Streaming data shows launching with ads is easier than adding them in later

Just 2% of Netflix and Disney+ subscribers in the US are on the cheaper, ad-supported tiers each streaming giant launched last winter, new research has shown.

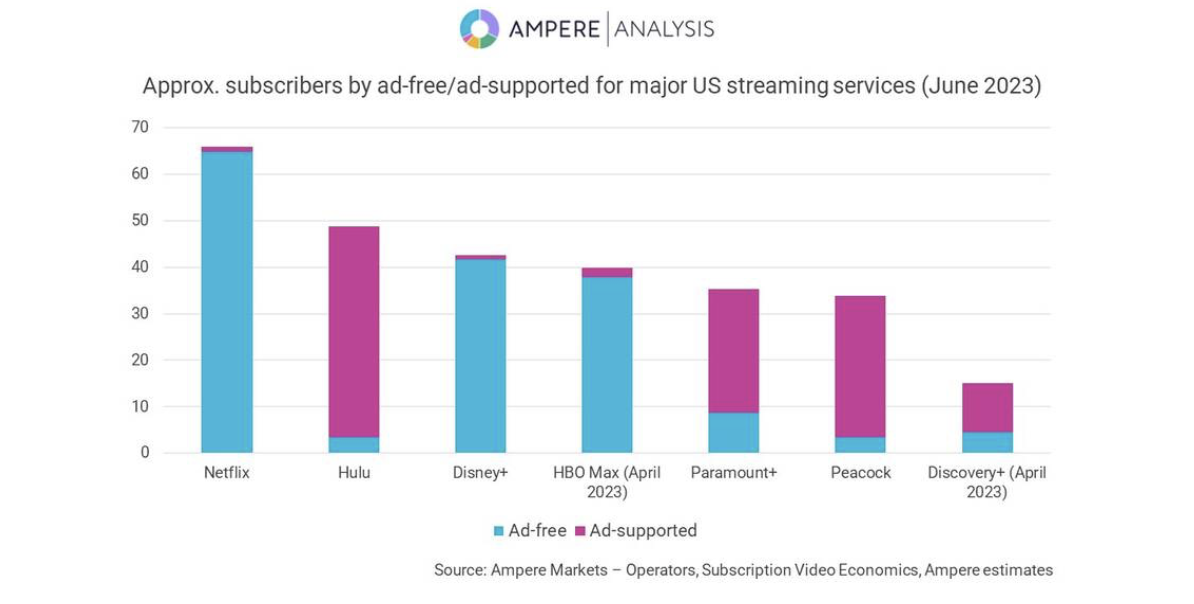

More than one million US Netflix accounts are on the ad-supported tier, representing nearly 2% of the entire subscriber base, according to research by Ampere Analysis. Meanwhile, around 800,000 Disney+ accounts are on the ad-supported tier, which is also about 2% of total subscribers.

Before HBO Max’s rebrand to Max in April, about 5% of HBO Max’s subscriber base was on the ad tier, having launched that ad tier in March 2021. Prior to the launch of Max, Discovery+ had about 10 million ad-supported accounts. HBO Max had around 2 million.

For the moment, the streaming services that launched as ad-supported offerings — Peacock (NBCUniversal), Paramount+ (Paramount), and Hulu (Disney) have a much higher proportion of subscribers opting for cheaper deals in exchange for advertising.

Peacock has the most ad-supported subscribers of any new US over-the-top service, with more than 30 million ad-supported subscribers. Paramount+ is not far behind, with more than 25 million ad-supported subscribers.

Ampere estimated that more than 90% of Hulu subscribers are on the ad-supported tier, representing around 45 million subscriptions. Hulu launched as an ad-supported subscription service in 2010, before launching an ad-free tier in 2015.

Ampere said it expects ad-supported subscription tiers in the US will generate more than $10bn in advertising revenue in 2027.

Analysis: coming late to the party may be fashionable but it’s costly

These figures paint a clear picture that subscription video-on-demand (SVOD) services that were late to launch ad tiers still have subscriber bases that still mostly watch ad-free. Meanwhile, services that launched with an ad-supported tier from the start have a far larger proportion of ad-supported subscribers.

Frankly, many entertainment media owners would love the freedom of not having to rely on ad sales and taking money from customers directly instead. ITV in the UK is a case in point: it reported a 11% year-on-year decline in quarterly ad revenue last week, while sounding bullish about the prospects for its content business ITV Studios.

Remember that Netflix announced the launch of an ads tier last year off the back of a very difficult earnings announcement. Fast forward to last month, and its net income and subscriber growth look very strong and it’s no coincidence that the company has recently renegotiated its ad sales contract with Microsoft.

As for Disney, it can afford to wait and see for Disney+. As the company’s ad sales chief Rita Ferro told our Future of TV Advertising Global event last December, there is now a unified sales team selling many verticals such as Disney+, FX, Hulu, ESPN, National Geographic and ABC.

In either case, the streaming giants have faced two challenges with launching ad-free first and ads later.

Firstly, you are chasing new customers with either limited spending power or limited interest in TV (because richer and more passionate customers would already be willing to pay for more expensive ad-free options).

But, perhaps more worryingly for advertisers keen to be on these platforms, your ad-free tier has already hived off the more affluent customers that brands want to reach. If 98% of Netflix’s customer base isn’t paying for ads, how attractive is the 2% that is left over and can’t afford a couple extra dollars or pounds to go ad-free?

That’s why Netflix has decided to be more polarised in its pricing strategy and this may well move the dial for its ad tier in the coming months. It announced last month that it would remove the cheapest ad-free Basic plan as an option for new subscribers. The price difference between ad-supported viewing and ad-free viewing has suddenly increased from $3 to $8.50 per month.