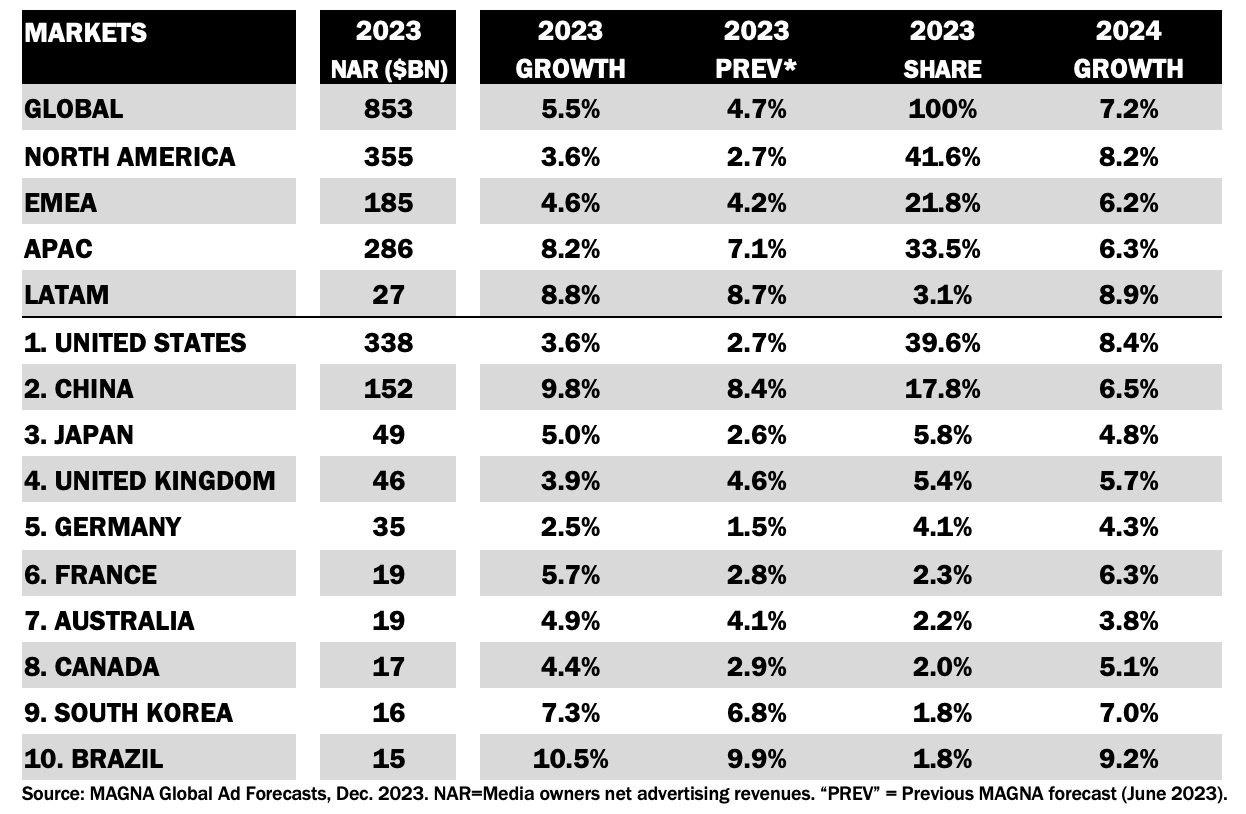

India, the world’s 11th biggest ad market, is set to be the highest-growing market in 2023 (up 12% to $14bn), while China is set to recover faster than expected after its zero-Covid policy in previous years (up 10% to $152bn).

Northern European markets are growing more slowly, with the UK (the world’s fourth biggest ad market) set to grow 4% to $46bn. The US, still by far the world’s largest ad market, will grow by a similar rate to $338bn.

Automotive ad spend was up almost everywhere this year, except in the US, but Magna predicts that will market will rebound for car advertising 2024 as demand for electric vehicles ramps up.

Looking ahead to next year, pharma marketing will continue to grow “organically”, the report said, driven by population ageing, competition, and new drugs being launched. Government and political adspend will grow due to general elections taking place in three major countries among the few where political campaigns are allowed on television: Mexico, India, and the US.

Media & Entertainment will suffer from the lower-than-usual volume of US shows and movies being released in 2024 due the Hollywood strikes in 2023.

Betting brands, which would normally benefit from there being more sports events, are at a greater risk of tightening regulation in Europe, particularly in Italy, Spain and the Netherlands, the report added.