Podcast listenership is growing fastest amongst 55- 74s and new categories are more than quadrupling their podcast adspend, according to Spotify’s Megaphone Podcast Trends 2022.

Megaphone’s report described podcast listenership as “skyrocketing” in southern Europe, with France, Spain, and Italy more than quadrupling their number of podcast downloads compared to this time last year. Spotify purchased the podcast advertising and publishing platform earlier this year for $235m.

The report also found globally the number of unique podcast listeners grew most amongst those aged 55- 64 (49%), and then those between 13 and 17 years old (45%) and the 65+ (42%) age bracket respectively.

Ways of listening to podcasts also evolved to include more time co-listening than previously.

While in the past most podcast listening was traditionally done alone through headphones, Megaphone’s report discovered time spent listening to podcasts in the car, on smart speakers and on smart TVs experienced significant year-on-year growth, with 131%, 83% and 82% growth respectively.

The fastest growing global podcast category in terms of time spent listening was health and fitness, which attracted triple digit growth in France, Australia, the UK and the US.

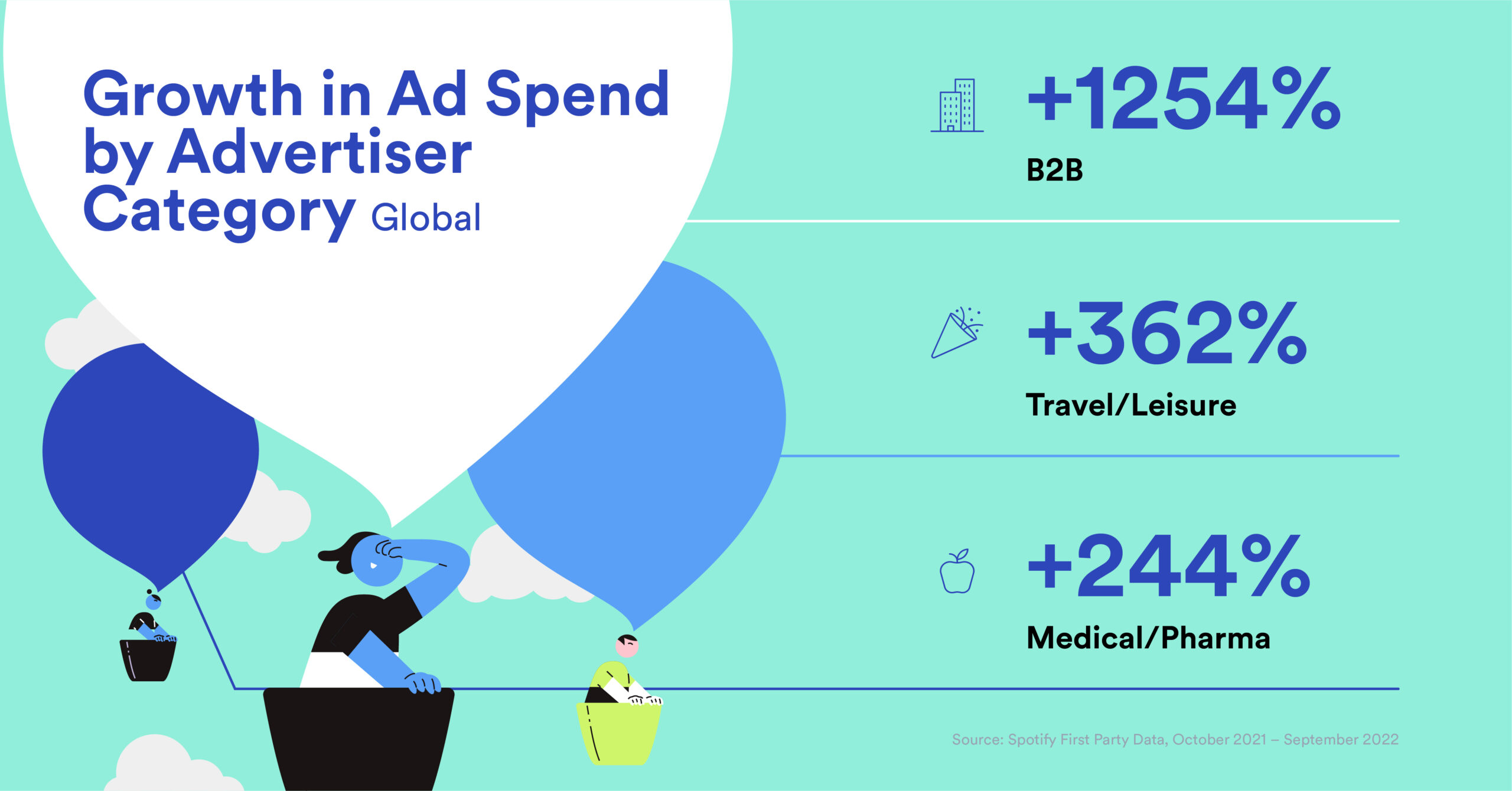

Spotify’s report also found that while early investors in podcast advertising globally “continue to understand the value of the medium” and were top spenders, new categories are significantly increasing their adspend in podcasts.

In particularly, B2B, travel/leisure and medical/pharma have more than quadrupled their adspend in podcasts on Spotify globally compared to the same time last year.

What’s the optimum podcast ad format, frequency or number of publishers?

In a separate report, Podsights, the marketing attribution platform for podcast advertising acquired by Spotify earlier this year, identified pre-roll ads, dynamic ads and running podcast ads with more than one publisher as more effective for advertisers.

Its quarterly Benchmark Report for Q4 2022 examined data from 4,200 campaigns measured through its platform, representing $545m in adspend between October 2021 and September 2022, and 10.8bn impressions from 1,000 brands.

The report calculated the average frequency, as well as average conversion rates, for different ad formats and placements, examining website visits, purchases, sign-ups, email capture, or app installs by people after they listened to a podcast ad.

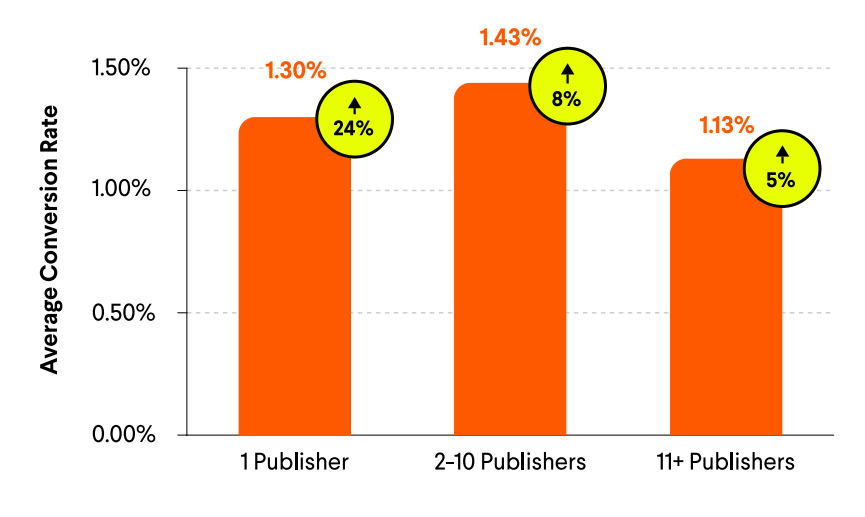

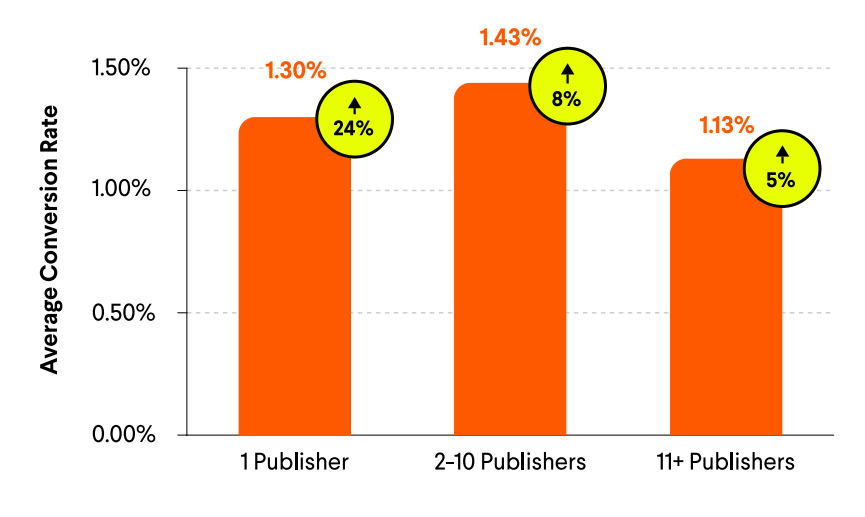

Podsights’ report found podcast advertisers running podcast ads on two to 10 podcast publishers or networks was “the sweet spot” with an average conversion rate of 1.43% compared to 1.30% with one publisher, and 1.13% with more than eleven publishers.

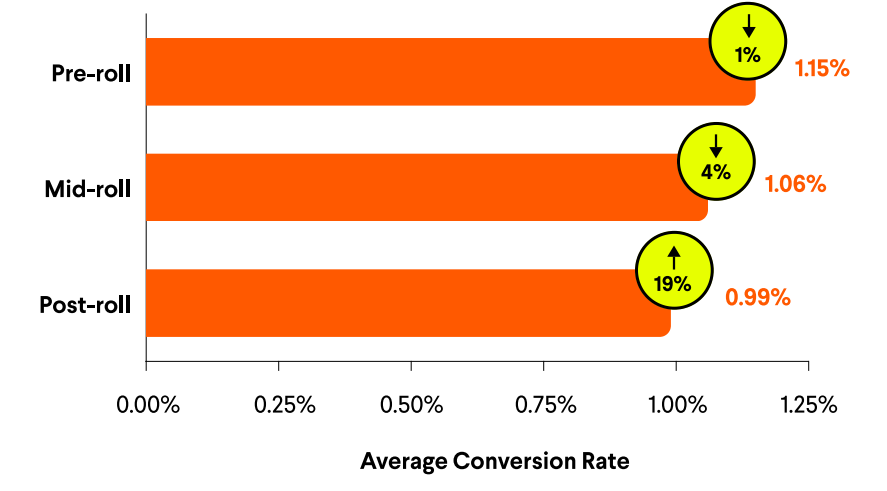

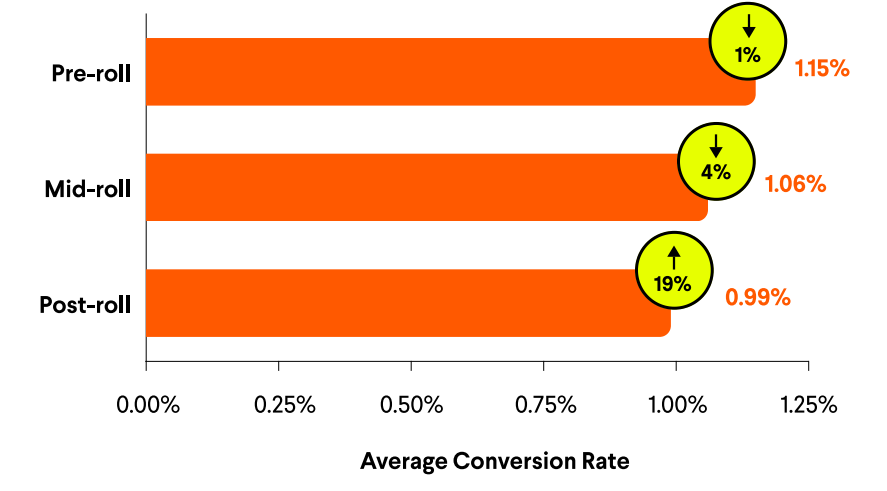

Additionally, pre-roll ads outperformed mid-roll and post-roll placements in terms of average conversion rate with 1.15% compared to 1.06% and 0.99%. However, the average conversion rates from post-roll ads did increase quarter-on-quarter by 19%.

Dynamic ads made up 84% of ads run in campaigns measured by Podsights, and garnered a 1.12% conversion rate.

Embedded or “baked-in” ads making up the remaining 16% of podcast and on average achieved a conversion rate of 0.93%.

Podsights recommended advertisers use a frequency of between 2 and 5 for “optimal results”. The average number of exposures to podcast ads in a household, or the frequency, remained flat with the previous quarter at around 4.75.

Its podcast trends report uses first-party data from Spotify users between October 2021 and September 2022 and its enterprise podcast platforms: Megaphone, Chartable, and Podsights. More than 700 global publishers host their podcasts on Megaphone, and the platform sees one billion monthly downloads. Chartable data was derived from 28,000 podcasts, 16 billion annual downloads, and seven billion annual cross-promotion impressions. Podsights data was aggregated from 8.2 billion impressions from 3,400 campaigns across 838 advertisers.

Podcast: Will outdoor advertising ever return to ‘normal’ after Covid?

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.